The Fixed Income Brief: Hikes Are Here

Fixed Income Trivia Time:

What percentage of global wheat exports does Ukraine produce? Bonus: Where does it fall on global rankings??

—————–

After months of discussions, the wait is over. Powell and the FOMC raised interest rates by 25 bps and signaled expectations for another six throughout the rest of 2022. The FOMC also adjusted their estimates on inflation increasing past estimates to 4.6% in 2022, considering the rate hikes planned for each meeting. The longer-term projections for 2023 show inflation cooling to +2.6% but still well above the 2% bogey the Fed aims to achieve. The issue the market confronts is the fear that either the FOMC flinches in the face of seeing risk markets collapse or feels the need to play catch up and ultimately scuddles the economy through more aggressive action with its balance sheet. Either scenario will inflict pain on the consumer and ultimately end badly.

Even though the Fed will argue they have more tools at their disposal, the fact that wage gains are expected to underperform the cost of living for the foreseeable future leaves them in less control of how the economy will absorb these factors. Pile on the significant amount of infrastructure spending that hasn’t even started. This will lead to additional borrowing and more debt issuance at a time when the Fed is looking to unwind its holdings or at least stop being the buyer of last resort. Chairman Powell’s ability to thread a needle here seems unlikely given how inflation has persisted along with current and future geopolitical risks that seem far from abating. In the end, the best gauge of where markets are headed lies with the consumer.

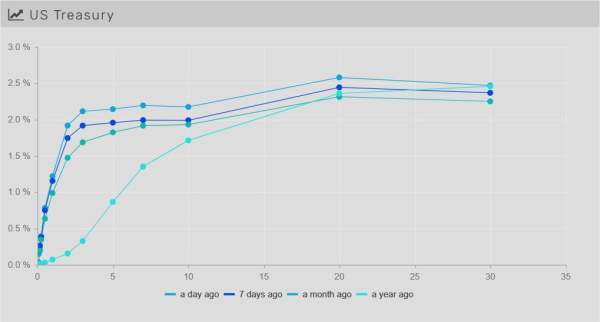

Rates gone wild: Flattening and closer to an inverted yield curve

Another volatile week with significant intra-day moves leaving the yield curve higher and flatter WoW. The height of yields came briefly on the back of the FOMC rate hike announcement, where the 10yr shot up to 2.24% and the 30yr broke 2.50%. U.S. 5yr and 10yr are now trading on top of each other (2.15%), with the 2yr (1.95%) rising the most this week to flatten the 2-10s curve to +20bps, roughly -6 bps lower on the week. The 5yr underperformed the most again this week with the 30yr bond (2.43%) outperforming the others as the rate was only +5 bps higher WoW.

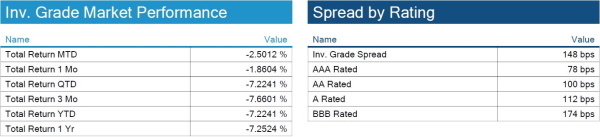

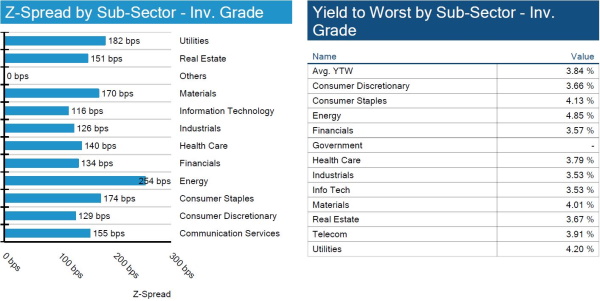

Spreads continue to widen with numerous risks in play

The Fed, a COVID outbreak in China, inflation, commodity prices, and a worsening situation in Ukraine saw IG spreads widen +5-6 bps WoW. Inflation will continue to impact the US consumer, and this month’s long move to wider spreads reflects concern over how it will ultimately reduce corporate profits going forward.

High yield spreads continue to move wider on increased global risks

HY spreads widened +25bps this week as the Fed and other central banks begin unwinding stimulus in the face of persistent inflation. This comes as geopolitical risks continue to cause investors to pull back future expectations of growth. The industrial sector was the bright spot where spreads held in relatively unchanged WoW.

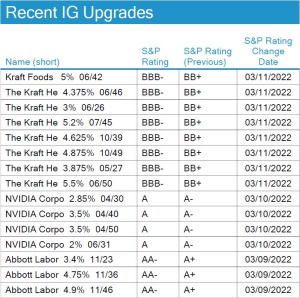

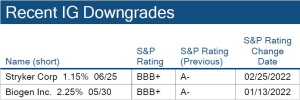

Stryker and Biogen see ratings cut, Kraft, Abbott and Nvidia upgraded

Both Stryker and Biogen were cut from A- to BBB+. Kraft sees its S&P rating lifted to IG (BB+ to BBB-). Abbott returns to AA- and Nvidia is now mid-A at S&P.

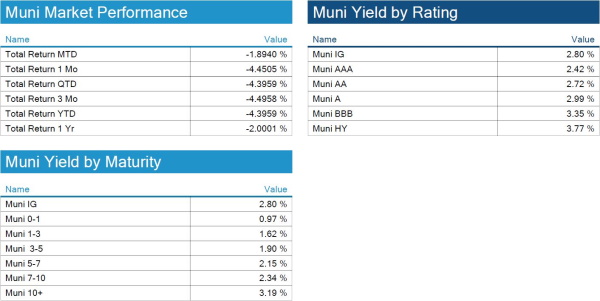

Municipal bond fund outflows reach 9 weeks in a row

The municipal sector has held up better than other sectors, despite 9 straight weeks of outflows, which have not been seen since 2018. The combination of future expected rate increases and absolute yields which still aren’t too attractive has led investors to rotate out of muni bond funds. This pressure has weighed on the market recently with 20 straight days of $1bn in bids wanted, causing an increase in bid/ask spreads with dealers forced to absorb the flows. The countering technical of low supply is still helping munis outperform, but if the outflows persist, the negative returns will be too.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, March 17, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

U12% of global wheat exports, making Ukraine the 5th largest wheat exporter in the world (Russia is #1). Ukraine also produces 16% of corn, 18% for barley, and 19% for rapeseed of global exports.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.