The Fixed Income Brief: Yields Head North

Fixed Income Trivia Time: Who was Dr. Doom and what was the month and year he made his famous prediction for a multi-decade long rally in the bond market?

Investors continue to grapple with the direction of rates as the global economy is showing signs of life led by a U.S. economy hopped up on stimulus against a backdrop of a stalling vaccination rate and future considerations of debt repayments. The Fed continues to stay the course as they acknowledged the uptick in recent activity but remain steadfast in providing continued support for the U.S. economy. The Federal Reserve continues to hold its key interest rate near zero and said it plans to continue supporting the economic recovery through open market purchases of $120bn ($80bn USTs/ $40bn Agcy MBS), while acknowledging recent progress in growth and employment. The Fed stated, “Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened [but] the sectors most adversely affected by the pandemic remain weak.” Investors are trying to get any sense of the Fed wavering, though none have emerged as they admit inflation has risen but largely reflects transitory factors. Fed Chairman Jerome Powell said Wednesday that the recovery has advanced “more quickly than generally expected,” while adding that it “remains uneven and far from complete.”

On the data front, PCE Price Index (MoM), the Fed’s favorite inflation gauge, picked up 0.4% which is higher than the expected 0.3%, but under the Fed’s 2% target (1.8% YoY). Household income rose at a record pace of 21.1% in March as stimulus checks hit checking accounts. The surge in income last month was the largest monthly increase for government records tracing back to 1959, reflecting the $1,400 stimulus checks and other government aid included in a $1.9 trillion fiscal relief package signed into law in March. Spending was also up sharply, increasing 4.2%, and this was the steepest month-over-month increase since last summer. Weekly jobless claims remained in the 500k range for the third week in a row and will be the gauge to watch along with the April non-farm unemployment release next week.

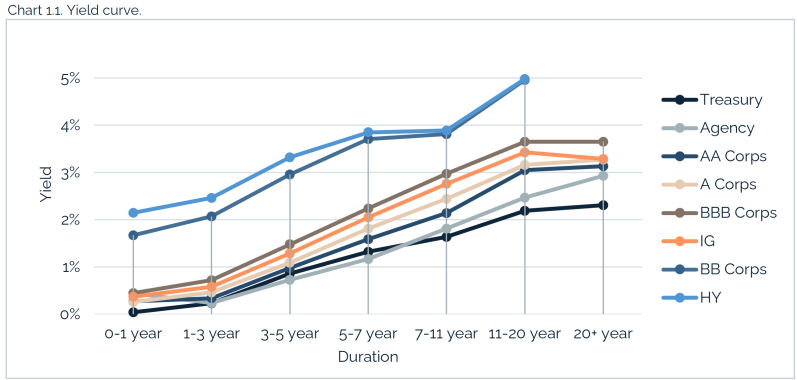

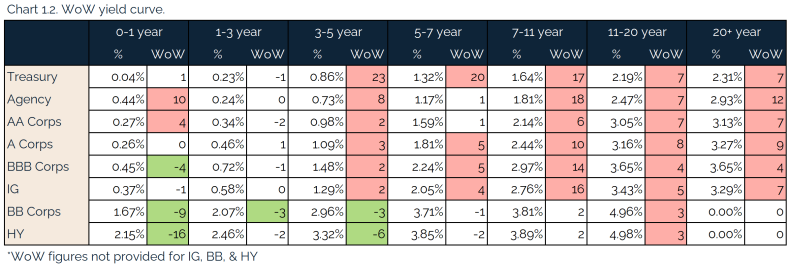

Rates finish relatively steeper on expectations of inflation

U.S. inflation picks up in March with core prices rising 0.4% and the headline rate up 2.3% for year. Wages were up 1% in first quarter and 2.7% over past year. Inflation coupled with an aggressive spending speech moved the 10- and 30-year up ~8bps, while the 2-year moved ~0.5bp and the 5-year jumped 6bps.

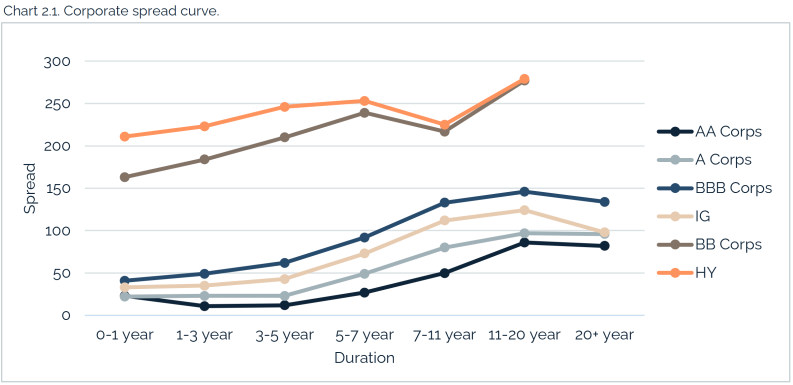

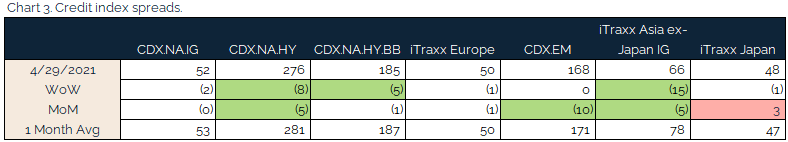

Spreads tighten as earnings and expectations outperform

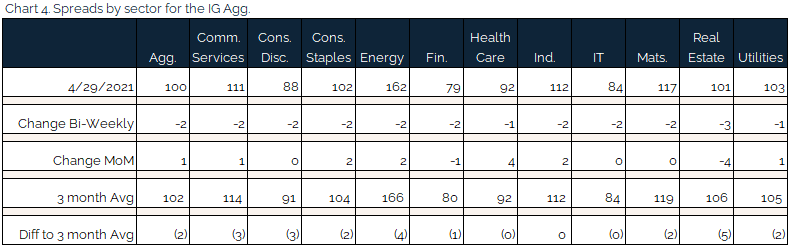

Credit spreads tightened WoW and are relatively flat MoM. The market has already priced in a return to “normalcy” and expectations have already been set for optimism. The reopening headlines simply confirm the existing outlook and are not leading to significant incremental upside in spreads.

Agg tightens 2bps on the week and ends the month flat with real estate outperforming the Agg. Idiosyncratic winner was Archer-Daniels. Losers for the week were the beaten-up cruise line industry as Carnival and Royal Caribbean see spread widening of +30bps.

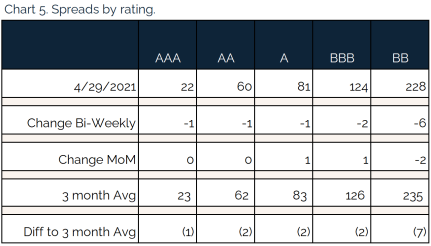

Small movements in tranches of debt

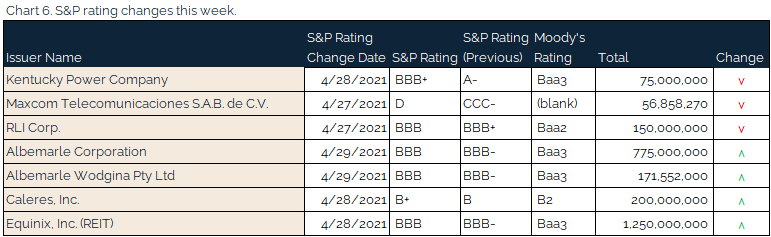

Benign week for rating changes. The big winner on the week was Equinix REIT, which saw $1.25bn of a 7-year CUSIP upgraded to BBB from BBB-.

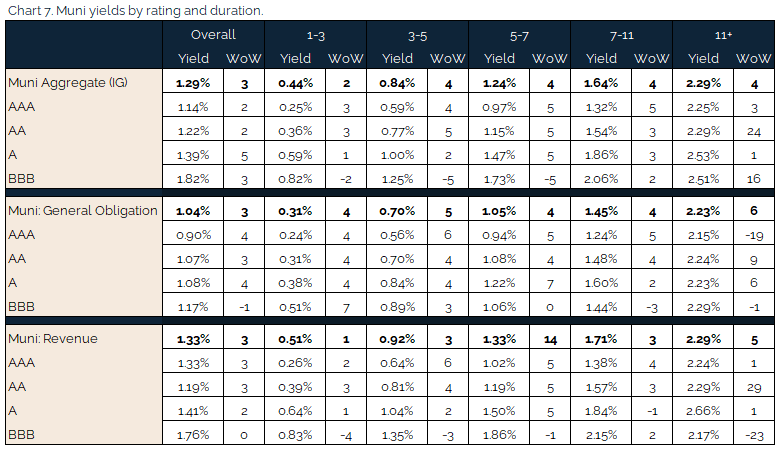

Muni yields move higher on inflation

Muni yields moved on back of inflation and in line with TSY moves. Expectations are for more demand in the muni space and a continued lack of supply. Biden has proposed $1.8 trillion of investment through government spending which will be paid for by top earners and demand will reflect the sought after tax-free income. Muni sectors on the move this week are universities (with smaller endowments) as enrollment is down 10% and GO’s from municipalities expected to collect additional tax-revenue on the back of higher property values.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Apr. 29, 2021.

Fixed Income Trivia Time Answer: Henry Kaufman of Salomon Brothers August 17th, 1982. PS – he’s now 93!

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.