A combination of modules to make investment decisions across accounts simultaneously including scenario analysis, optimization, allocation, portfolio filtering, cash flow modelling, and more.

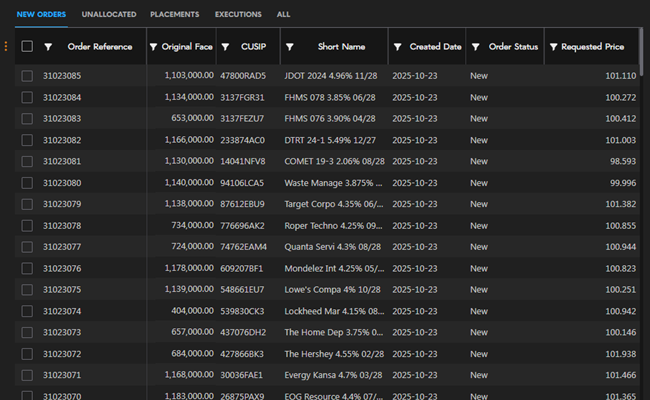

A trade blotter with functionality to manage orders with direct connectivity into ECNs, dealers, and third-party OMS/EMS platforms to route orders effectively and process trade confirm details automatically.

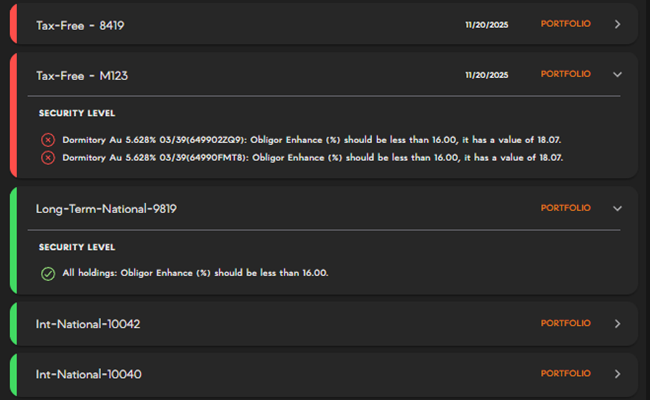

The compliance module embeds effective risk management and adherence to portfolio strategies, targets, and unique investment guidelines into every investment decision, pre-trade.

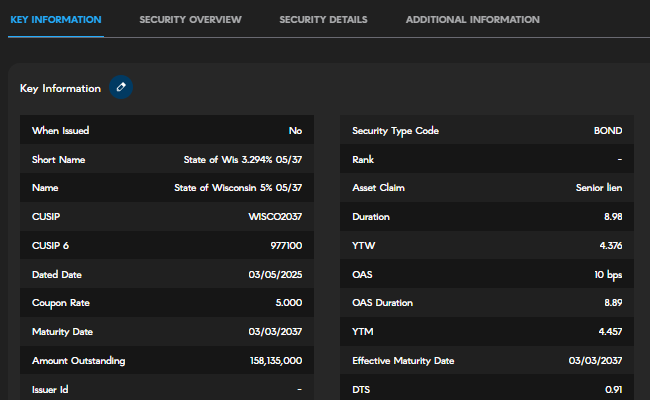

A platform that aggregates all data needs including security masters, live market data, analytics, and more with complete flexibility and control over data.

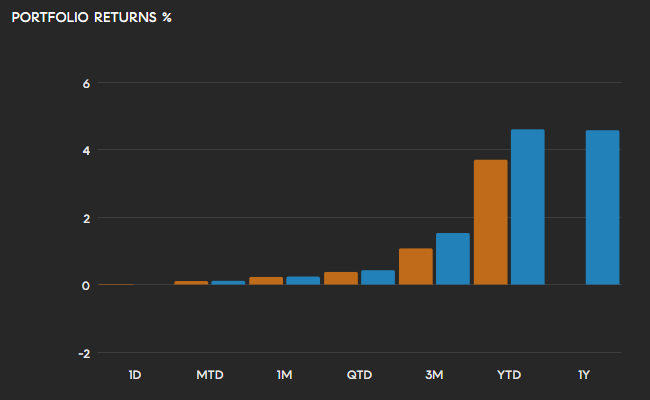

A dynamic tool to generate both internal reports and client reports, including white-labelled portfolio reporting, attribution, composite reporting, portfolio comparisons, and more.

IMTC builds and maintains all data and platform integrations to minimize the burden of managing data for firms.