Weekly Market Update 9.16.19

Geopolitical tensions continued to drive market movements last week. Treasuries ended on six-week highs, with the 2-year rate increasing 8bp to 1.80% and the 10-year yield rising 13bp to 1.90%. Domestic equities also ended on a high note following a midweek uptick when the S&P 500 closed just .5% below all-time highs thanks to rumors that US and Chinese delegates were nearing a “limited trade agreement.”

Globally, European and Asian stocks also improved amid trade optimism. Even the GBP saw gains after reports that Brexit negotiations were making headway surfaced. The European Central Bank’s decision to restart a controversial quantitative easing program also bolstered European credits.

The allure of safe-haven assets continues to draw investors amid the sustained climate of uncertainty and volatility, particularly at a time when sub-investment grade debt is “sending investors warning signals” that companies laden with debt could fall into highly distressed territory, regardless of whether the US enters recession.

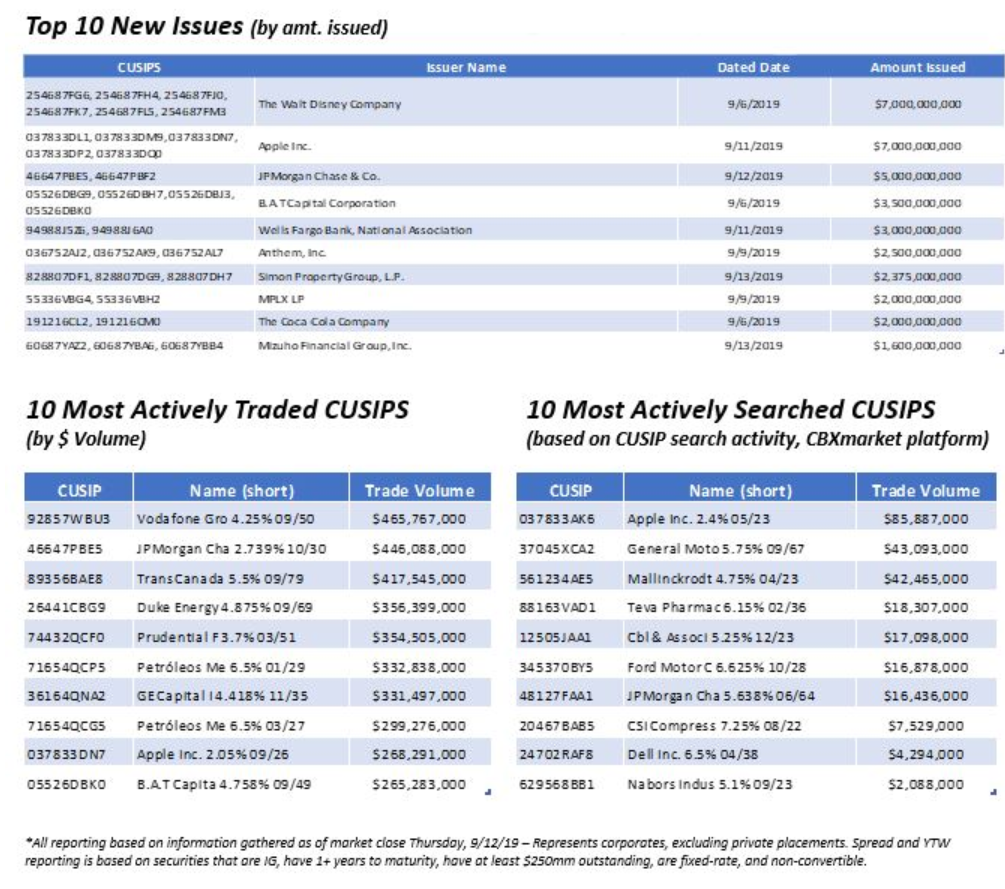

Energy saw the most trade volume by sub-sector over the week, as CBXmarket data indicates that roughly $11.1bn in paper changed hands. American household names like the Walt Disney Corporation and Apple each placed monster deals last week—Apple sold $7bn in a multi-tranche offering which included a 30-year maturity—and Coca Cola snagged a spot in our weekly Top 10 New Issuance chart after coming to the market with a $2bn note.

The week ended on an explosive note after attacks on the Saudi Arabian oil industry sparked historic price movements. Energy prices soared 15% on Monday, although PMs and traders indicate a limited long-term impact, given that stockpiles and flexible arrangements regarding the transport of oil are still available, according to the Wall Street Journal. A sustained increase in oil prices could weigh on consumers via higher gasoline and heating prices, leading Trafigura’s chief economist to speculate that the world economy isn’t in as strong of a position to absorb the shock as it would have been a year ago.

In the week ahead, global risks remain front and center. British Prime Minister Boris Johnson is slated to meet with EU President Jean-Claude Juncker. The Fed will also meet on Wednesday, and the investment community waits with bated breath to see whether policymakers will take a firm stance on easing. The markets have already priced in another quarter-point cut this month, and the spike in oil could offer yet another reason for the Fed to act: “While the jolt could spell upward pressure for inflation, the Fed is more likely to add it to the list of downside risks already facing the U.S. economy,” according to Bloomberg.