The Fixed Income Brief: A Balance of Risks Keep Markets on Pause

Fixed Income Trivia Time: How many AAA-rated U.S. corporations are there? Can you name them?

The balance of risks that remain in play kept markets steady over the past week and helped hold rates relatively flat WoW. The yield on the benchmark 10-year Treasury note remained within the recent near-term range at 0.65% and the yield on the 30-year Treasury bond was also little changed at 1.37%. One area to watch is the amount of cash still sitting idle on the sidelines, ready to go back into the market on any increase in bond yields or dip in the equity markets.

Yields bounced off their recent lows after U.S. manufacturer growth rebounded this month to post its fastest improvement since January 2019. The U.S. manufacturing PMI (purchasing managers’ index) jumped to 53.6 in August from 50.9 in July, according to IHS Markit. Any reading above 50 signals an economic expansion. Meanwhile, IHS services business activity rose to 54.8 from 50.0 from July, marking a 17-month high.

Meanwhile, new home sales in July were up 24.7% compared with June, marking the biggest month jump on record, dating back to 1968, according to the National Association of Realtors. As rates remain at historic all-time lows, prices pushed higher; the median price of a home sold in July was up 8.5% annually to $304,100. This is a record high nominal price and also the highest price when adjusted for inflation. When adjusted, it is 3.4% higher than the bubble high set in 2006.

Job numbers this past week retraced some of the momentum of the recovery after figures from the prior week dipped below 1 million claims. The latest jobless claims caused investors to pause as they grapple with figuring out the timing around an economic recovery from COVID-19. In a mark against bulls, the Labor Department showed that the number of Americans filing for jobless benefits climbed back above 1 million last week.

Diverging economic paths of Americans and others around the globe continues. People who have jobs that can be done completely remote are feeling confident; the large portion that cannot work remotely are struggling with when help will arrive from the government. This divergence is exemplified in people who rent, where evictions are expected to skyrocket after government moratoriums on eviction proceedings end in the coming weeks. This is also not being helped by the job situation.

The economic data has moved investors to focus on higher quality sectors such as ABS, CMBS, and U.S. MBS, which have outperformed U.S. Treasuries and corporates this month. These safe haven assets have not kept up with corporates YTD given their yield differential, but they do provide credit protection and better liquidity in times of a risk off move.

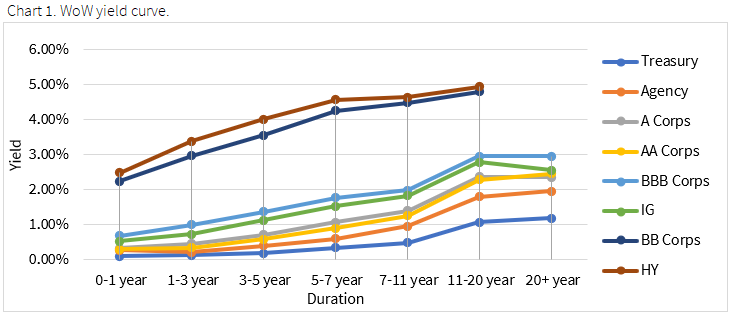

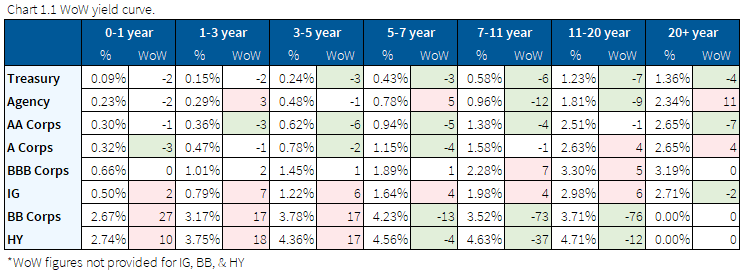

Yields lower, retrace last week’s sell-off

Treasury yields retraced their recent sell-off this week ending around -10 bps lower overall. This was a relatively quiet stretch after rates ended higher last week as investors had to digest a lot of supply and positive economic data, leading investors to price in a quicker recovery than recently anticipated. The government stimulus bill and jobs remain top of mind at the moment; Congress negotiations and job hiring will determine which direction yields go over the next 1-2 weeks.

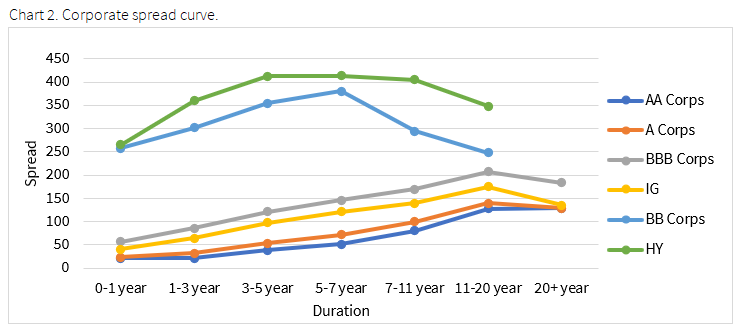

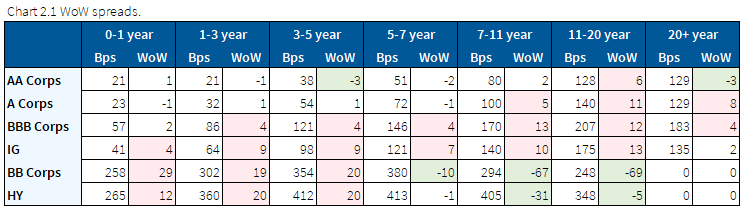

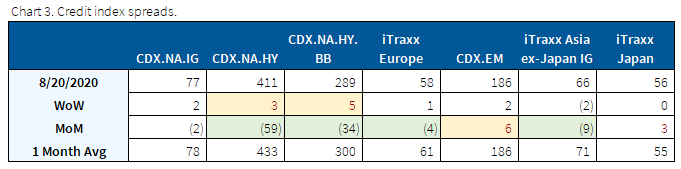

Spreads end the week slightly wider as healthcare underperforms

All major credit indices traded wider on the week, as IG bond spreads were off ~5bps on the week. All in yields still remained to trade lower, with a slight flattening in the yield curve.

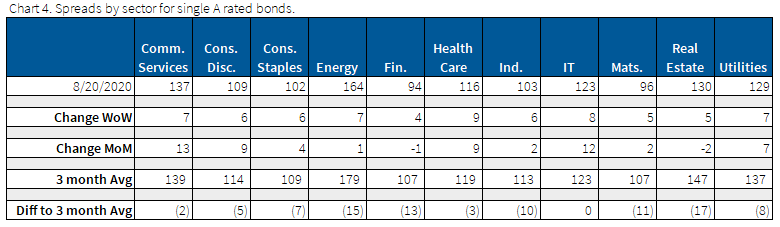

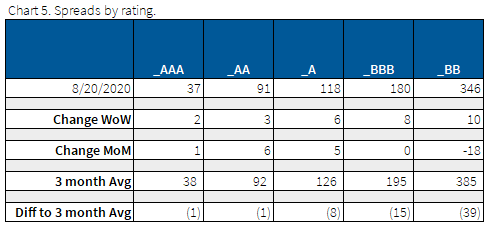

Healthcare underperformed all other sectors this week, while financials outperformed by 3 bps. The BBB space widened by 8bps this week, though is flat month over month.

Healthcare underperformed all other sectors this week, while financials outperformed by 3 bps. The BBB space widened by 8bps this week, though is flat month over month.

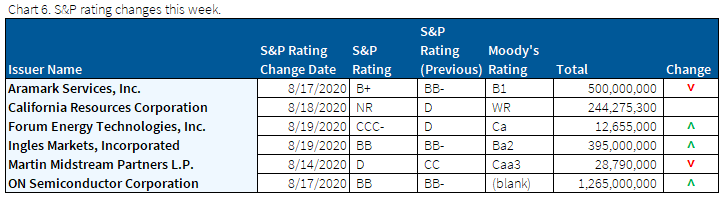

Technology companies faring well as seen by ratings upgrades

Rating changes this week highlight that technology names have fared well in the coronavirus economy. However, energy and wholesale food supplier, Aramark, are facing deteriorating business models and credit outlooks.

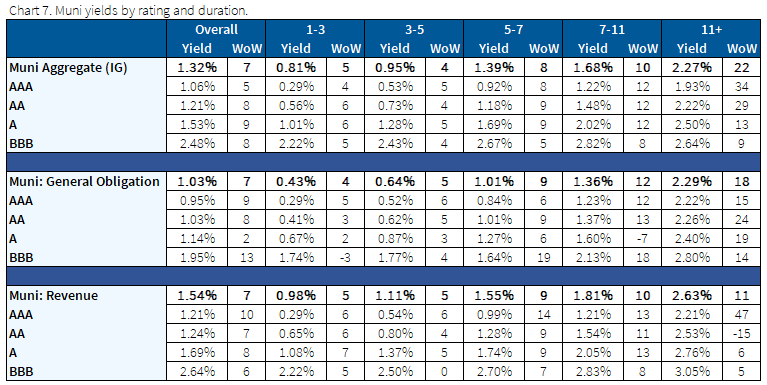

Munis inflows remain strong; yields slightly higher as supply hits the market

$21.4 bn has moved into municipal bond funds in the past 14 weeks, marking this week as the 14th straight week for net inflows. Municipals yields rose slightly though moderately underperforming Treasuries as +12bn in supply hit the market this week.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions.

Fixed Income Trivia Time Answer: 2; Microsoft and Johnson & Johnson

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.