Fixed Income Data & Analytics

View interactive dashboards with curated data

Optimize the visibility of your investment management workflows with an intuitive, sleek, and modern interface.

- Process significant volumes of data and analytics easily with aggregated dashboards designed by and for fixed income investors.

- Simplify portfolio management and analysis with user-friendly filtering, field selection, and sorting across accounts.

Explore IMTC’s latest product developments, including the support of structured products, new model portfolio management functionality, an integration into Flyer, the addition of yield curve…

Harnessing the Power of Data: The Case for AI, Big Data, and Predictive Analytics in Fixed Income

Fixed income portfolio managers have access to a much wider range of data than ever before and those that understand the information are much better positioned to make more confident investment…

Gain complete control & flexibility over data

Manage accounts more precisely when you can tailor data to the needs of your firm.

- Accurately portray accounts with the ability to specify unique classifications, standardize data, set groupings, and edit sectors.

- Create custom fields to incorporate internal ratings, scores, recommendations, or other data points that are critical to your investment process.

- Utilize data or tags unique to your firm to group and filter with ease.

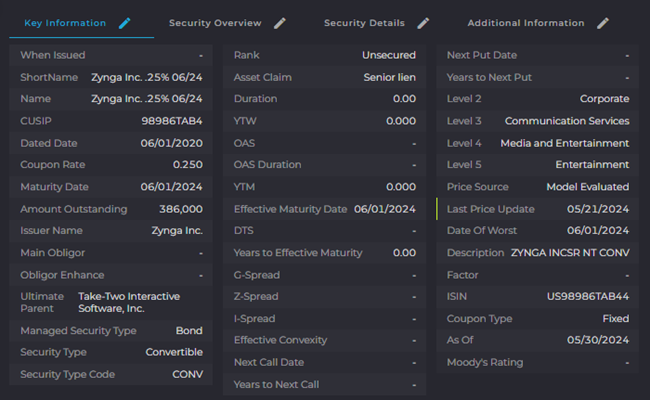

Access comprehensive security masters

Gain insight into fixed income securities to assess bond valuations and fit for portfolios, faster.

- Visualize quantitative information on securities by combining integrated data and calculations, including terms & conditions, yields, and more.

- Digest extensive analytics in a clear, summarized format on a single screen that contains over 250+ fields.

Analyze bonds with advanced analytics & insights

Leverage advanced analytics and insights to assess securities’ value and perform relative value analysis. Data can be tailored to the needs of each firm.

- Determine future cash flows and risks with option-adjusted spread, duration, and other metrics.

- Conduct granular security- and issuer-level due diligence, bringing key information together for stronger investment decisions.

- Identify comparable securities to inform pricing strategies and complete relative value analysis.

Develop shared buy lists

Curate watchlists of approved names or available inventory to make faster investment decisions amongst team members.

- Incorporate market data and live quotes into buy lists for better insight into a bond’s fit in a portfolio.

- Optimize portfolios based on an investment objective using buy lists developed from recently traded bonds, available inventory from brokers, or approved name lists.

IMTC Selected as a WealthTech 100 Company in 2024 for Second Consecutive Year

In its sixth edition, the WealthTech100 shines a spotlight on the WealthTech companies that every player in the wealth management industry should know about in 2024.

Recalibrating Fixed Income Investments: Insights from the RIA Summit in NYC

At the 2024 NYC RIA Summit, Russell Feldman and Jeffrey MacDonald spoke on a panel about the changing landscape of fixed income. Topics included the state of the market, how SMAs have grown to…

Want to learn how IMTC helps your firm to outperform?

Speak to our sales team. Our team has a consultative approach to help you assess if IMTC’s technology is right for your firm.

-

info@imtc.com

-

99 Wall Street, Suite 5501, New York, NY 10005

-

(646) 992-3530