Fixed Income Portfolio Management Software

Revolutionize how you construct and optimize portfolios to generate ideas, rebalance allocations, and create customized solutions at scale.

Embed investment preferences into powerful decision support tools

Make faster, more accurate decisions due to increased transparency in fixed income workflows resulting from automation of tedious processes that inhibit performance.

Identify accounts that need attention

Optimize portfolio construction & rebalancing

Find best-fit bonds to satisfy client needs

Visualize pre- and post-trade impact

Ensure optimal allocations across accounts

Align investment preferences to actionable outcomes with IMTC’s Optimizer

IMTC’s proprietary optimization engine is a decision support tool to assist you in making optimal investment decisions, 450x faster.

Most optimizers fall short in building an optimal portfolio: only allocating bonds or maximizing a single factor like yield. Worse are solutions that lack transparency into results.

Manage bespoke portfolios at scale

IMTC’s platform is unique in how it considers client and portfolio manager preferences, aligning outcomes with your portfolio management style while fully maintaining compliance every step of the way.

The result? You can act quicker on optimal bonds for your portfolios, including the ability to:

- View best-fit buys and sells across hundreds of portfolios

- Codify in your investment strategies, IPS, and compliance rules

- Match fixed income portfolio needs with live market inventory

Allocate bonds equitably across accounts

Generate equitable bond allocations across all accounts simultaneously in new issue and secondary markets. IMTC’s Allocation tool brings precision and fairness to your investment process with rule-based allocation protocols, including pro-rata and customizable waterfall approaches.

In seconds, determine which accounts are most in need of a bond and in what specific quantity all while adhering to portfolio strategy and targets, enabling you to take advantage of market shifts and client requirements.

Adhere to unique strategies and requests

Respect investment rules on a portfolio, strategy, or firm-wide level to safeguard portfolio positioning all while ensuring adherence to compliance and guidelines.

Manage client-specific guidelines and IPS with ease so you can:

- Mitigate potential risks with automatic pre-trade compliance checks

- Offer new products with the ability to deliver highly customized models, strategies, and direct indexing

- Tailor portfolios to account for ESG, values-based investments, or other client requests

- Instill positioning preferences by codifying exposures

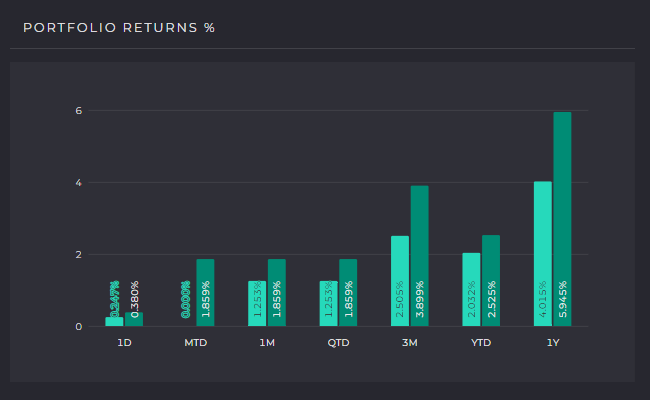

Aggregate portfolio needs to start your day

Identify portfolios that need attention and aggregate those needs to prioritize a proactive strategy at the start of each day.

- Filter portfolios for real-time cash balances, compliance breaches, rating changes or investment target drift

- Determine aggregated underweights versus targets for each portfolio and strategy to easily convey needs

- Visualize upcoming cashflows, maturities, and coupon payments to enable proactive portfolio management

Easily perform scenario analysis

Understand the pre-trade impact of a potential trade to validate a scenario, fast. With the ability to gain high-level and in-depth analysis into potential trades across portfolios, portfolio managers can make more informed investment decisions.

- Mockup orders to see the impact on analytics, restrictions, and investment targets

- Visualize portfolio-level impacts with an enhanced dashboard

- Drill down into scenario metrics and compliance with detailed delta metrics

- Promote orders to the OMS in one click

Model cash flows to better fulfill client requests

Manage cash more effectively with the ability to view short- and long-term cash flows along with ad hoc cash requests from clients. Model withdrawals or contributions to see the impact by month or year and more effectively monitor portfolio needs. This highly intuitive workflow allows you to be more proactive about upcoming requests and available cash.

Pitch to prospects with portfolio comparison tools

Demonstrating potential changes to portfolios is critical in pitching new clients or executing a strategy shift for existing clients.

- Upload prospective client portfolios to the platform without impacting total holdings at the firm

- Construct mock portfolios using the full suite of portfolio tools leveraging available inventory and compliance for preferred positioning

- Create sleek, white-labeled reports to compare multiple portfolios for clients and prospects

Want to learn how IMTC helps your firm to outperform?

Speak to our sales team. Our team has a consultative approach to help you assess if IMTC’s technology is right for your firm.

-

info@imtc.com

-

99 Wall Street, Suite 5501, New York, NY 10005

-

(646) 992-3530