Continuing IG Bond Issuances and Political Unrest

As economies gradually re-open, the focus shifts from dealing with emergency to facilitating recovery, but also brings back lingering political tensions. Protests in both Hong Kong and the U.S. continue to dominate news headlines. The market returns to trading off negotiations between China and the U.S. Tensions are unlikely to go away in light of recent protests, which could drive a shift in the supply chain and technology dependence on China.

Beyond the political unrest, the Federal Reserve and Congress continue to monitor how the approved stimulus affects the market, with an eye on unemployment. Expectations are that deeply damaged labor markets may need some time to recuperate, weighing on any recovery, as jobless consumers will likely not spend as they used to. U.S. is not the only country focused on policy, as both China and Europe weigh additional fiscal or monetary stimulus. Europe’s fiscal proposal could be a turning point for the most affected countries in the EU, but negotiations will take some time.

U.S. investment grade sales hit $1 trillion at fastest pace

This past Thursday, the debt market reached $1 trillion worth of investment grade (IG) corporate new issuance, in just the first 5 months of the year. The Federal Reserve made a commitment in mid-March to the debt market and issuers have rushed to bring new bonds to market at an unprecedent rate. In 2019, the $1 trillion mark for IG bonds was not met until November, but that was without a $750 billion promise from the Fed to buy corporate debt.

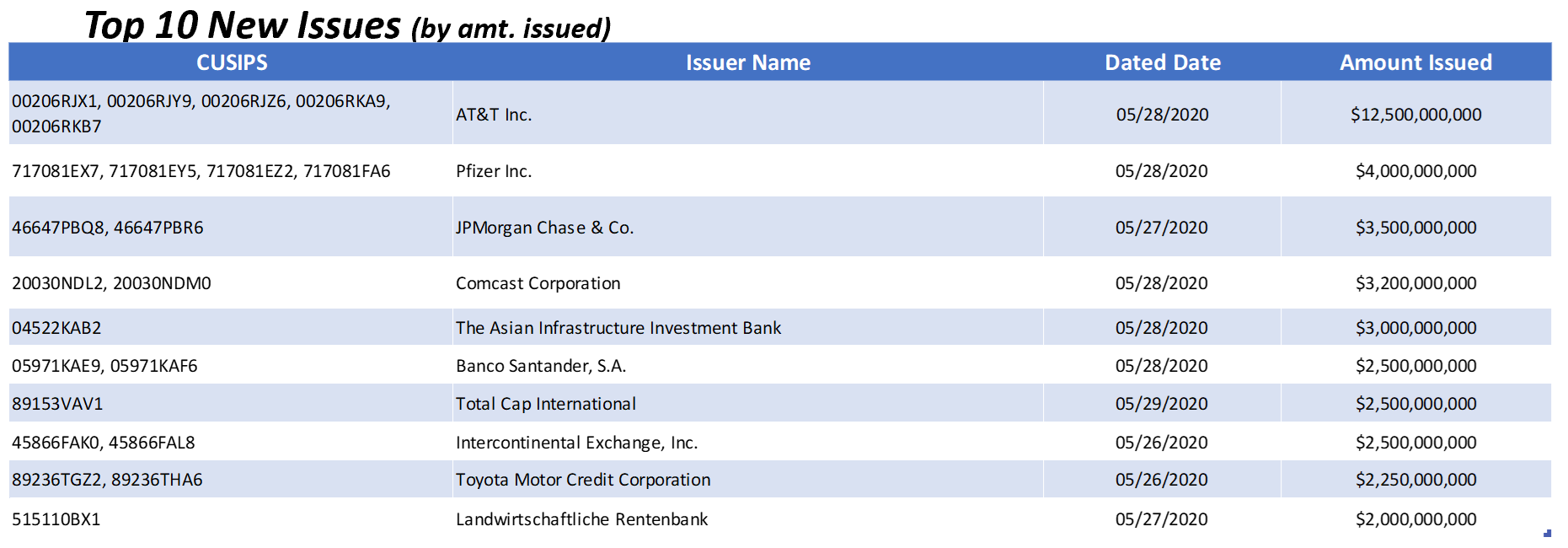

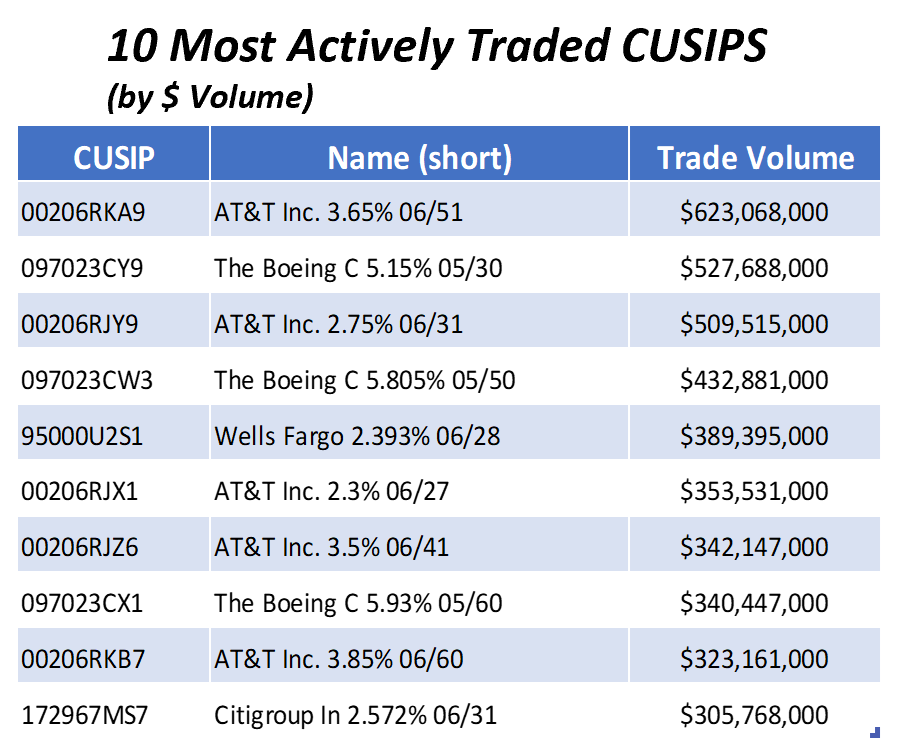

New issuance continued to rhyme with previous weeks, as financials (35.22%) and 11+ year duration (33.88%) bonds drove the largest percentage of new issuance. AT&T issued $12.5 bn in a 5-part deal, targeting the long end of the curve for over 50% of the issuance. Tencent Holdings came to market with a 4-part, $6 bn in light of recent turmoil between China and the US.

S&P issued key takeaways last week showing a wide range of possibilities that reflect an uncertain path of next steps for the economy as the coronavirus pandemic offers a large blind spot. In their optimistic scenario, the expected default rate rises to 6% by March 2021 (112 defaults) and in their pessimistic scenario, we expect the default rate to expand to 15.5% (289 defaults).

U.S. – China tensions grow prior to annual policy meeting

China will hold its most important annual policy meeting. Investors always keep an eye on the National People’s Congress as their policy decisions tend to have substantial economic and geopolitical implications.

Expectations for China’s stimulus measures are underwhelming as they look to shift to a more prudent policy stance that for the first time does not have pre-set growth targets. China is focused on a sustainable recovery rather than the kind of direct stimulus that catalyzed a global cyclical resurgence in 2016 and 2017. Geopolitical concerns (both on trade and Hong Kong) will be at the fore over the next few months and the range of possible outcomes on each is wide. Hong Kong will become a hotspot amidst rising U.S.-China tensions, but the phase one trade deal seems safe, at least for now.

European recovery fund proposal revealed

This past week, the European Commission came through with its official proposal, amounting to €750 billion of support for the European Union (EU), divided between €500 billion in grants and up to €250 billion in loans to countries hit worst by the crisis. To create the fund, the EU itself will raise €750 billion from capital markets. The proposal is to support countries with funds based on need, rather than size of the country. More heavily impacted and high-debt-laden countries like Italy, Spain, and Greece are net receivers, while wealthier member states like Germany, France, and Sweden are net contributors. The markets will look to see how this proposal is accepted and the hope is for a speedy approval.

As investors follow the progress of the European recovery fund, they will also be keen to see the U.S. brings another major fiscal package. Expectations for another law are beginning to be priced in, which include support for municipal governments, as well as an extension of unemployment insurance benefits.

Key indicators for the week ahead

Today we saw market manufacturing PMI come in-line with last month and construction spending for April came in well above expectations at –2.9% (forecast –6.8%). Economic indicators for the week will offer a firm temperature check on the labor market. Key economic indicators include ADP employment report, initial jobless claims for May, nonfarm payrolls, and the unemployment rate. No Fed speakers are scheduled to talk this week.

Happy June!

YTD Returns as of EOD Friday 05/29/2020

US Barclays Agg +5.47%, 1.34% yield, -223 bps excess return

US Barclays Corp +3.00%, 2.40% yield, -735 bps excess return

UST 10yr 0.67% yield, -125 bps

S&P 500 3,044, -5.77%

DJIA 25,383, -11.06%

OIL (WTI) $35.32, -42.30%

Gold 1,743, +14.67%

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.