The Fixed Income Brief: Rapid Progress

Fixed Income Trivia Time:

After the 2-10’s spread inverts, what is the typical duration until returns turn negative?

Our team at IMTC is excited about the year ahead and we look forward to providing snippets of insight as you navigate fixed income markets. We wish you and your families a safe and happy holiday season, and we look forward to hearing from you when the Fixed Income Brief returns in 2022.

Note: We would love to hear from you, so please reach out to team@imtc.com.

—————–

The initial response to Chairman Powell’s Wednesday admission that inflation was stubbornly too high and that the U.S. had made “rapid progress” on the employment front was a show of confidence, which sent risk asset prices higher. The day after Powell’s conference, the positive vibes wore off as the reality set in of the extent of the pullback given the Fed was going to reduce purchases by double to $60bn per month and that the bond-buying program would cease in March with a direct correlation to an immediate hike thereafter. So, as economists and strategists adjusted their forecasts, investors simply bought safe-haven assets in the view that the reduction of stimulus from the Fed, coupled with the lack of progress on Washington’s stimulus bill and significant pickup in cases and hospitalizations worldwide, could be too much for the economy to handle.

The fact now is that central bankers now realize that pandemics are actually inflationary despite lower growth in some areas of the economy. This took almost a full two years to understand, but now that remains the case nothing is going to stop the Fed from putting a pin in inflation at this point. Certainly, the risk of popping evaluation bubbles could wreak havoc on the real economy but it seems as though the market better get used to Powell being able to stomach this in the near to medium term in order to keep the credibility of investors around the world.

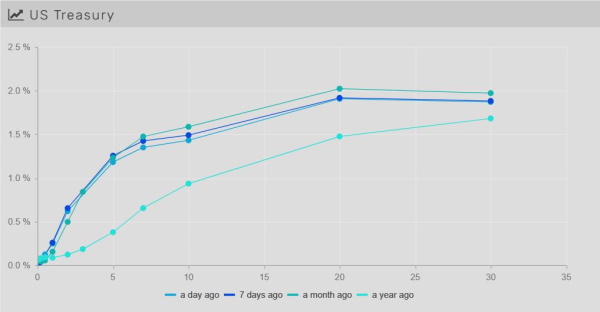

Volatility persists as rates go lower post FOMC meeting

In a very eventful year, starting with an attack on the Capitol to the persistence of COVID and its many variants, rates normalized in an expected fashion. The front-to-intermediate parts of the curve were more influenced by future Fed actions and fiscal stimulus hopes and the long end was supported by Fed purchases and global investors seeking safe havens with some return. We started 2021 with the U.S. 2yr note trading around 0.12%, and now its stands at 0.625%, +50bps higher, reflecting the probability of a couple of hikes in 2022.

The long end, particularly the U.S. 30yr bond was the outperformer on the curve, only +16bps higher YTD, starting at 1.65% and now at 1.83%. The benchmark 10yr U.S. Treasury bond traded +48bps higher, moving from 0.92% to 1.40%. In the end, the U.S. 5yr note took the brunt of the rate moves as a pivot point whereby yields were +80bps, going from 0.36% to 1.16% and claiming the prize for the worst spot on the curve in 2021.

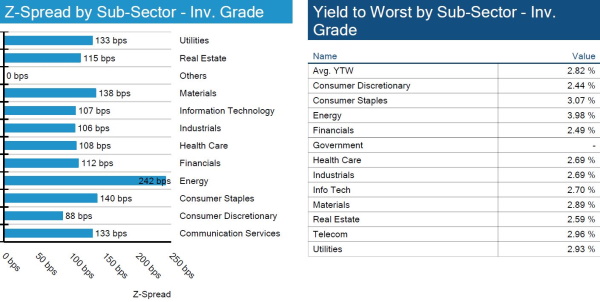

IG spreads widen to 12-month high

Interest rates are still the primary driver of return but credit spreads continue to widen, driving total return performance to -1.36% over the past 12 months. The supply chain is continuing to improve and the next large catalyst will be Q4 earnings.

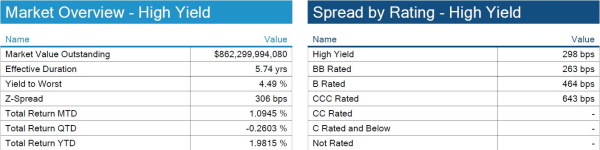

High yield spreads end week wider for the first time in a month

HY spreads widened ~15bps as volatility was injected into the market via the Fed. Default rates continue to lower and expectations are for a continued economic recovery in 2022.

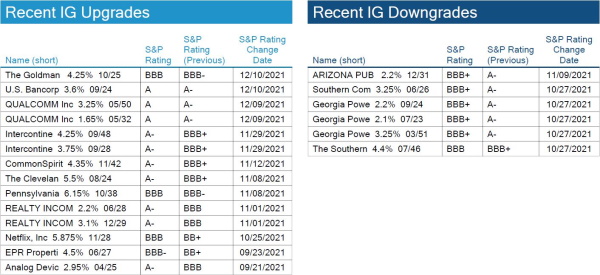

No investment grade upgrades/downgrades on the week

No rating changes by S&P for IG issuers.

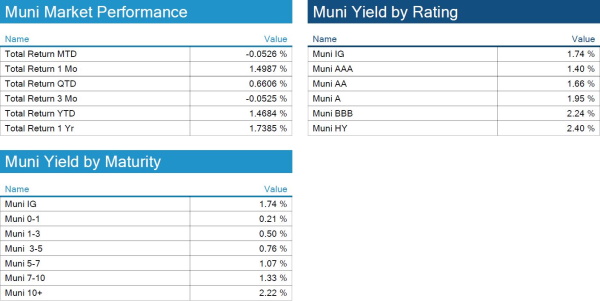

Muni space to remain supported in 2022, finishing the year on a strong note

The inevitability of higher taxes to pay for Washington’s next spending bill has continued to support flows into the muni sector. Despite the lack of clarity around the expected income tax hikes, there is a growing sense that anything announced will come into effect retroactively for the full year in 2022.

Despite initially higher estimates of supply coming next year, Vanguard research expects new issuance to slow to $400bn, an -11% decrease compared to 2021. The basis is the continued message that municipalities have plenty of liquidity and are far less likely to need to issue to fund activity given the pandemic-induced support that has yet to be spent.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, December 16, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

18 months

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.