Fixed Income Trivia Time: When was the first green bond issued and by what issuer?

Congress heads off for vacation without an extension of the unemployment stimulus; markets were instead bolstered by decent economic data and a leveling off of COVID cases. Ultimately, markets will feel the impact. The good news is that the economy continues to recover allowing investors to focus on economic activity and consumer spending, which have continued to comeback. Job gains have also supported the risk tone in markets. Despite unemployment remaining above +10%, the economy has continued to repair itself by adding millions of jobs in the past few months. In addition, initial jobless claims announced this past week fell below the significant 1 million threshold for the first time since March.

Is the progress sustainable though? As good as corporate bond and equity markets have been, the risk to the downside is greater given the rally. Higher expectations seem to be baked into future economic activity and there’s the potential it may not come to fruition as fiscal stimulus lapses. The U.S. economy remains in a sensitive spot still facing a significant number of hurdles, including escalating China-U.S. disagreements, the November general election, recovering more of the 13 million jobs that have been lost since March, and the herculean task of trying to get schools and universities running. The next few weeks will be pivotal to see if the momentum of the economic recovery fades.

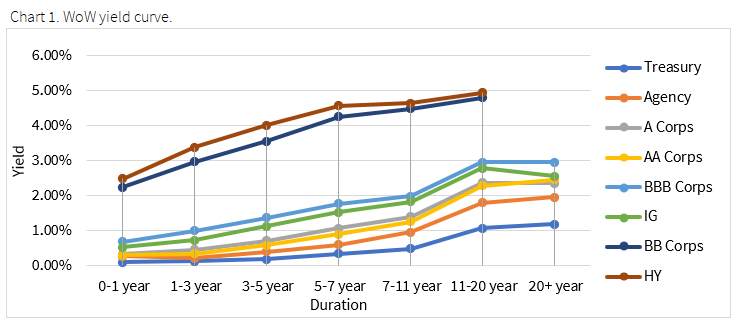

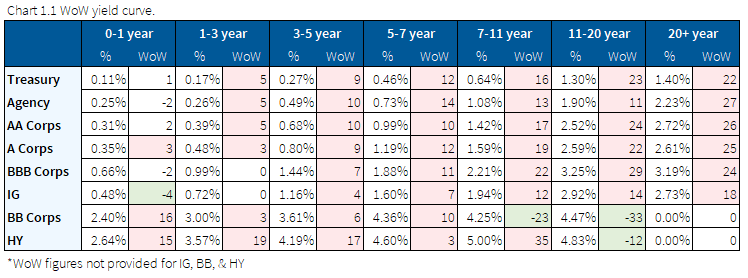

Yield rise on the back of economic indicators

Treasury yields rose this week on the back of better than expected economic indicators, specifically, lower jobless claims. The long end of the curve raised more significantly, driving a slight steepening of the curve. Overall, the increased US Treasury auctions performed well and the Treasury successfully raised some of its largest issuances ever.

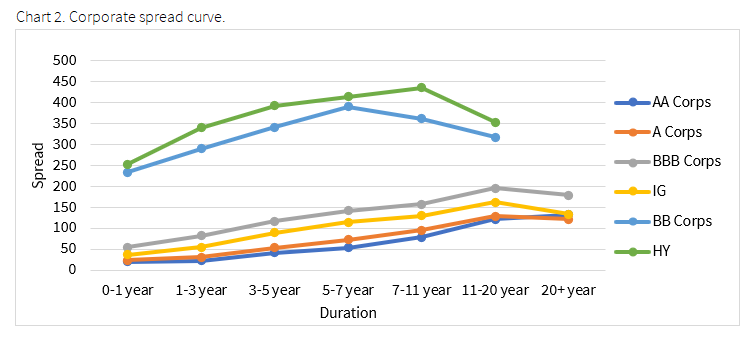

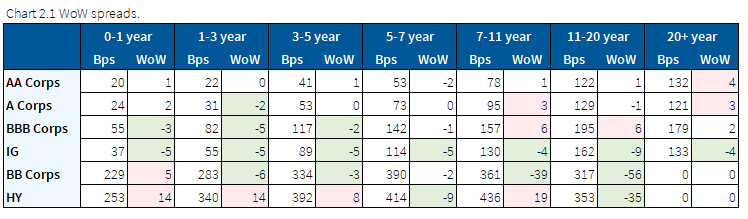

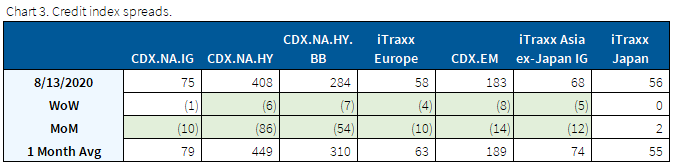

High yield and emerging markets outperform broader indices

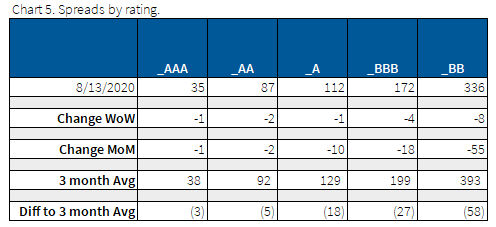

All major credit indices traded tighter on the week with high yield and emerging markets outperforming the broader indices. High yield credit indices continue its MoM tightening (86bp tighter) while credit rating agencies expect for credit deterioration in 2021.

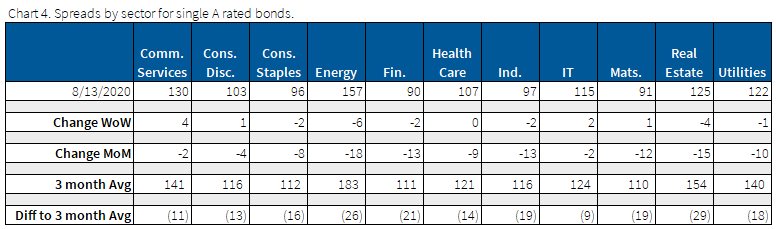

IT was flat on the week, while Apple is the next IG tech name to tap the new issue market with size. Apple’s longest maturity (40 years) came in at a spread of 118 bps compared to Amazon’s 130 bps and Google’s 108bps over Treasuries. Google briefly held the record for the lowest yield on corporate debt before Visa quickly surpassed Google with a 0.75% 2027 green bond this week, as green bonds continue to be popular among IT firm.

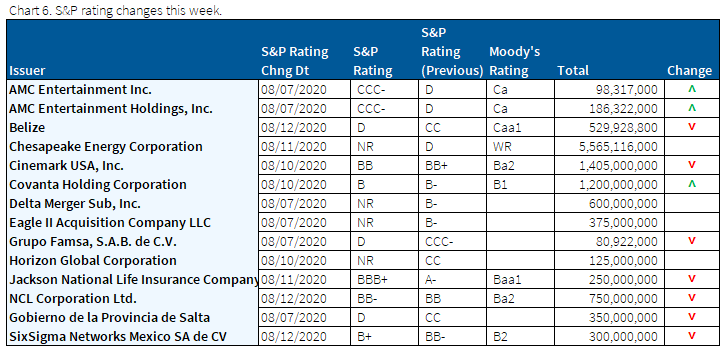

Downgrades outpace upgrades, while S&P drops ratings on 4 names

Rating downgrades continue in the below investment grade space, with 7:2 downgrade to upgrade ratio this past week.

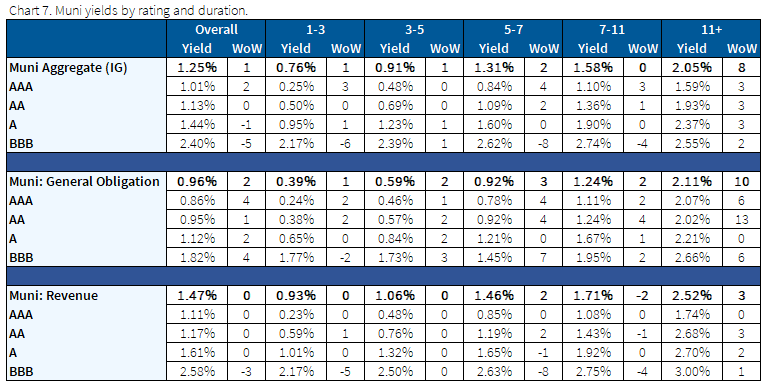

Munis experience 13th week straight of net inflows

$19 bn has moved into municipal bond funds in the past 3 months, marking this week as the 13th straight week for net inflows. Municipals yields rose slightly though significantly outperforming Treasuries this past week; this is despite fundamental credit concerns and a lack of stimulus from Washington.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions.

Fixed Income Trivia Time Answer: Issued in 2008 by The World Bank

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.