The Fixed Income Brief: Rates Remain Steady but Demand for Spread Assets Continues

As the equity market gains recently look less based on economic fundamentals and more like merely betting on a cure than anything else, corporate bonds and municipal bonds are benefiting from the large amount of cash that needs to be put to work. We saw utilities and financials outperform this week as demand for yield and better bank earnings surprised the market.

Financials and utilities drive tighter credit spreads

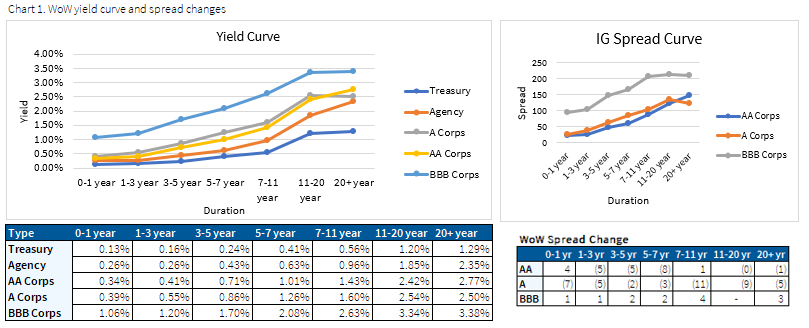

Yields tightened mid-week due to unemployment claims, but rates ended the week little changed week over week with a slight steepening across the curve. Volatility remains low given all the Fed programs and stimulus currently baked into the bond market.

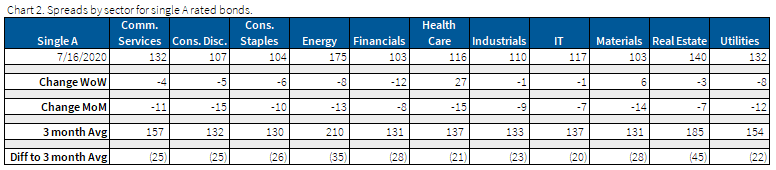

Credit spreads ended tighter on the week driven by financials (-12 bps) and utilities (-8 bps). Financials were led by the banking sector, which saw earnings outperform expectations on the back of better trading volumes. Financials reversed most of the recent relative under performance, but still lag a number of other corporate sectors on a month-over month basis. Financials will be an interesting sector to watch as they have recently benefited from substantial debt issuance and volatility, but the performance of consumer loans could shift sentiment negative.

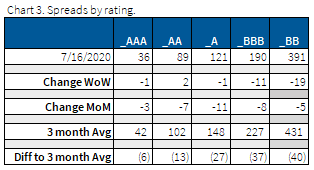

BBBs overall were the best performing as the search for yield continues.

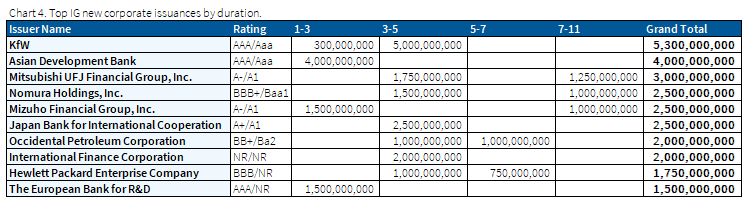

New issuance led by high quality global deals

The bulk of the issuance this week came out of supranational organizations and several large Japanese financials. The largest two U.S. deals were Occidental Petroleum and Hewlett Packard, both issuing in the 3-5 and 5-7 parts of the curve. Overall, of the larger deals the majority of the issuance was in the 3-5 part of the curve which was a break from seeing longer dated issuance over the past several weeks.

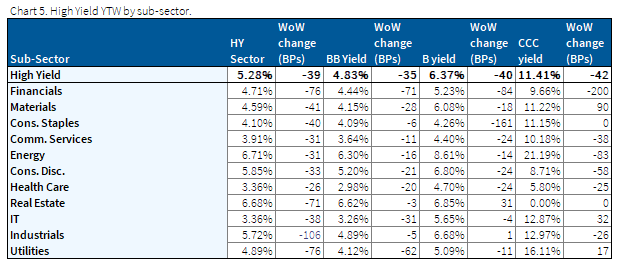

High yield trading continues to outperform with decent compression of spreads

The high yield space is now ~70bps tighter on the month. BBs traded tighter on the week again, led by financials, utilities, and IT. High yield overall continues to trade very well down in quality as well in lock step with recent equity performance.

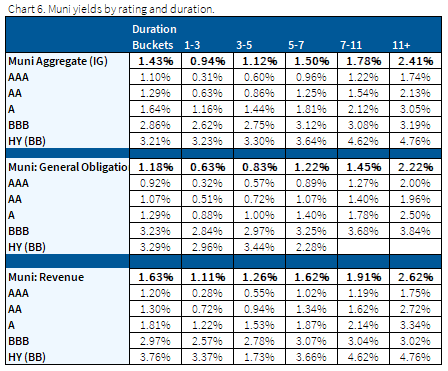

Munis continue to see inflows with only a slight uptick in supply, keeping valuations high

Municipals outperformed Treasuries as investors compete for bonds.

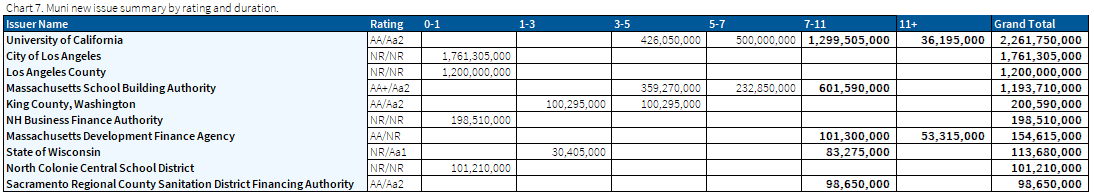

The largest non-front-end deals of the week were the University of California (AA/Aa2) and Massachusetts School Building Authority (AA+/Aa2) with the bulk of the bonds coming in the 7-11 year buckets. New issuance has picked up a bit as of late but certainly not enough to satisfy demand, as deals continue to be oversubscribed by 5x and pricing remains on the tight side of guidance.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.