The Fixed Income Brief: A Portion of Mickey Mouse’s Debt Gets Cut

Fixed Income Trivia Time: Which 4 countries have the lowest interest rates?

Fixed income investors learned to be a bit more tempered in their reaction from last week’s major vaccine announcement from Pfizer where risk markets rallied hard; rates sold off and the curve steepened significantly. This week’s market reaction to the positive Moderna vaccine news was like a lighter edition of last week. Risk markets rallied initially but then faded in the realization of the actual vaccine timeline, a more prolonged rocky Presidential transition, and the lack of expected additional fiscal stimulus in the next two months. With only five weeks of trading left in 2020, it will be interesting how risk markets play it given the YTD returns in hand are so positive at this point.

Data this week showed a glimpse of the economic weakness that the Fed and economists have been warning about recently. Jobless claims, after a several month steady decline, picked up again to +742 vs. +707k expected. Even though jobless claims data can be quite noisy, everyone will be watching if this trend continues back to higher levels on increased cases and lockdowns. October retail sales also disappointed coming in at +0.3% vs. 0.5% expected. The timing of the increase in COVID-19 cases couldn’t be any worse for malls and pure brick & mortar retail as the holiday season seems like it will be even more virtual this year. Make sure you get your online shopping orders in now or you might end up with nothing to give your loved ones and friends this holiday season!

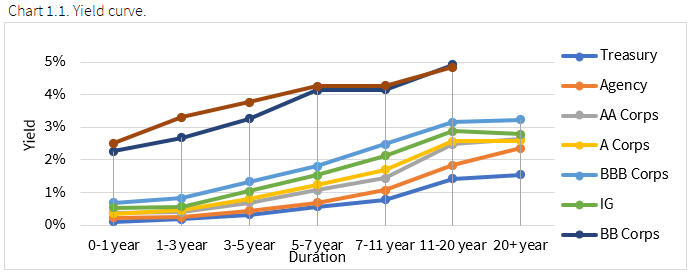

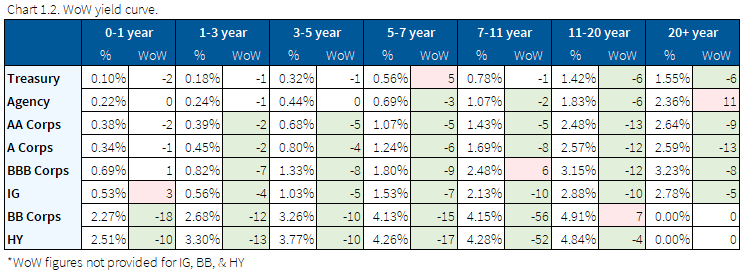

Rates traded in a narrow range and curve steepening reversed

It was a much less eventful week in rates markets as the yield on the 10-year Treasury traded in a range of 10bps, settling lower on the week to 0.84% after peaking around 0.93%. The curve also reversed recent steepening as 2/10s are now below 70bps after almost touching +80bps last week.

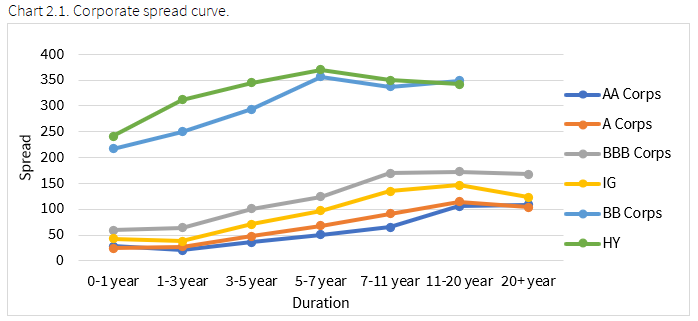

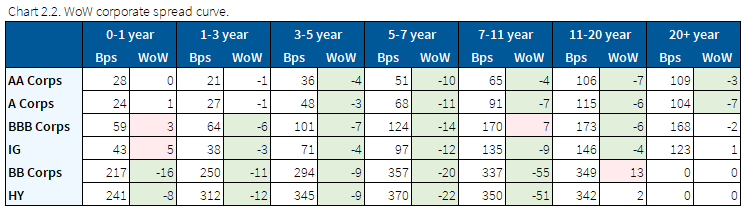

High yield and IG energy outperform

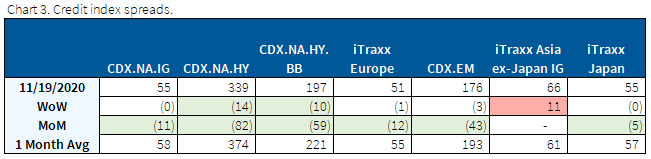

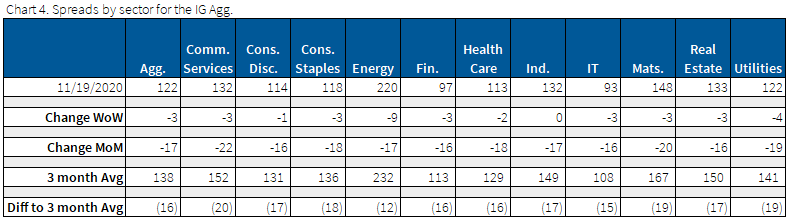

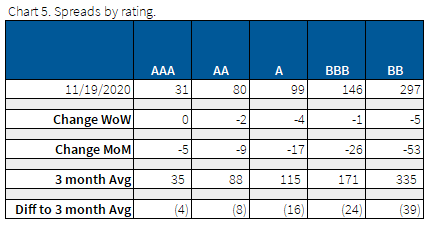

IG credit was a few basis points tighter across most sectors with the riskier IG energy and HY sectors seeing the most demand.

MoM the communications services sector has lead the way in terms of spread tightening (-22bps), with IT and financials now the tightest on a relative basis to their respective 3-month averages.

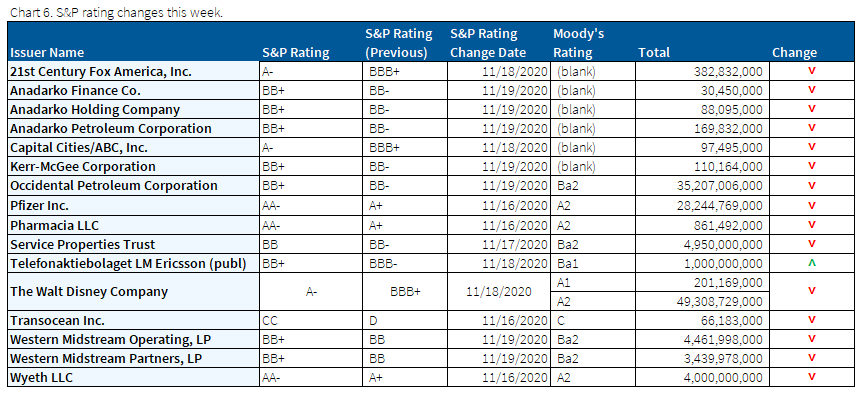

A portion of Mickey Mouse’s debt gets downgraded

S&P Global Ratings downgraded the Foreign Currency LT credit rating of Walt Disney from A- to BBB+ with a negative outlook. Occidental Petroleum Corp. was also lowered from BB+ to BB- due to its high leverage with a negative outlook.

Munis outperform Treasuries on continued strong demand, less daunting fundamentals

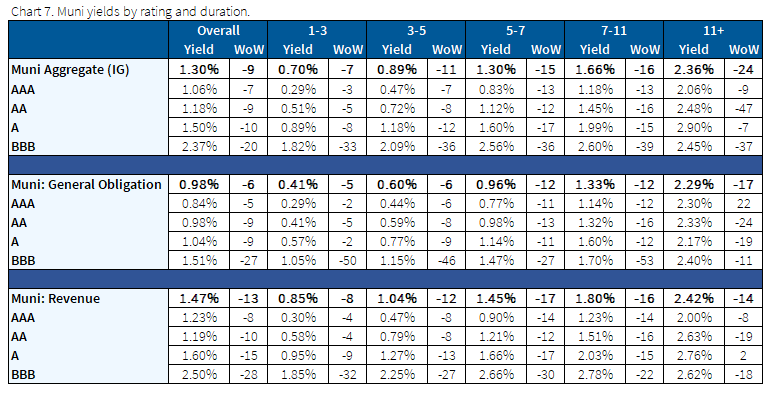

Municipal bond yields were significantly lower WoW. Municipals fund flows increased $1.32bn last week and individual investor demand has not waivered. Signs that state budget deficits are less worse off than originally anticipated have come from the two large Muni bellwethers, CA & NY, who saw significantly higher tax revenues than anticipated during the pandemic. The fear of extensive deterioration of municipal debt fundamentals is waning as cheap refinancing and an expected eventual fiscal stimulus package will ease some of the burden away from states and local governments.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Nov. 19, 2020.

Fixed Income Trivia Time Answer:

- Switzerland: -0.75% 3-month Libor

- Denmark: -0.60% CD rate of central bank

- Japan: -0.1% 3-month Libor

- Sweden: 0% benchmark interest rate

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.