The Fixed Income Brief: Markets Begin to Feel the Heat

Fixed Income Trivia Time: How many times has Argentina defaulted on its debt since 2000?

The four-month one-way recovery in risk assets is about to face its biggest hurdles. Equity markets have sounded the alarm with a significant uptick in volatility stemming from the darling tech sector. Investors head into a period of uncertainty with the U.S. general election less than two months away and a fragile economy holding out hope for a vaccine whilst praying a third wave of the virus doesn’t take hold in the autumn months ahead. No question the recovery has been based on the reality of continued substantial monetary and fiscal support, but there is a chance investors may wake up to the fact that the fiscal support can no longer be relied upon at this point. The Fed remains completely engaged and continues to keep fixed income investors at bay by forcing them to stay invested and to redeploy cash at these yield levels as there are few alternatives out there. Corporate bonds continue to perform okay against a backdrop of a low and stable U.S. yield curve. For now, issuance from governments and corporations alike remain easily digested as Powell and team are assuring investors that rates will remain lower for much longer.

Recent economic data has been positive, from the strong jobs number last week to global growth this week, but most of that has been priced in at this point. The next thing for investors to consider is where we go from here. Congress does not seem to have the answer and polls showing this election will come down to the wire continues the ongoing uncertainty. The heavy rhetoric around China is also leading to more uncertainty in the markets, causing most to proceed cautiously. This noise will only increase as we get closer to November, but all the market needs at the moment is some peace and quiet.

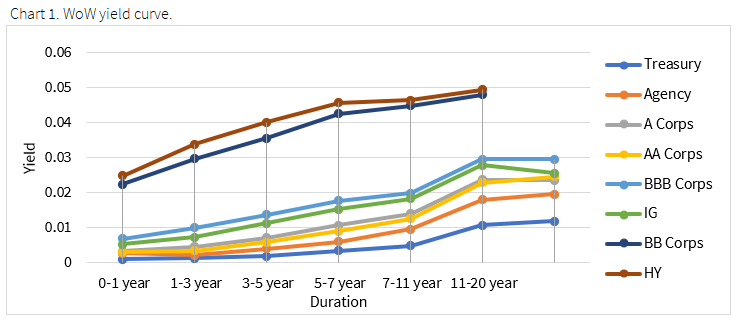

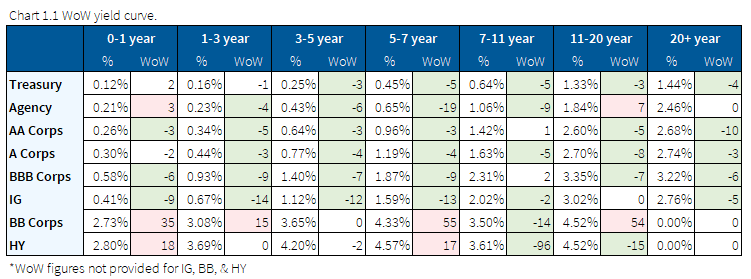

Treasuries rally on week on back of strong demand

Treasuries rallied from a move to safety as the 10-year moved down -5bps but is still +10bps wider month-over-month. The Treasury sold $23bn in 30-year bonds on Thursday. The firm demand sent yields lower and we saw modest flattening of the yield curve.

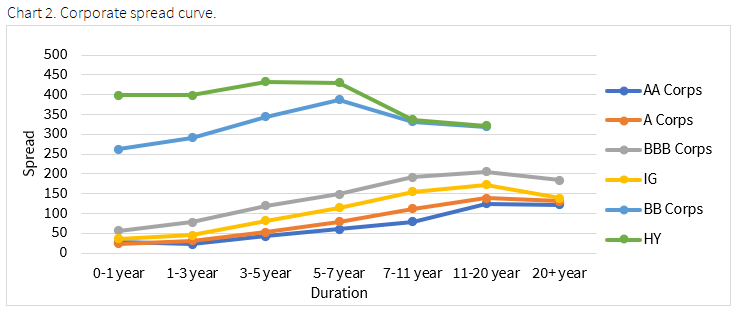

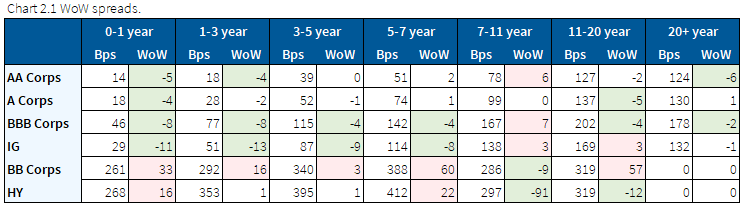

Spreads modestly widened as materials took the win

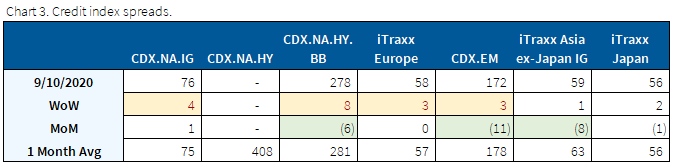

All major credit indices traded modestly wider on the week. In the face of negative economic news and volatility in the equity market, only moderate movements can be seen as a positive for investors.

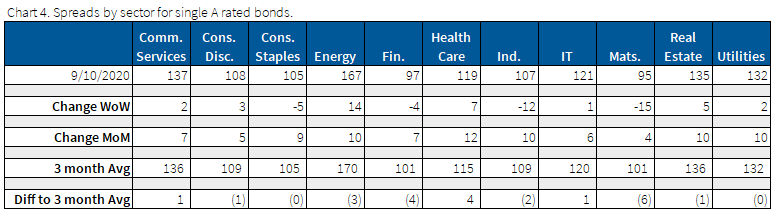

Materials was the big sector winner this week, which tightened 15bps on the back of increased demand in the industrial hydrogen market for Praxair Inc.

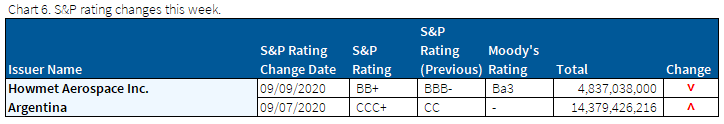

Argentina restructures foreign bonds resulting in an upgrade from S&P

Argentina restructures $69bn in foreign bonds. 99% of the bonds ended up being exchanged in the restructure and S&P upgraded them out of default after the debt revamp.

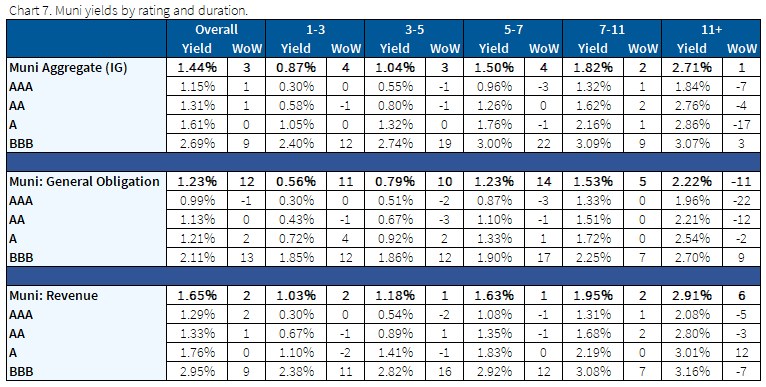

Munis weekly net inflow run continues but at a much slower pace

Over +$20bn has moved into municipal bond funds in the past 4 months, marking this week as the 17th straight week for net inflows. This amount has slowed to a trickle in the recent weeks which is on par with the usual end of the summer slowdown. We did see yields rise with BBB rated munis showing the biggest increase, however, this is with a backdrop of reports of minimal volume moving through the market. The Labor Day holiday exacerbates the illiquidity and investors remain content to hold the gains they have for now.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions.

Fixed Income Trivia Time Answer: 3

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.