Fixed Income Trivia Time:

What was the first ESG focused song?

As the economy continues to heal, there are a number of short-term issues that are muddling the waters. From the May non-farm payroll figures, it is evident that the recovery is in full swing but capped by being able to find people to work at reasonable wages. Fear about contracting the virus, supply-side constraints, high jobless benefits, and lack of childcare are structural issues that are overriding economists’ expectations for the trajectory for the recovery. Given Friday’s market reaction to the jobs report, fixed income and equity investors are betting on a patient Fed when they meet June 15-16th. Fed Chair Jerome Powell and other FOMC members have been firm in their stance to remain patient in order to see how these factors all play out, but any sign of wavering in their position will likely lead to increased volatility in rate and risk markets. The unknown here is how the fiscal side of things translates to economic activity and the timing of when those funds will impact the various sectors aimed to benefit. In the end, investors are comfortable for now with the fact that the overall economic stimulus will continue to flow.

In terms of economic data this week, it was all about the May non-farm payroll which came in at +559k, below +650k expected. Given recent revisions, this puts the average monthly jobs gains over the past three months at +535k. The average hourly earnings MoM was up +0.5% vs. +0.2% expected and is now up +2.0% YoY vs. 1.6% that was forecasted by economists. The unemployment rate did end up beating expectations coming in at 5.8% (5.9% exp.), -0.3% lower than April. The employment pictured was also bolstered by a booming ADP nonfarm employment figure (+978 vs. +650k exp.) and the weekly Initial jobless claims breaking the 400k level, coming in at 385k. The preliminary robust Markit Services PMI report from May was finalized even higher (70.4 vs 70.1) and shows hotels and restaurants are the biggest beneficiaries of the continued re-opening. In addition, the ISM Non-Manufacturing (64.0 vs 63.0) and Manufacturing (61.2 vs. 60.9) exceeded expectations and showed a further expansion versus last month. Next week the main focus will be the May CPI data on Thursday and the market will be eager to digest the JOLTs figures on Tuesday along with a 10-yr note auction on Wednesday.

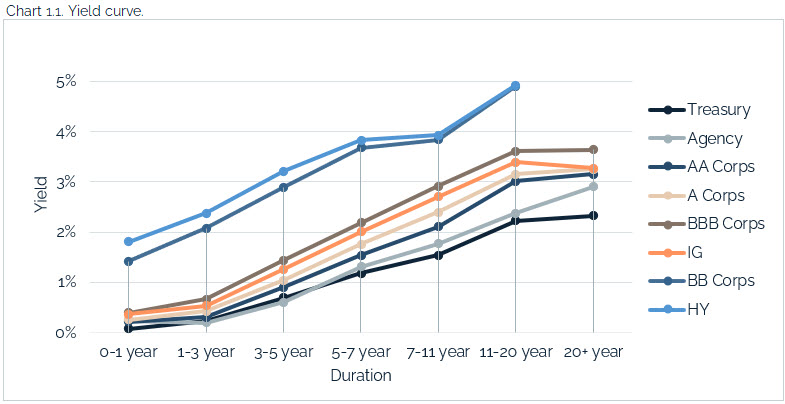

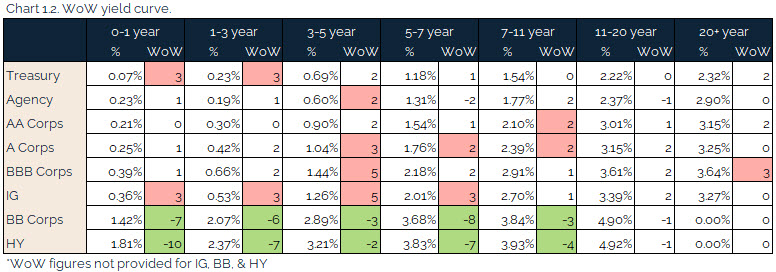

Rates remained steady in anticipation of May jobs report

Rates WoW were relatively unchanged leading up to the much-anticipated May non-farm jobs number. Not captured in the data below, but the initial reaction to the report was a rally in the longer end as investors bet that the jobs and wage inflation data were not enough to shift the Fed policy of remaining patient.

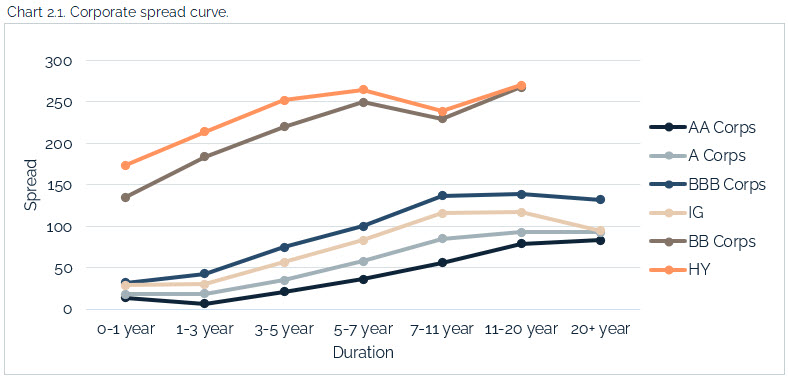

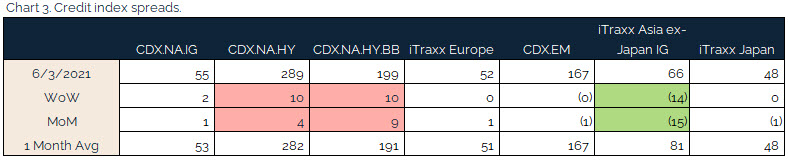

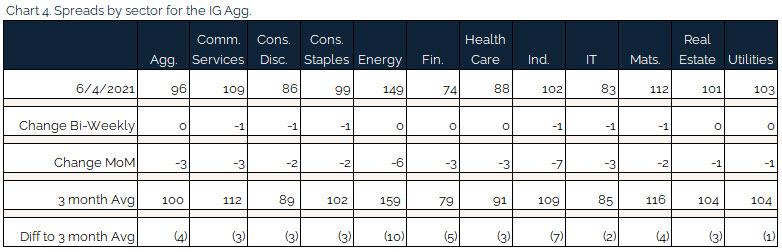

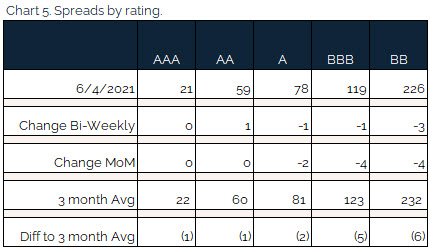

Credit spreads slightly tighter this week, HY outperformed

Investors held off from sending spreads any tighter this week in anticipation of the Friday’s jobs report. Given the somewhat Goldilocks nature of the report, it will be interesting to see where investors go from here.

Little movement this week with spreads trading well through 3-month averages.

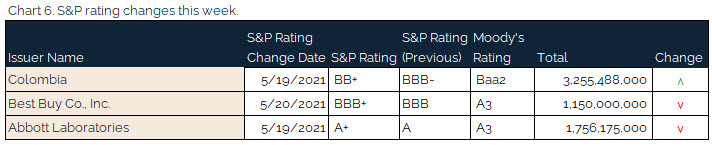

Merck downgraded, another “AA” name gone for investors

S&P downgraded Merck & Co. Inc.’s long-term issuer credit rating to A+ from AA- on their most recent spin-off.

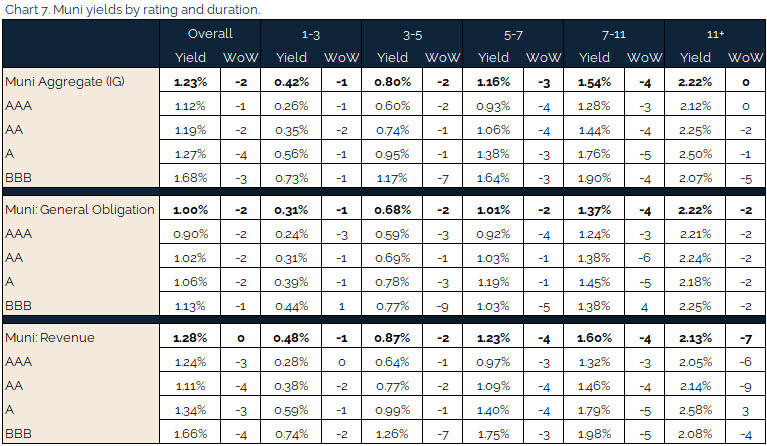

Muni yields slightly lower, outperform Treasuries prior to jobs release

No change in the municipal market technicals as demand continues to outstrip supply and the fundamentals continue to surprise to the upside as consumers keep spending. The flow of funds from the Federal government and how states intend to use the cash will dictate how the rating agencies adjust their outlooks.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, June 3, 2021.

Fixed Income Trivia Time:

Where Do the Children Play? By Cat Stevens / Yusef

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.