The Fixed Income Brief: Running to Standstill

Guest economic analysis and muni commentary: John Hallacy

Fixed Income Trivia Time:

How many conferences or conventions are held in Las Vegas every year?

—————–

From John Hallacy:

The confidence in financial markets has long ago evaporated at this point. Collectively we are attempting to find our way, but there are many obstacles. The major market indices continue to find fresh lows. M&A deals that were easy to accomplish in the not-too-distant past are now encountering obstacles on the path to completion. Does anyone really know how the takeover of Twitter will unfold? How about JetBlue’s or Frontier’s acquisition of Spirit?

What is different about this period is that all markets are suffering to an extent. Value is supposed to be winning out overgrowth, but losses have been widespread despite the investing theme.

One area we do have complete confidence and conviction about is that rates are moving higher. The Fed has scheduled three moves of 50bps regardless of current events. The earliest it would appear to be time to reconsider would be after the three moves.

The Fed is earnest about slowing the economic pace to tame the ultra-high inflation that we are experiencing. How much slower is acceptable? The Fed must use a lot of discretion in this consideration. This aspect takes on even greater importance given the upcoming mid-term elections.

No one was actively outstating that the retailers’ activity would be declining this much. The recent reports by Walmart and Target have cast a bit of a chill on activity going forward. Some of the downturn may be related to supply chain bottlenecks, but consumers were already applying the brakes to their spending behaviors.

The other factor has been the increasingly dear cost of energy. $6 per gallon in California must be curtailing some of offline, discretionary shopping trips. Several states are providing a modicum of energy relief, but we are not clear how long these programs will be in existence.

The war in Ukraine continues to drag on with all the daily tragedies. Some possibility of meaningful talks to cease fire would help markets, but there is no expectation that such a scenario is forthcoming.

So, what is an investor to do? Liquidating investments and going to cash has its own set of cost implications. Technology is here to stay. The advances in tech have improved all our lives. Is it reasonable to think that higher rates alone can blunt the effects? We clearly cannot abandon the sector. Some would argue that now is the time to acquire more tech investments at an advantageous cost. But such a move takes confidence and conviction.

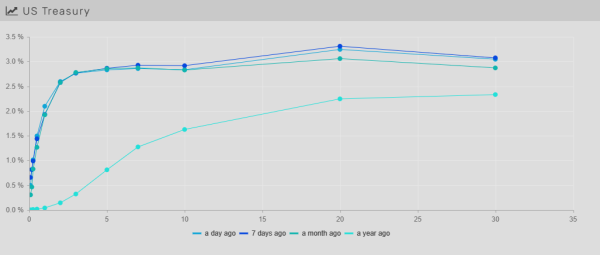

The slight inversion from 5-to-10yr Treasury bonds is not particularly worrisome. The three months to 10yr spread remains positive. Recession does not appear to be imminent. However, as profits sink, the pace of hiring may be in for a change. The appetite to tap financial markets may also wane in this environment, except if the borrowing is done for cash for operations.

One must ponder liquidity in this kind of market and in all markets. At least the Greek chorus complaining about liquidity has not found its voice yet.

Rates down slightly on risk off

Treasury bond trading ranges were a little more subdued this week, trading in a +/- 20bps range, about half of the prior week. The risk off tone in equity markets has fixed income investors in “wait-and-see” mode as they contemplate the inflationary outlook. After trading higher through the beginning of the week, rates settled mostly lower WoW, with the 5, 10, 30yr down -5bps, -9bps, -5bps respectively. The 2yr yield was +1bps higher WoW, narrowing 2-10s spread ~10bps, which now stands at +23bps.

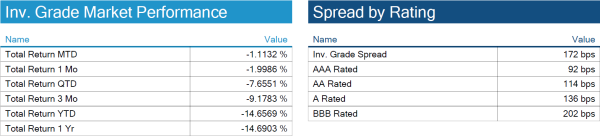

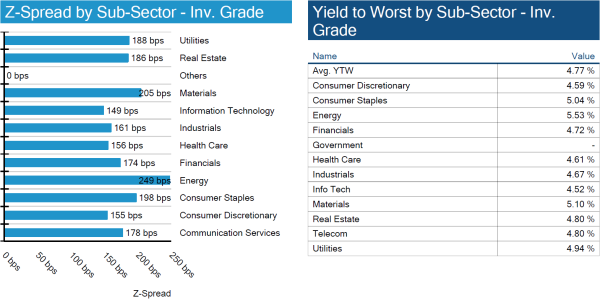

IG spreads widen again WoW

Spreads continued to widen (+6bps) as inflation and increased chances of recession moved risk markets lower. Earnings calls the week indicated margin squeezes on wages and concerns inflation will continue to have a large, negative affect on the economy. BBBs led the underperformance +8bps, with single-A and AA rated Corps +4bps WoW. The positive side is that overall yields (~4.77%) are looking much more attractive at these levels, which may tempt more investors to increase their demand despite.

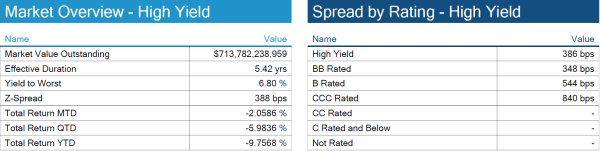

High yield weaker but more dispersion between ratings

High yield corporate bonds continue to sell-off, but BBs were little changed (+5bps) versus single-B and CCC which were +19bps, and +38bps respectively. As more investors bake in a greater probability of recession, the comfort in holding the lower quality names in HY loses conviction, causing selling or simply less buying.

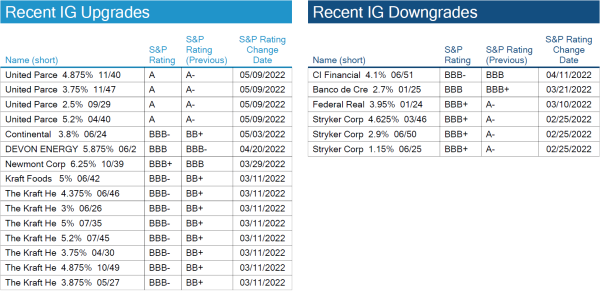

Kraft upgraded to IG by S&P; Stryker downgraded to BBB+ from A-

Kraft was upgraded to investment grade by S&P. The upgrade comes on the back of better cost controls and prudent balance sheet management. The rating agency said that improvement in the Kraft Heinz’s operational execution, forecasting and hedging process, and divestment of higher commodity volatility business are likely to lead to limited profit erosion in the current high inflation environment.

John Hallacy: Las Vegas Confidential

This week, the municipal analysts who are a part of the National Federation of Municipal Analysts (NFMA) and guests gathered in-person in Las Vegas for NFMA’s annual conference. You should be able to surmise that municipal analysts are not big gamers. The crowd intensely focuses on the sessions. I should know because I am a member even though I did not attend. I do think it worthwhile to discuss a sampling of the topics discussed there.

One of the topics of keen interest is the continuous uptick in the digitization of the municipal market. One panelist associated with the MSRB stated that “EMMA must evolve from a repository to a functional database for all investors.” This comment cuts directly to the central challenge of the task. Many providers, including IMTC, are finding ways to make these improvements and to make the granularity more available than ever before. Change has required earnest effort given the number of issuers in the market and the range of reporting from state to state. We look forward to further improvements.

ESG has been a topic for all eyes as well. The S or Social element is on the rise. By one account, Social accounted for less than 5% of ESG activity in 2018 and is now in the double-digit range. A transaction that is focused on Social needs to be clear in its goals for the application of the funds. Investors need to be confident that the application of bond proceeds will adhere to these goals. We can see more future growth in this segment.

On the transportation front, the shortfall in the Highway Trust Fund continues to grow. It is far from clear how long the federal budget makes up the shortfall. Fuel taxes collected by the states are not keeping pace with the needs. As electric vehicles continue to increase as a percentage share of rolling stock, fuel taxes receipts will decline. The hunt is on for how to address this circumstance. The discussion focuses on Vehicle Miles Traveled (VMTs) or Mileage Based User Fee (MBUF). There are reservations from privacy and technology perspectives. There have been pilot programs for these formats. Although the information gathered may not be conclusive, the way forward must be carefully considered. We know that toll roads and Public Private Partnerships (P3s) cannot do all the heavy lifting in this sector.

We look forward to more themes post conference.

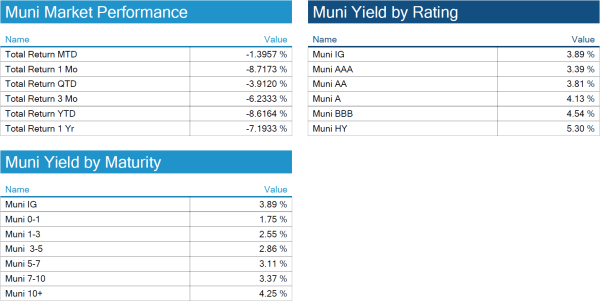

The outflows from the mutual funds continue at over $7 billion this week. One of the more interesting trends is that the proceeds from trading are finding a home in the large municipal ETFs. This trend has been more of a positive in a sea of negative news.

More about John Hallacy

John is an accomplished municipal and fixed income analyst, respected and recognized by the industry with over 35 years of experience at major financial firms including S&P’s Global Ratings, FGIC, Bond Investors Guaranty, Merrill Lynch, MBIA, Bank of America, Assured Guaranty, and most recently The Bond Buyer. A leading expert in state and local fiscal affairs. John’s experience includes ratings, insurance, public finance and sell side research.

Want more from John Hallacy? Check out his recent guest post on larger muni market trends here.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, May 19, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

Over 22,000 conventions are held in Las Vegas every year

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.