In the ever-evolving landscape of fixed income investments, staying competitive requires a dynamic approach that embraces innovation and leverages technology to meet the evolving needs of clients. At the RIA Summit in NYC, IMTC’s CEO Russell Feldman participated on a panel with Jeffrey MacDonald from Fiduciary Trust to discuss ‘Recalibrating Fixed Income Investments’. The fireside chat shed light on key trends shaping the fixed income markets, the growth of the Separately Managed Account (SMA) business, and how technology is empowering fixed income managers to customize at scale. Here, we delve into the key takeaways from this insightful discussion and explore the critical role of innovation in modern fixed income portfolio management.

The shifting landscape of fixed income markets

In the current landscape of fixed income markets, several critical factors demand attention and strategic consideration. Jeffrey MacDonald explains the demand for a greater allocation into fixed income on multi-asset class portfolios. When assessing the earnings yield between the S&P 500 and the 10-year UST, “that relationship is as tight as it’s been in over 20 years…and as a result, reflects that competitiveness of fixed income within a multi-asset portfolio.”

Another significant consideration in the fixed income markets is the interplay between credit and interest rate risk. MacDonald adds that “credit fundamentals are still pretty strong… [and] a strong consumer is also helping not only the credit worthiness of our portfolios but helping the growth in the U.S. and the global economy.” However, challenges include that “the market isn’t demanding compensation for credit risk in the market…and the restrictive monetary policy we have in place now.” Jeffrey discusses how Fiduciary Trust is positioning portfolios as a result of the current landscape: keeping the quality of credit on the higher side and adding interest rate risk to move maturities further out the curve. This allows them to lock in income streams and capitalize on potential principal appreciation amid evolving rate environments.

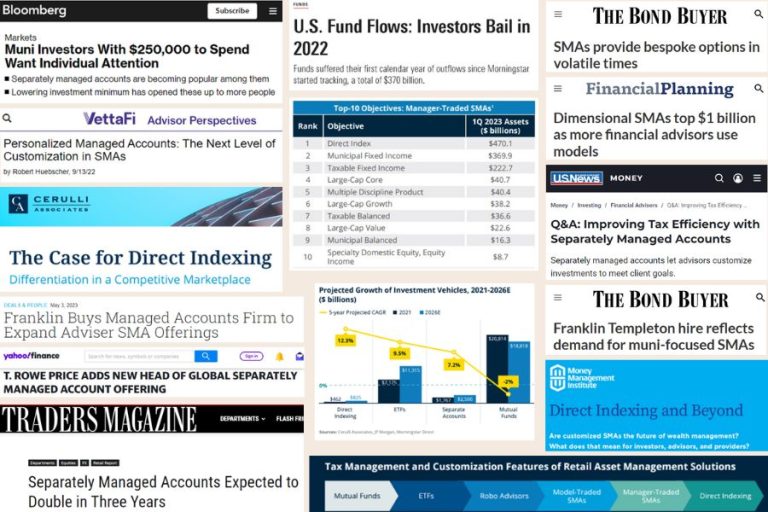

The rise of separately managed accounts (SMA)

With the increasing demand for personalized investment strategies, the SMA business has seen significant growth in the fixed income space. SMA structures offer clients the flexibility to have their portfolios managed according to their individual preferences and requirements, something that historically popular mutual funds and ETFs can’t provide. Customization has become a key differentiator in addressing client needs and delivering tailored fixed income strategies that align with specific investment objectives and risk profiles. However, SMAs come with their own set of challenges.

“If you give me ten SMAs at $5 million each and I have to customize, I can do that standing on my head. But what if that number moves up to 500? What if the $500,000 client says, ‘I want an SMA solution?’ I can’t achieve that in an efficient manner with the traditional tools in place – traders, Bloomberg, Excel spreadsheets, and compliance engines,” MacDonald discusses.

Russell adds that “it’s too challenging for any one individual to synthesize the massive amount of data that exists in that market and be able to deliver optimal outcomes across hundreds or thousands of client accounts simultaneously.”

Another challenge for fixed income investors? “You cannot, under any circumstances, exactly replicate the indices in the benchmarks,” says MacDonald because of the number of securities and liquidity in this asset class. The best alternative is to try to replicate it using characteristics. “How can we use different factors in the market, whether its interest rate risks through duration, whether it is sector exposures… that gets me 90% of the way there?”

MacDonald knows that he “can’t do [direct indexing] at scale across accounts using Excel or just talking to traders in any kind of efficient matter… and that [tools like IMTC] helps me do that with precision across a large number of accounts.”

Technology’s role in customization at scale

Technology has emerged as a game-changer in the realm of fixed income portfolio management, enabling managers to replicate strategies and customize portfolios at scale. By harnessing innovative tools and platforms, fixed income managers can efficiently address factors like interest rate risks, sector exposures, and duration targets across a wide range of client portfolios. They can also find more optimal positions available in the market, such as odd lots, that offer more value.

Feldman discusses how technology like IMTC is enabling portfolio managers to do this: “It’s about amassing the necessary data – taking in holdings across all of your clients’ portfolios, live bids and offers across the market, unique constraints, restrictions, and targets that you and your team are setting, and individual client preferences.” A centralized hub of data is one of the key components in order to make decisions at scale.

Once investment data is aggregated, IMTC’s optimization engine can “actually spit out optimal buys and sells across those portfolio settings… Think about the work that a PM has to do to actually determine optimal allocations across individual portfolios without technology. It’s totally impractical to do that across hundreds of portfolios,” Russell explains.

Jeffrey discusses a common situation: “The fixed income market can be a little bit of a roach motel. You can block up trades, spread them across all your accounts, and fill those gaps that you need to fill.” But if you need to raise cash and sell out of small positions, “sometimes you can’t find bids and sometimes the bids are nowhere near what the bonds are worth. [Technology] is what helps me rebalance to get that liquidity out of the portfolio traded efficiently.”

Automated solutions play a crucial role in enhancing operational efficiency, reducing manual errors, and ensuring compliance with regulatory requirements and policy statements, thereby allowing managers to focus on strategic decision-making and client relationships.

The imperative of innovation and adaptation

Of course, no panel is complete without predictions on AI. Russell sees the future of AI for portfolio managers which will incorporate language models to simply speak or type a command, and platforms will complete those tasks. Russ gives an example to say “On my intermediate strategy, find anybody that owns more than 2% cash” which would automatically run an optimization.

The panel discussion underscored the imperative for fixed income managers to embrace innovation and adapt to the changing dynamics of the market. Technology serves as a catalyst for modernizing fixed income portfolio management, offering sophisticated analytics, risk management capabilities, and customization options that drive operational efficiencies and enhance competitiveness. Firms that invest in cutting-edge technology solutions position themselves for sustainable growth and differentiation in a crowded market, ultimately fostering stronger client relationships and long-term success.