The Transformation of Fixed Income Asset Managers into the Future

Fixed income asset managers are experiencing existential shifts to their industry. Facing increasing competitive pressures, asset managers are modernizing and embracing transformation to remain resilient in 2021. Many will be focused on cost savings, adding more value for clients, and increasing efficiency of workflows. Overall, the theme is to be able to do more with less.

On the 4th webinar in our series focused on performance for fixed income managers, our panelists explored how the industry is changing. Top discussions included how both client expectations and the market are impacting the way they need to invest. For more insight, watch the on-demand recording of Firm of the Future: Designing the Modern Investment Management Firm, moderated by Lynne Funk, Innovation Editor of The Bond Buyer.

Shifting expectations for fixed income asset managers

Investment managers are experiencing many pressures that impact their ability to invest. What are the top pressures that firms are adapting to?

- The New Nominal

Central banks’ continuous bond purchases to reinforce the pandemic recovery have maintained relatively low volatility during 2020 but it has also put additional downward pressure on interest rates and bond yields. The low interest rate environment may have reached its limit and clients will have to alter their expectations on yield.

“The Fed has stoked demand for corporate debt, which has brought yields down. All investors with fixed income exposure should reset their longer-term expectations around yield and performance. Yields are so low it’s difficult to make decent returns unless you take on a lot of risk,” explains Chris White, CEO of ViableMkts/BondCliq. - The March of Passives

Throughout the initial 6 months of 2020, global investors allocated $98bn to fixed income index funds and withdrew $50bn from non-index products. Passive investments have exploded in popularity; however, this puts even more pressure on active management strategies and their cost inefficiencies.

One of the bigger considerations, though, is what happens to passive funds in periods of low liquidity or when credit is in a down cycle? “Passive investing works when there’s a large community of things that trade frequently,” notes Steve Liberatore, Fixed Income Portfolio Manager at Nuveen. It’s not clear what tailwinds will exist for passive investments as markets become more uncertain. - The Growth of Green

While ESG investments have grown over the past decade, asset management clients are increasingly requesting more green bonds, according to Melissa Pendergrass-Hoots, CEO of Falcon Square Capital. Impact investing often provides enhanced financial returns so investors seeking long-term yields can look to more sustainable companies, limiting exposure to downside risk. Socially responsible firms often have better credit ratings and have lower credit risk. - The Rise of Customization

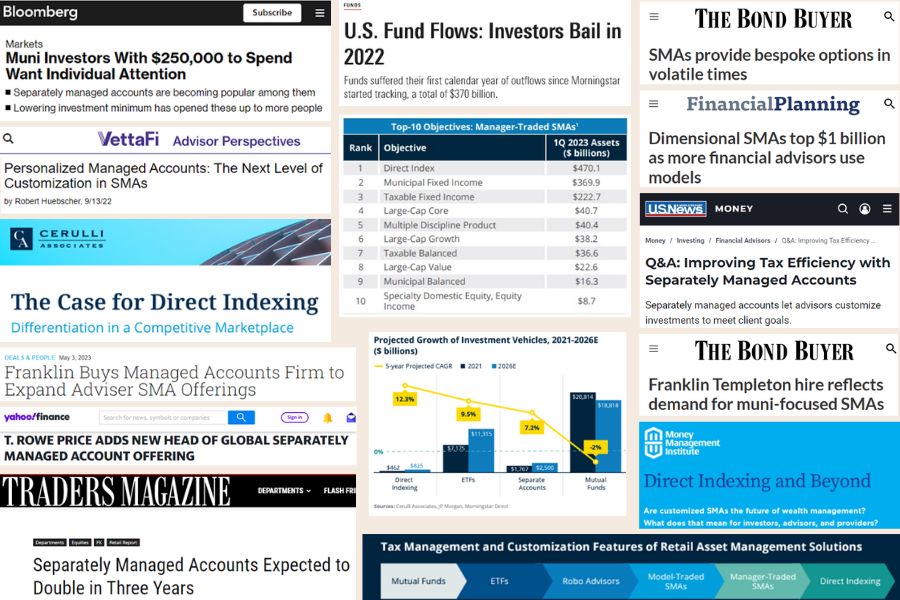

The rise of impact investing, along with the need to differentiate from passive investing strategies, has driven portfolio managers to focus on tailored strategies for clients. “The benefit of the utilization of technology is that it’s allowing us to do more. ESG/impact investing are unique. I have 17 different strategies…but each have different constraints and parameters. Without the utilization of technology, we wouldn’t be able to run all of those different mandates, we wouldn’t be able to maintain the different risk tolerances, because it would simply be too complex,” explains Steve Liberatore. “It’s allowing us to better meet client needs.”

Fixed income asset management firms need to adapt or die

Adapt or die. While it sounds a bit dramatic, active fixed income management is going through this transformative period and whether a firm adapts may define whether it succeeds or not. The use of technology and data are vital for firms in modernizing.

When it comes to data, the most critical factor is the quality and aggregation of data. Asset managers need to ensure they are working with quality bond data. Chris argues that “data scientists without improvement in data quality is similar to placing a Ferrari on an unpaved dirt road with potholes. You don’t receive the performance you want as the road is not reliable for trading/driving.”

Similarly, Liberatore discusses the arduous nature of the large amount of data to be digested. “We have to spend a lot of time working with issuers and their underwriters and understanding the type of information and format to receive it in. There’s an inherent desire to provide a data dump that’s irrelevant.” Data needs to sorted through and put into a format that is easy for portfolio managers to make decisions.

After assessing the quality of data, asset managers need technology to add visibility to their data and to streamline ineffective workflows. To maximize alpha generation and build better portfolios, siloed data and processes must be broken up. Having integrated portfolio management, research, trading, and compliance platforms means that investments teams can share knowledge and collaborate more effectively. The time is now to consider implementing next generation data and technology architectures to reduce manual processing and develop more efficient investment processes.

IMTC’s end-to-end integrated platform connects people, processes, and data to streamline workflows alongside mitigating risk. Talk to our team to learn how your investment workflows can be taken to the next level.

Asset managers are allocating significance to modernization through new technology. It is crucial to differentiate and remain competitive in the industry. However, the most considerable gain is in the ability to serve clients better through customized solutions and stronger active management, at the lower fees that are demanded in the market.

Technology is only as good as how it is used. IMTC is designed by and for fixed income professionals, empowering them to take action and make decisions quickly and accurately with real-time data and analytics capabilities. It allows you to future-proof your business; driving operational efficiencies, mitigating risk and delivering performance, to ultimately enable business growth.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.