Fixed Income Trivia Time:

According to Federal Economic Data (FRED) when is the last time the 2-10s yield inverted?

Check out the sweet cheetah picture captured by none other than IMTC COO Russell Feldman. Look out, National Geographic!

—————–

The Powell Pivot is in full effect. The Fed chairman used words like nimble, adaptable, and humility in his prepared remarks at the FOMC press conference on Wednesday, reemphasizing the balancing act the Fed must perform to phase out the extraordinary monetary stimulus. The sense is that raising rates is a blunt but known tool that sends a strong message that sustained inflation above their target will not be tolerated. Powell stated, “there is quite a bit of room to raise interest rates without threatening the labor market,” noting the strength in indicators around the number of job openings, quits rate, and employer surveys are at levels that have never been seen before.

Now that the Fed has one pillar – maximum unemployment – buttoned up for the foreseeable future, it can focus its energy on landing the stimulus plane in stormy, volatile conditions with a short runway – where’s Captain Sully when you need him? The key going forward will be how the central bank uses its balance sheet flexibility to help smooth the transition – we will get hints of how this might work over the next month through Fed speakers leading up to the March meeting.

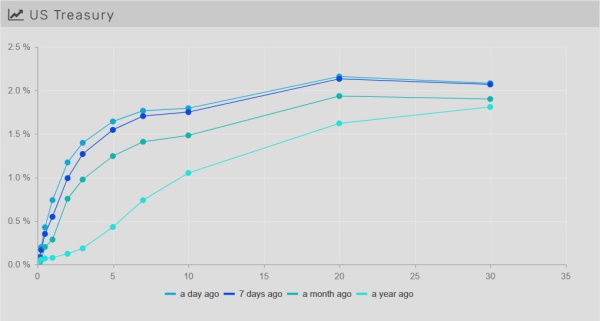

Volatility persists with a significant flattening of the yield curve

Rates ended the week higher overall, but most notably, the 2yr rose +17bps and the 5yr rose +10bps, with the 10yr and 30yr only higher by +3-4bps. The market continues to balance high inflationary data and the Fed’s willingness to act aggressively with a risk-off tone from lingering COVID cases and continued Ukraine threat from Russia.

The 2-10s curve flattened ~15bps WoW to 63bps, which is the flattest the curve has been since November 2020, as short-term hikes shift the front end higher, while the longer end of the curve trades more as a function of risk sentiment and longer-term expectations on growth and inflation – which remain intact.

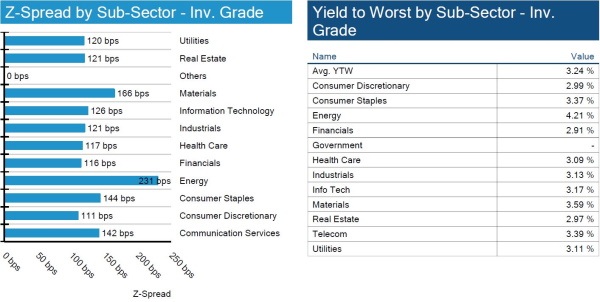

Spreads widen to new 2022 wides

Spreads widened ~6bps on the week to hit new wides. Industrials underperformed on the week, and we are seeing most sub-sectors move above their one-year averages. Total return remains negative, and it will be interesting to see how this affects new issuance.

High yield spreads move wider

HY spreads widen in line with the rest of the market. Energy was a big loser on the week, moving ~12bps wider in spread. Kohl’s was the largest idiosyncratic driver widening ~130bps on the week as investor pressure comes from activist

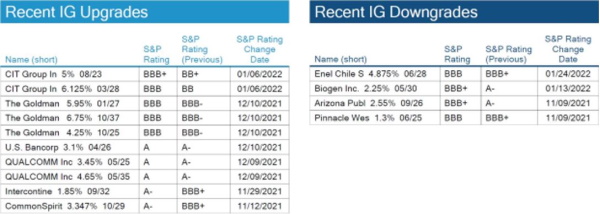

No IG rating changes this week

No rating changes by S&P for IG issuers. Enel Chile saw a small downgrade to a specific tranche of debt.

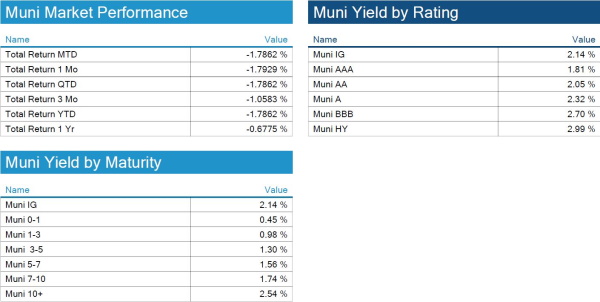

Munis limping into the end of the month with continued negative returns

As the Fed continues to pull back stimulus, the muni market got hit for another -67bps of performance this week. This still leaves munis as the least-worst sector within fixed income for January, supported by lack of visible supply, currently at $9.9bn versus an average of $11.4bn in 2021. The consensus is that supply will continue to support muni technicals in the near-to-medium term. The medium-term risk here is some additional funding is expected as part of the Build Back Better policy – currently stalled in Washington – could bring forward more issuance than originally forecasted.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, January 27, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

Wednesday, August 28th, 2019 (-3bps). It recovered to finish +34bps by year-end.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.