The Fixed Income Brief: Risk Sentiment Sours on Lockdowns

Fixed Income Trivia Time: Clark County, Nevada recently drew on a reserve account to make an upcoming debt payment due for bonds sold to finance the Las Vegas Raiders stadium. What are the most expensive stadiums by sport?

As we find ourselves in the midst of a 30-day period with the least amount of daylight for the northern hemisphere, the pandemic continues to make things even more gloomy. Up until this week, markets had been optimistic with the hope that several successful vaccines are on the horizon. Now there seems to be a pause in sentiment as the reality sets in that a lot more lives will be lost before vaccines can be distributed and life will continue to be negatively impacted by this virus for several more months to come.

The reversal in risk saw spreads widen and the benchmark 10-year note reverse course, rallying -10bps over the week as markets retreat before the last week of real trading this year. Credit spread compression took a backseat to widening due to investors not looking to add risk in front of the holiday period.

Economic data this week was highlighted by U.S. CPI and initial jobless claims that were both higher than expected. U.S. November core CPI came in at +0.2% MoM (vs. +0.1% exp) and now stands at +1.6% YoY, well below the Fed’s 2% target. Initial jobless claims were +853k, significantly higher than the +725k expected and a big uptick to the prior week’s +716k. On the positive front, JOLTs job opening figures for October were up over the month and came in at 6.652mil, +350k more than what was expected. Given the data lag on the JOLTs number it is easy to discount by a market that is now seeing an increased number of shut down measures aimed to quell the virus. In addition, the absence of an agreement on a federal stimulus package as folks struggle to find work is more of a concern to investors at this point. Doing nothing would indeed continue to add to the recent slowdown the economy is experiencing as many are potentially about to lose jobless benefits. Lastly, the Michigan Consumer Sentiment Index for December was better than anticipated with the timing of the survey in line with the vaccine announcements. Any recovery momentum that was still left will likely be out the window if the current government fails to act on some stimulus. Investors and consumers will need something during this month of uncertainty or there is a risk to sentiment souring further.

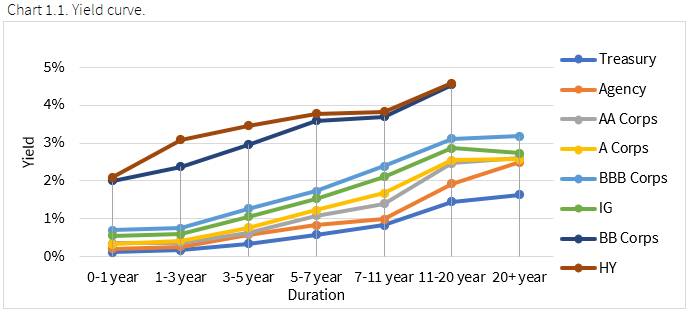

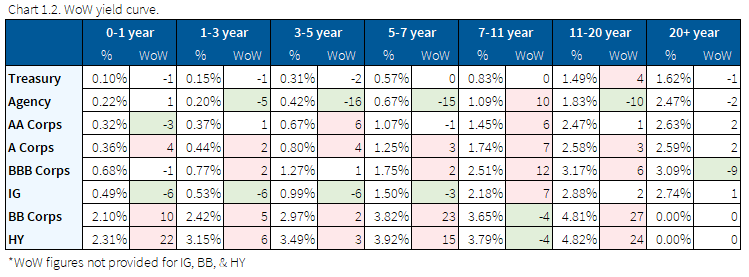

Rates reverse recent rise, curve flattens

U.S. interest rates moved lower over the week, reversing most of the recent move higher from the positive vaccine news. The trend continues whereby the front end remains completely anchored so the direction of the long end dictates curve steepness. Given the rally in rates we saw the 2/10s curve flatten back -5bps to +76bps, but remains nearly twice as steep as we saw in August (+40bps).

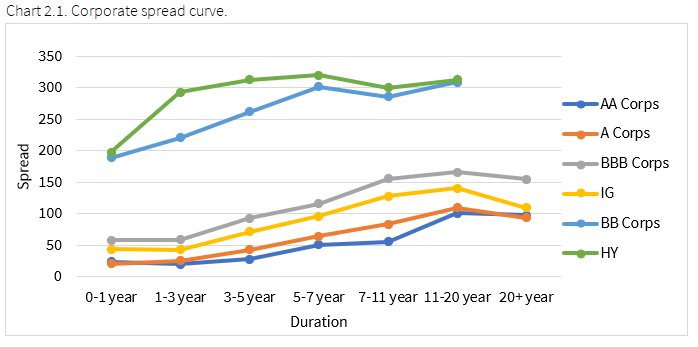

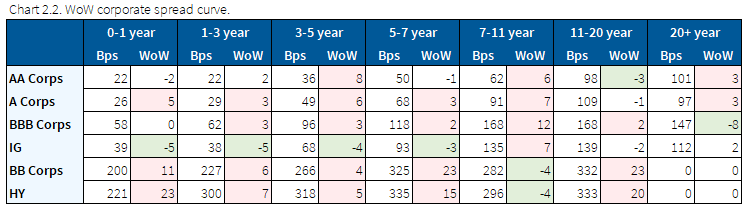

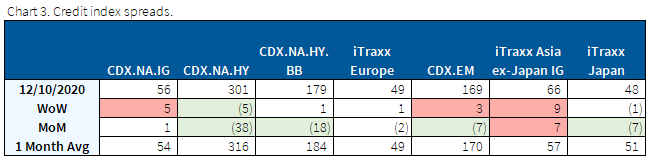

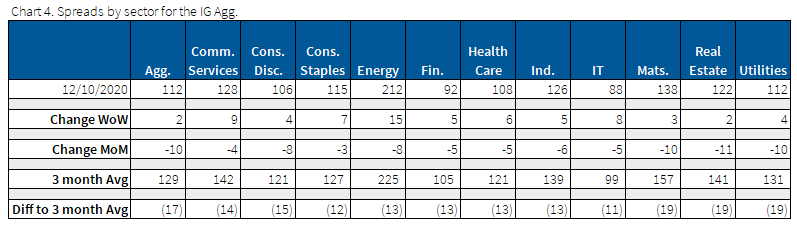

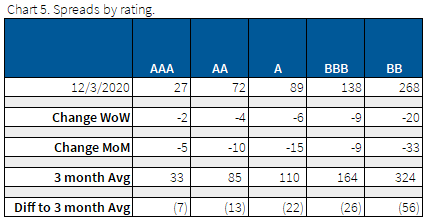

Credit spread tightening paused with a backup in spreads out the curve

This risk-off tone over this past week saw credit curves steepen as front-end spreads held in and 5yr maturity and longer spreads widened. The pause in risk sentiment comes as investors prepare for the final full week of 2020. The widening stopped a consistent run of spread tightening we have seen since mid-November and although some of the widening was significant, we remain tighter MoM and on a 3-month average.

The worst performing sectors this week were energy, communication services, and IT.

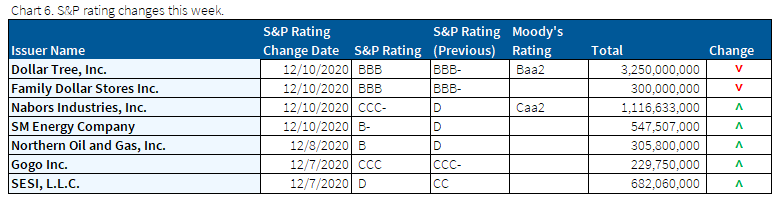

Dollar Tree cut by S&P, closing in on junk status

Only a handful of corporate ratings changes occurred over this past week, with Dollar Tree being the most notable. Their $3.25bn of debt outstanding was lowered to BBB- from BBB, now only one notch away from junk status.

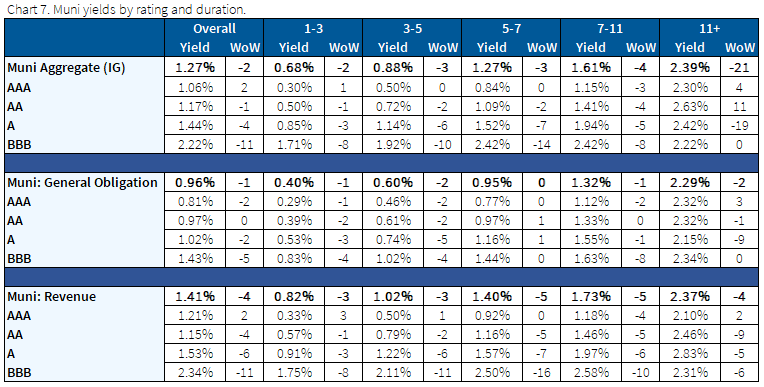

Munis yields lower, positive fund flows help keep pace with Treasuries

Investors continue to add municipal debt here with +$1.4bn moving into muni funds last week. The demand has remained consistent and continues to hold yields lower with a backdrop of less issuance, given many issuers came to market in the lead up to the election to avoid any unforeseen risks.

Key ratings news for the sector was the announcement that Fitch downgraded NYC to AA- from AA and its outlook was revised to negative by S&P.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Dec. 10, 2020.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.