The Fixed Income Brief: 75 is the New 50

Fixed Income Trivia Time:

The Fed had not raised rates +75bps since 1994. What was the top grossing movie in 1994?

Hint: There is also a very popular Broadway play based on the film still running

What a week in financial markets with only more potential volatility on the horizon as investors sift through Fed Chairman Powell’s outlook and upcoming data to try to determine “peak inflation” in an environment where supply-chain disruptions continue to blossom out of everywhere and anywhere. Labor resources and capacity remain so tight that any delay has knock-on effects that would be unheard of pre-pandemic, but now are a part of everyday norms. Don’t even get my wife started when it comes to women’s feminine product shortages. If you add on commodity costs, war, poor liquidity, and rapidly declining market sentiment, it paints a grim picture for markets on a short-to-medium term basis. Summer may be canceled before it even began.

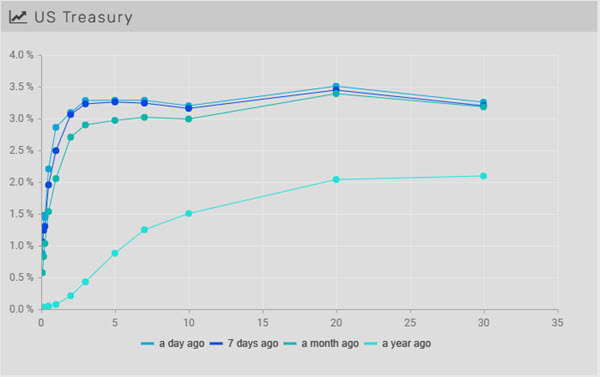

Price check on aisle four? Rates jump higher on Fed hike and outlook

Yields continued their shift higher on the week following the Friday, June 10th CPI print as markets ultimately priced in +75bps for the FOMC hike on Wednesday. The lead up to the extraordinary action caused markets to continue to heavily reprice the front-end (2yr) out to the 5yr part of the curve, as they jumped to 3.44% (+47bps) and 3.61% (+42bps) respectively. Ultimately, WoW rates settled down after hitting fresh highs, but the curve continued to flatten, reinforcing the recession talk that is now perceived as imminent given the expected hike trajectory. Both 2s-10s and 5s-30s spread flattened by -11bps to end the week +5bps and -9bps respectively, signaling the shift in sentiment around a recession probability.

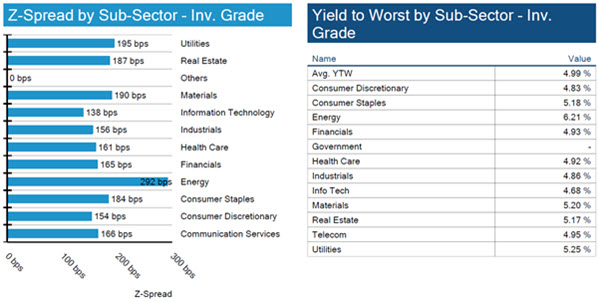

IG spreads capitulate on more aggressive Fed and consumer demand risk

Spreads widened +21bps WoW through Thursday as sentiment collapsed around the likelihood the Fed can induce a soft landing for the economy and avoid a recession. Spread moves in utilities (+31bps), energy (+67bps), and consumer discretionary (+22bps) underperformed the rest of the IG credit space. MTD spreads are now wider (+23bps), moving to +170bps from +143bps over the period. There are no signs things will improve anytime soon as fund managers continue to build cash balances and remain content to let spreads widen further before stepping back in. U.S. investment-grade bond funds have now seen 12 straight weeks of cash withdrawals, making for the longest outflow streak on record, Refinitiv Lipper data shows.

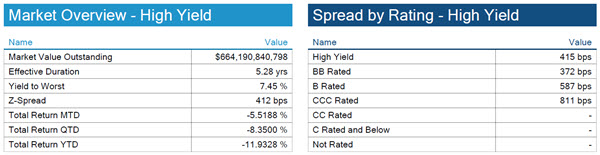

Double whammy in U.S. high yield as rates and spreads lurch higher

HY spreads moved about +50bps higher (+15%) WoW. The widening combined with higher rates have sent total returns for the month to -5.52% , the worst move since November 2020.

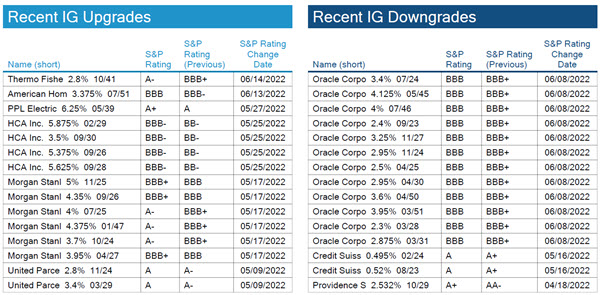

No changes in ratings this week

S&P did not have any significant changes in ratings.

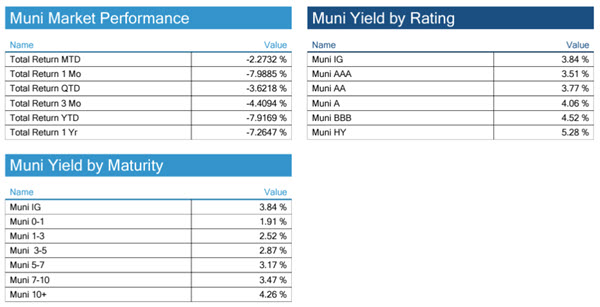

Demand in high quality bonds helps offset some of the recent rate hikes

Municipal debt continues to be the least bad option in a part of the market getting hit with outflows and rate hikes simultaneously. The lack of liquidity and relatively attractive yields at this point will keep muni investors engaged and dollar cost averaging into sector as investors have learned too many times that when it is time to get back in, it takes too long to build an allocation. Munis have posted -2.27% total return this month despite the significant rise in rates and have again performed much better than other fixed income sectors, especially corp IG which is down -3.43% and may see more turmoil on the horizon as the consumer fades.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, June 16, 2022.

Fixed Income Trivia Time:

1. The Lion King $312,855,561 (Jun 15)

2. Forrest Gump $329,694,499 (Jul 6)

3. True Lies $146,282,411 (Jul 15)

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.