Weekly Market Update 6.3.19

Last week, May concluded with what Bloomberg dubbed a “brutal month for asset classes except bonds.” More than $3tn in global equities were wiped from the books during May as rising trade tensions between the US and China continued to fan the flames of market volatility.

President Donald Trump took to Twitter to talk trade midweek, this time leveling threats against the US’s neighbor to the South. Trump said he will impose tariffs on Mexico starting June 10 in order to pressure the country into staving off the flow of migrants across the countries’ shared border.

The announcement dealt a further shock to global markets, according to international wires. Should Trump follow through with imposing tariffs against China and Mexico, Morgan Stanley predicts a US recession could begin in nine months. As things currently stand, Goldman Sachs expects 10% tariff increase on Chinese imports, while JP Morgan indicated that the probability of a recession has increased from 25% to 40%. According to Bloomberg, Bank of America and Citi have lowered corporate profit forecasts and are also anticipating an escalation in trade tensions.

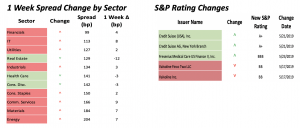

Investors continued to seek safe haven in fixed income, and with an increasing likelihood of Fed rate cuts on the horizon, two-year Treasuries saw their biggest advance since 2008. Meanwhile, 10-year Treasury yields reached 2.071%, lows not seen since September 2018. According to a Barclays research report, the “seemingly relentless” rally of Treasuries could result in a slowdown of international flows, with foreign investors finding US credit less attractive to purchase right now. Declining yields could also weigh on the demand for longer-dated IG paper, the bank wrote, adding that 10- and 30-year credit curves will be driven steeper.