Fixed Income Trivia Time: What is the fastest-growing fixed income sector?

All of us at IMTC would like to wish you a safe and happy holiday season! This will be our last Fixed Income Brief of the year and will return in the new year. Thank you for all of your support this year.

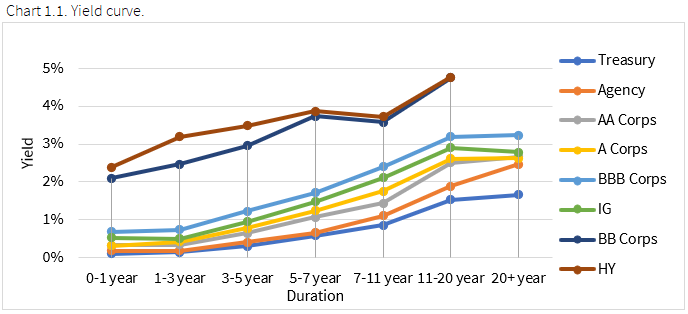

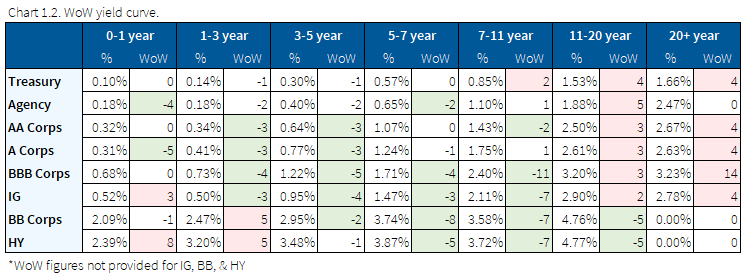

While stocks close at all-time highs, the fixed income market remains more in lockstep with the guiding force of the Fed. Seeing through to a future when the pandemic will be contained, where fiscal and monetary stimulus will be at full force, has bolstered markets. The risk rally permeated throughout all markets except for U.S. Treasuries as we finish off the last full trading week of the year. Despite the vaccine rollout and fiscal stimulus euphoria, the benchmark 10-year note trading at 0.93% barely budged, trading in a weekly range of +/- 5bps. Credit spreads rallied across the board and even Bitcoin has grabbed more headlines with +200% this year. Given this backdrop, you might expect interest rates to be pushed higher yet all signs point to a well-anchored yield curve at the moment.

Rate volatility is nowhere to be found as Powell and the FOMC quadruple down on their dovish stance, stating that rates will remain “the same for many years.” Powell signaled a very long-term dovish signal and indicated that the asset purchase program would continue until the Fed sees “substantial further progress” on the economy. Although the Fed is projecting more robust growth in 2021 and 2022 that relates to the lower base established due to the virus in 2020. They also do not see unemployment getting back to where it was before the virus until 2023. According to their projections, they also do not see a fed funds rate increase until 2023.

Away from the Fed, the economic data this week was highlighted by another uptick in weekly initial jobless claims (+885k), the highest level in three months, and a disappointing retail sales report with core down -0.9% vs. +0.1% exp. We also had a disappointing Philly Fed Manufacturing Index (11.1 vs. 20.0) with a significant drop off from the prior month’s reading. On the positive side we saw November’s industrial production increase 0.4% (vs. 0.3% exp.) along with December’s Manufacturing PMI showing decent expansion again this month (56.5 v 55.7 exp.). The housing and residential construction sectors continue to be bright spots on the back of low rates as we saw +6.2% change MoM in building permits and housing starts come in at 1.547mil vs 1.53mil exp. And finally, U.S. PMI Services for December cooled off a bit as the closure of parts of the economy continue to take their toll on the current state of things.

No volatility in rates to unofficially close out trading

U.S. interest rates traded in a very narrow range going into the Fed meeting and after as the message of lower for much longer was digested by investors. The December theme of low volatility has played out as yields on the 10-year have hovered between 0.90% and 0.95% since December 1st with only two-to-three brief breaks above and beyond those bands. No doubt that volatility will return, it is just a matter of which direction we go from here given the Fed’s stance versus the positive outlooks most are prescribing for 2021.

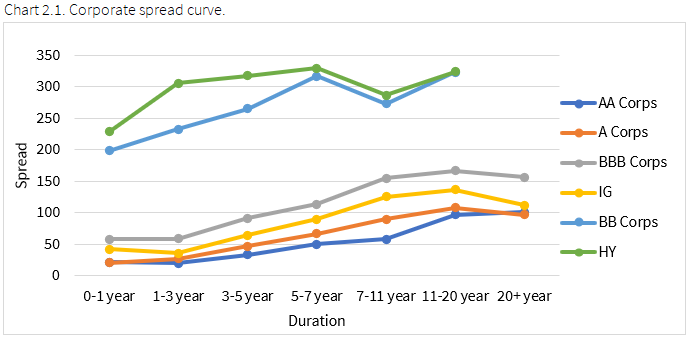

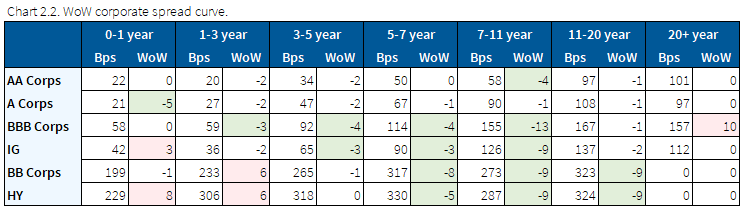

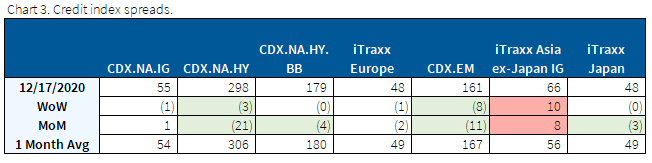

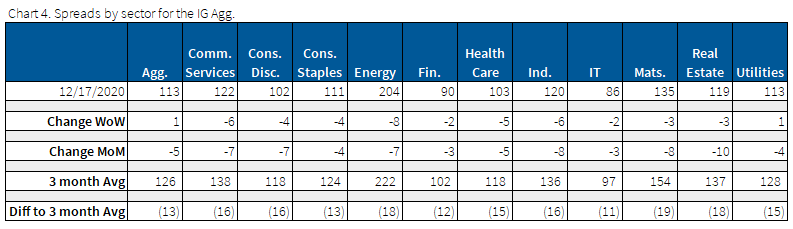

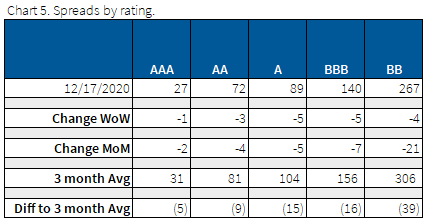

Credit spreads tighten modestly as investors continue to price in optimism for 2021

2021 expectations remain optimistic and a lot of the optimism has been price into the market, following another week of modest spread tightening. The Fed reiterated their dovish stance this week and willingness to help American consumer and businesses.

The best performing sector this week was energy, led by Haliburton with the largest spread tightening.

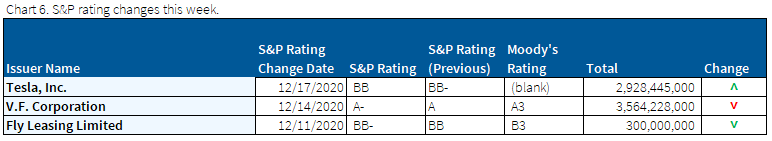

Tesla gets another bump from S&P

Only a handful of corporate ratings changes occurred over this past week with Tesla being the most notable. The YoY high-yield default rate jumped from 4.1% to 8.4%, however, the positive outlook for 2021 has driven strong returns, specifically in the HY space.

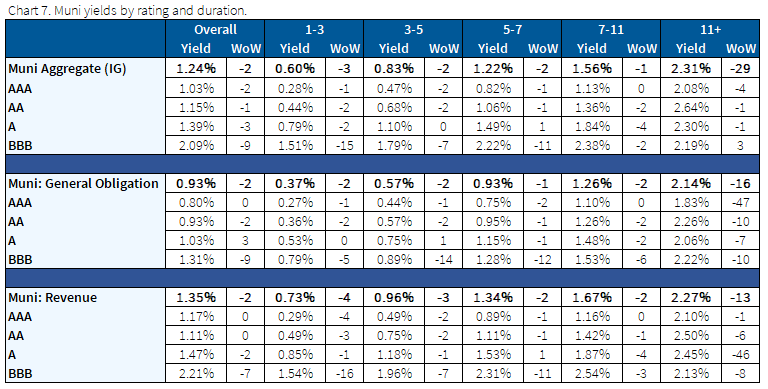

Munis yields continue trend lower and outperform Treasuries

Municipal yields yet again rallied as overwhelming technicals continue to support this trend continuing. Given the hope around the start of the vaccine rollouts, future potential for increased taxes, lack of relative supply, and heavy cash positions, many market participants are very bullish on municipal debt. The main risk to fly in the face of munis being able to outperform Treasuries would be weak fundamentals and the realization of an uptick in defaults. However, those fears have been mostly contained given the expected fiscal stimulus support that will eventually come and the Fed liquidity facilities that would likely be extended if needed so the bullishness will be hard to stop in 2021.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Dec. 17, 2020.

Fixed Income Trivia Time Answer: Taxable municipal bonds – this year, issuance has totaled more than $170bn, double the $85bn sold in all of 2019.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.