Offer personalized muni portfolios at scale

Manage across multiple strategies concurrently on a modern, intuitive platform without manual, time-consuming processes.

Are you limited to investing one strategy at a time or using spreadsheets to manage accounts?

Managing hundreds or thousands of portfolios across different strategies – state-focused, laddered, barbell, or custom – isn’t scalable using current technology. Using platforms that can only invest one strategy at a time or using spreadsheets to make decisions isn’t effective.

IMTC can help if you’re having difficulties with:

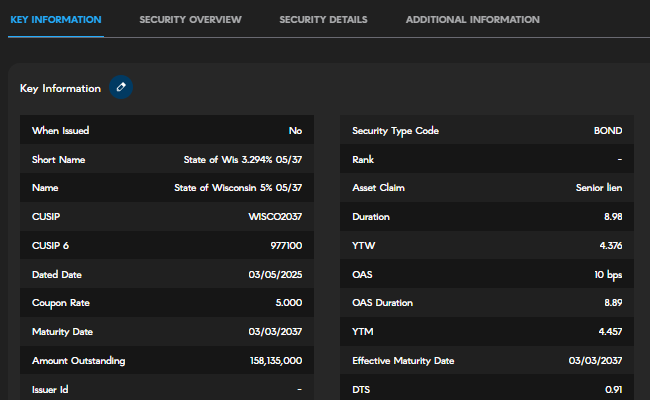

Aggregating and adapting data

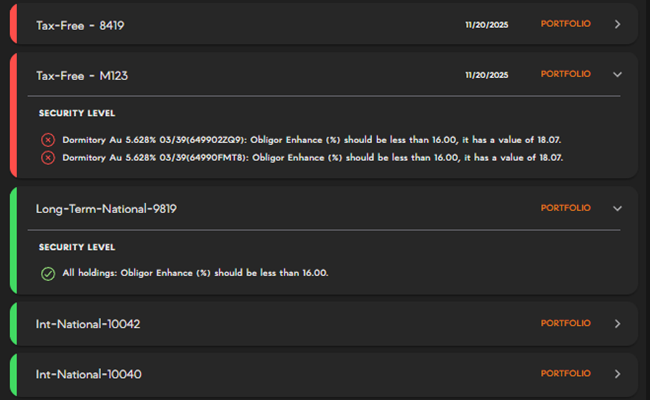

Identifying portfolio gaps

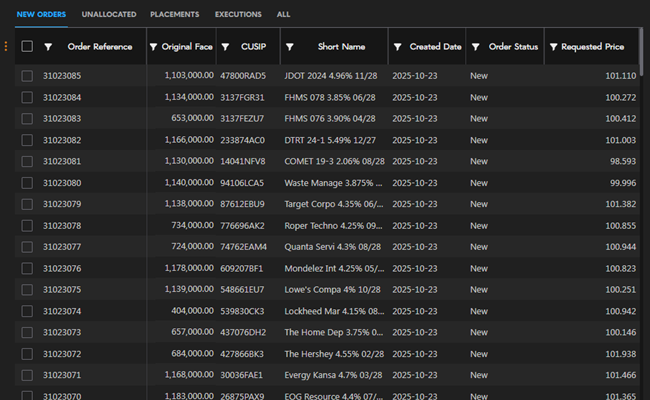

Allocating across accounts

Automating post-trade workflows

Streamline and automate fixed income account management with a fully integrated solution

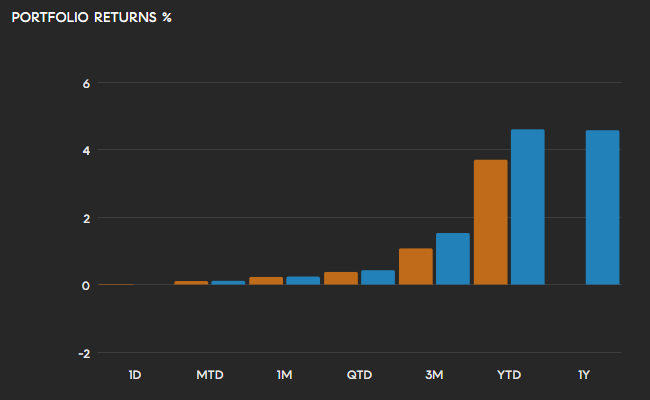

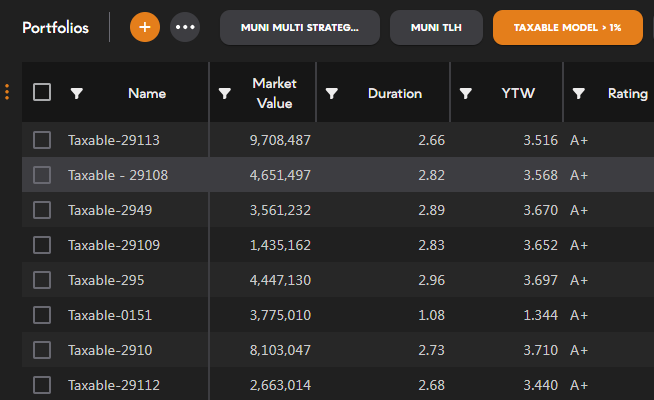

- Monitor cash flows and identify exposures across your entire book

- Create optimal portfolios using live inventory that adheres to targets and maximizes tax equivalent yield

- Allocate trades equitably across numerous accounts using a user-defined, rules-based waterfall methodology

- Enhance pre- and post-trade visibility with aggregated, flexible data

Modernize portfolio construction across accounts, faster, with IMTC

Transform your ability to scale fixed income management when you can make investment decisions with speed and accuracy not before possible.

of clients can move to managing multiple accounts simultaneously

reduction in time spent allocating trades

of our clients are able to offer increased customization within 6 months of using IMTC

fully connected ecosystem of portfolio management, order management, execution platforms, and data systems

Explore how IMTC clients are using IMTC

Streamline fixed income management with a comprehensive and flexible suite of modules

Latest insights

Fixed Income Trade Allocation: How Technology & Automation Ensure Equitable Bond Allocation Processes

Beyond the Spreadsheets: Why Wall Street’s Migration to Modern FinTech is a Fixed Income Imperative

Want to learn how IMTC helps your firm to outperform?

Speak to our sales team. Our team has a consultative approach to help you assess if IMTC’s technology is right for your firm.

-

info@imtc.com

-

110 E. 42nd Street, Suite 805 New York, NY 10017

-

(917) 310-2218