Manage fixed income at scale

Elevate fixed income management by automating manual workflows and customizing portfolios with speed and precision—so you can focus on strategic growth and stay ahead of the curve.

Grow your fixed income business and launch new

offerings, efficiently and easily

Deliver highly customized fixed income products

Offering new strategies such as SMAs, model portfolios, tax optimized accounts, and more to meet the changing demands of end clients isn’t scalable with current technology. Using a combination of legacy technology and spreadsheets to make decisions while communicating with clients, sponsors, and custodians is slow and prone to errors.

Customize fixed income accounts at scale

Managing individual bond accounts, blended portfolios, and UMAs has become increasingly tedious, prohibiting the ability to tailor portfolios or scale growth. Using a combination of legacy platforms, custodial platforms and spreadsheets to make decisions is slow and prone to errors.

Manage customized model portfolios with ease

Enabling access to custom indexing or customized corporate bond portfolios with model portfolios isn’t scalable with current technology. Using platforms designed for equities means you need spreadsheets to make decisions, effectively limiting investment options.

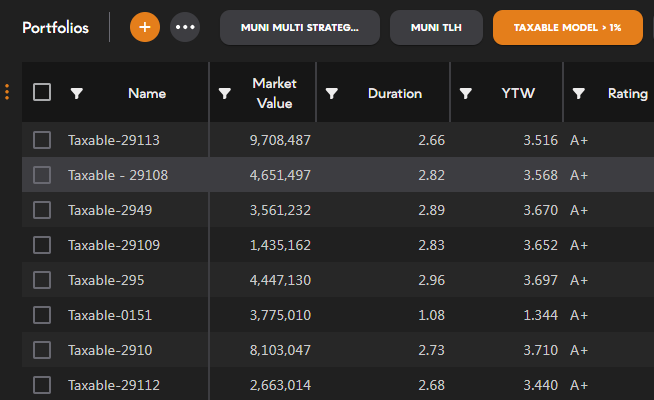

Offer personalized muni portfolios at scale

Maintaining hundreds or thousands of portfolios across different strategies – state-focused, laddered, barbell, or custom – isn’t scalable with current technology. Using platforms that can only invest one strategy at a time or spreadsheets to make decisions isn’t effective.

Transform bond account management with

precision-driven intelligence

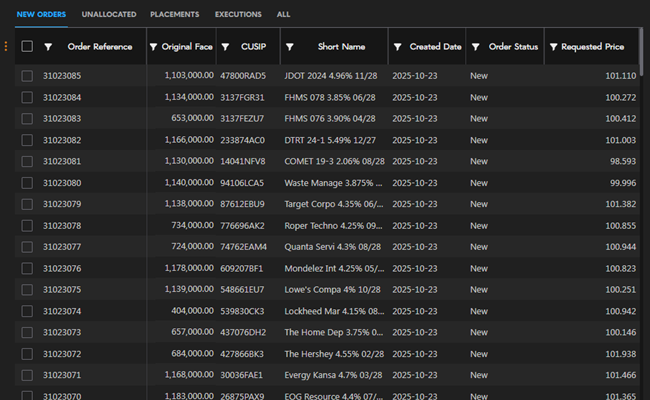

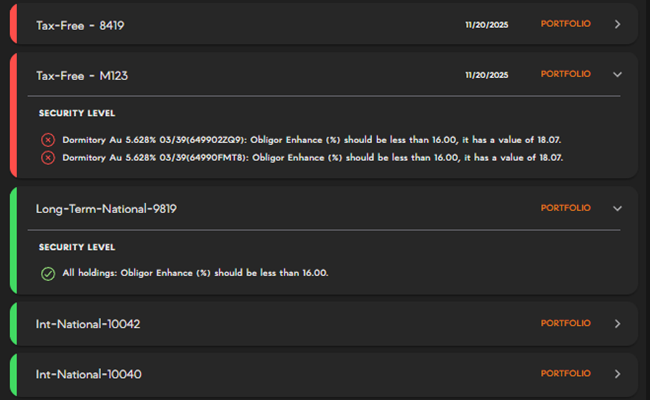

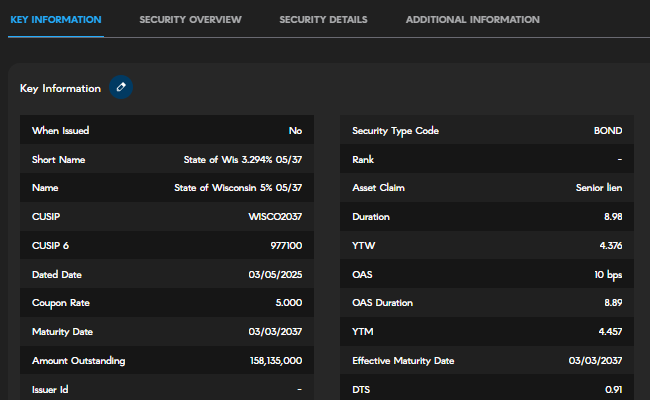

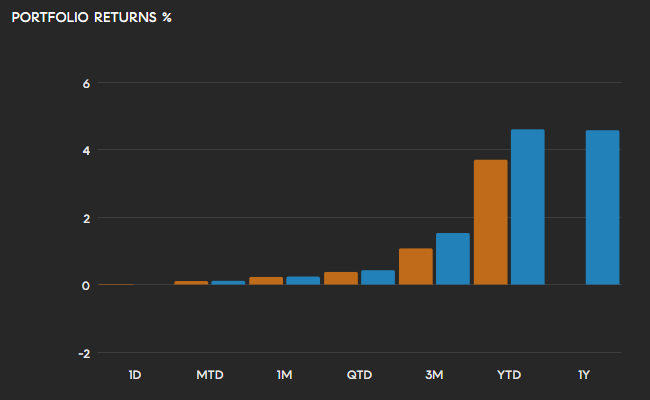

Whether you’re managing SMAs, model portfolios, bond ladders, or funds, you need to make

decisions across accounts simultaneously – with confidence. IMTC |im-TEK| empowers you to generate ideas,

construct portfolios, and execute trades in one seamless workflow and automates manual

processes with our turnkey portfolio and order management system.

Dynamic Portfolio Construction

Unparalleled Connectivity

Flexibility & Scalability

Streamline fixed income management with a comprehensive and flexible suite of modules

Seamlessly integrate with our industry-leading partners to aggregate all your critical data

Connectivity into portfolio data, live inventory, routing and execution, market data and analytics, CRMs, and proprietary data sources streamlines the flow of data across the investment lifecycle, automating manual processes and minimizing the risk of errors.

See a sample of the 25+ key platform and data integrations available on IMTC or talk to our team for an exhaustive list.