Investors Seek Yield Despite Rising Re-Lockdown Fears

Markets were negative as news of rising COVID-19 cases contributed to fears of reinstated lockdown measures, specifically for those states that were first to open. The Dow and S&P 500 lost 3.3% and 2.9%, respectively, this week. The spreading cases around the country had investors shifting to a more pessimistic outlook that has not been seen in recent weeks.

Financials continue to underperform the market after the Fed’s banking sector stress test results restricted dividends and share buybacks due to capital requirements. Additionally, consumer spending rebounded less than expected for May and June consumer sentiment was revised downward. This was exacerbated by weak earnings from Nike, while Gap offered a strong surge after an announced partnership with Kanye West. Treasury yields were lower as bond prices rose modestly, with the 10-year Treasury Note closing at 0.64% (vs. 0.68% on 06/19) and the 1-month Treasury Bill closing at 0.11% (vs. 0.14% on 06/19). The U.S. dollar was little changed, while crude oil prices were modestly lower and gold was higher. Europe relinquished early gains and finished mostly lower, while markets in Asia were largely higher.

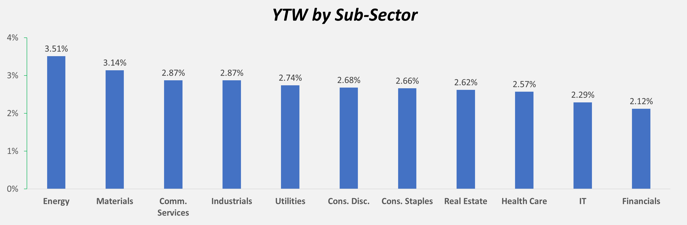

Fixed income investors continue to seek yield as spreads widen

Investors both domestically and abroad continue to have strong demand for yield. Issuers from municipals to high yield corporates are leveraging their balance sheets, while revenues are shrinking. This is leading to many investors questioning the long-term credit quality in bonds. Expectations are for a spike in defaults on bonds issued in 2020, which was funded by loose monetary policy and an insatiable demand for yield from investors.

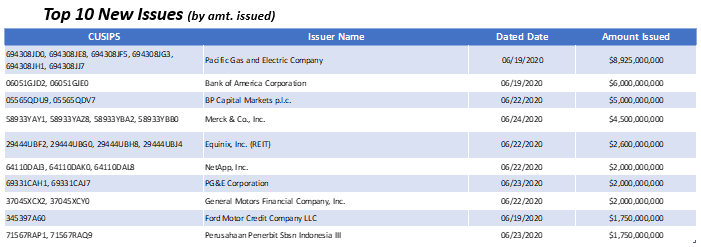

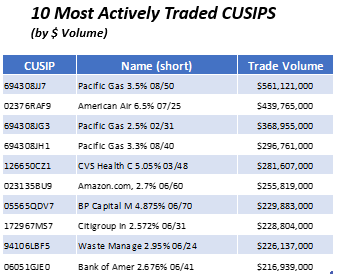

CDX IG and iTraxx Europe spreads ticked upwards as concerns related to COVID-19 continue to weigh on market sentiment, as investment grade spreads widened to 189bps amidst concerns of renewed containment measures. High grade issuance volume totaled ~$68bn last week, driven by financials and healthcare. Issuers continue to return for subsequent rounds, resulting in multiple issuances across compressed timeframes, including:

- Wells Fargo issued $6.0bn on 5/26, $6.5bn on 4/23, and $6.0bn on 3/23

- Citigroup issued $3.5bn on 5/26 and $1.5bn on 5/07

Corporate bond issuers seeing higher spreads for comparable issuances

Issuers are locking in liquidity at higher spreads than previously recorded for comparable issuances, albeit generally at tighter coupons due to lower base rates.

UnitedHealth Group secured its lowest-ever long-term funding costs:

- May-20 ($5.0bn across five tranches): 10-year $1.25bn senior notes; Spread: 145 bps; Coupon: 2.000%

- July-19 ($5.5bn across five tranches): 10-year $1.00bn senior notes; Spread: 80 bps; Coupon: 2.875%

Apple Inc. secured its lowest absolute borrowing costs on record:

- May-20 ($8.5bn across four tranches): 10-year $1.75bn senior notes; Spread: 110 bps; Coupon: 1.65%

- Sep-19 ($7.0bn across five tranches): 10-year $1.75bn senior notes; Spread: 78 bps; Coupon: 2.20%

PepsiCo secured its lowest absolute borrowing costs on record:

- Mar-20 ($6.5bn across six tranches): 10-year $1.5bn senior unsecured notes; Spread: 180 bps; Coupon: 2.75%

- Oct-17 ($4.0bn across three tranches): 10-year $1.5bn senior unsecured notes; Spread: 68 bps; Coupon: 3.00%

High yield market remains active as new issuance soars

High yield markets continue to see an uptick in new issuances, taking YTD volumes to ~$215bn, up ~64% year-over-year. Total YTD returns for the index are at -3.8%. MTD volume has already exceeded the full-month record across all months, including the previous record set in September 2013 ($48bn).

Highlights from last week issuances include:

- American Airlines issued $2.5bn of 5-year senior secured notes at 99 with a coupon of 11.75%

- Minerals Technologies issued $400mm of 8-year senior notes at par with a coupon of 5.00%

Key indicators for the week ahead

The market will still have plenty to consume on this holiday week. The most important economic indicators have been stats released around COVID, but we will still see a reports around housing and employment this week. ADP employment, nonfarm payrolls, and the unemployment rate will all be released on the second half of the week. The FOMC minutes will also be released on Wednesday, where investors will go through the rhetoric to predict future stimulus.

Happy 4th of July!

YTD Returns as of EOD Friday 06/26/2020

US Barclays Agg +6.14%, 1.27% yield, -175 bps excess return

US Barclays Corp +4.91%, 2.17% yield, -572 bps excess return

UST 10yr 0.65% yield, -127 bps

S&P 500 3,009, -6.86%

DJIA 25,015, -12.34%

OIL (WTI) $38.16, -37.66%

Gold 1,784, +17.42%

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.