The Fixed Income Brief: That Was Fast – Rates Higher

Fixed Income Trivia Time:

Under Chairman Jerome Powell, what is the highest the Fed Funds Rate has risen?

Welcome back to The Fixed Income Brief! We’re looking forward to keeping you updated weekly on everything from the Fed to the bond market with commentary from IMTC’s resident market experts, Kevin Bliss and Patrick Duffner.

Note: We would love to hear from you, so please reach out to team@imtc.com.

—————–

Happy New Year to all our readers. Unfortunately, there was little time for pleasantries on bond desks this week as portfolio managers and traders had to deal with a significant shift in sentiment around interest rates as we made it through the first week of trading in 2022. It was highlighted by a move higher in yields across the curve, with a repricing in the front end increasing the probability of a 25bps Fed hike in March to 88%, moving expectations forward from May, which had been priced in as the month of the first hike prior to the start of the year. The move mainly stemmed from a reaction to the Fed minutes on Wednesday that caught some market participants off guard. The release laid out a case for more aggressive policy action by the central bank to stem the rise in inflation as they also acknowledged a stronger employment picture and a decent growth backdrop despite COVID continuing to wreak havoc.

Today’s nonfarm payroll release Friday also exacerbated the move higher in rates despite missing on a headline level as underlying inflation forces stemming from jobs do not look to be abating. Total nonfarm payroll employment for December rose by +199k, a significant miss versus street expectations of +400k and a second large miss in a row. Despite the miss, the unemployment rate declined to 3.9% from 4.2%; the employment trend was up across the board with leisure and hospitality, professional and business services, manufacturing, construction, transportation, and warehousing all adding jobs. Revisions from November’s payroll report were up +39k, but the real inflationary signal remains average hourly earnings readings MoM and YoY, which were up +0.6% vs.+0.4% exp. and +4.7% vs. +4.2% respectively. This underlying wage pressure along with the pressure of finding labor in the midst of the significant uptick in Omicron cases shows that this trend looks to continue at least in the near term. The closely watched labor participation rate remained static at 61.9%.

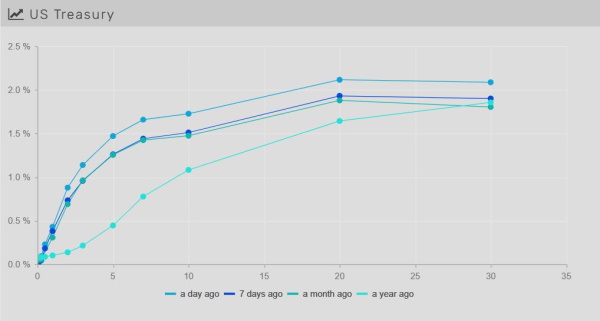

Yields higher, back to pre-pandemic levels

Rates markets started on the back foot this week with a double-whammy from the Fed minutes and December jobs report causing investors to bet on a more aggressive Fed to start the year. The front end repriced on the back of moving the expected first rate hike up to March from May and the back end of the curve reacted to a persistent inflationary environment that points to a long-term level of 2.5%, at the higher end of the Fed’s inflation range. To recap the WoW moves, the curved ultimately steepened ~12bps as the U.S. 2-year was up +14bps to 0.87% vs. the U.S. 10-year which was up +26bps to 1.77%. The 5-year note was up +24bps last week, marking its third-worst year-opening week on record, a sharp move we haven’t seen since 2003 (+29bps). The 30yr bond moved through the 2% level, up +21bps to 2.12%.

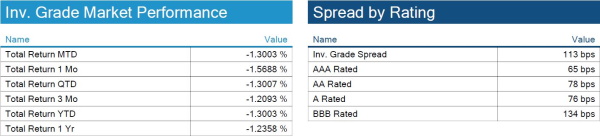

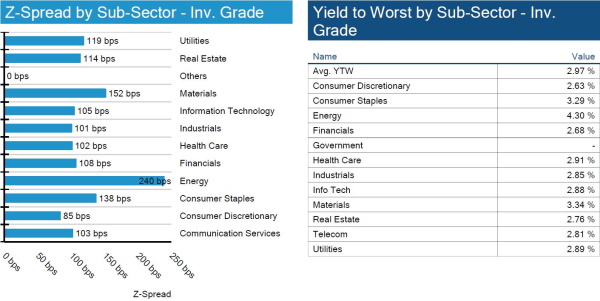

Large rate movements and modest spread movement

Spreads end the week slightly wider and at the wider part of the average range over the past year. The movement in rates made for most of the volatility on the week, and there being no issuance was welcomed by investors.

High yield spreads slightly tighter

HY spreads were calm over the week ending slightly tighter. Default assumptions continue to move lower, and the expectations are for another strong year in 2022. Talen Energy was one of the bigger names widening on the week, which has had a lot of headlines around bitcoin mining.

Not surprising, but no IG rating changes on the holiday week

No rating changes by S&P for IG issuers.

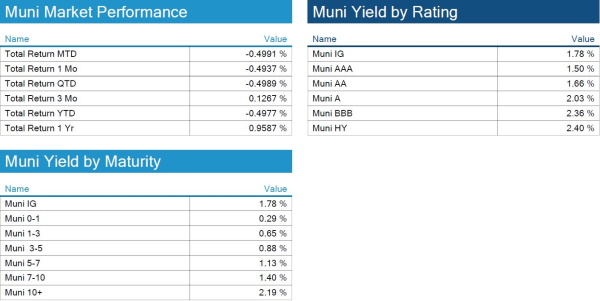

Muni yields rise but outperform other fixed income sectors

The 2022 playbook for the municipal bond market played out nicely for investors the first week of the year. Many investors and strategists see munis as a safe haven within fixed income with expected rate rises on the horizon. Given expected higher taxes and limited amount of supply, investors have had to fight to get bonds. These same technical dynamics are expected to remain intact for munis throughout the year as expected demand is meant to outstrip supply. The real question is by how much. A lot of that is predicated on Congress’ ability to finally pass a large stimulus package that would take care of a lot of state and local authorities need to issue new debt.

This week munis lost ~ -0.50% in aggregate, but both credit (IG & HY) saw losses much greater with Treasuries being the worst performer to start the year. Visible supply began the week at $3.5bn, far below the 2021 average of $11.4 billion.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, January 6, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

2.50% in December 2020

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.