The Fixed Income Brief: Divided Government Drives Rally in Bond Spreads

Fixed Income Trivia Time: What is the YTD return for the 10-year Treasury vs. the S&P 500?

The wait for the election is finally over. Though the market hasn’t processed the presumptive election of Joe Biden, it already concluded that a divided Congress will be enough to reign in either party’s mandate at least for the next two years. The stock market performance with a divided congress led by a democratic President is up over +33% historically, so in essence gridlock is good. The initial reaction of investors saw a tightening of spreads across the board 5-10bps and a retracement of Treasury yields, with the 10yr Treasury yield recovering from an intraday high of 0.94% to 0.81%. On the positive side of things we have a fully committed Fed policy to support the economy through this pandemic, a likely government stimulus package within 2-3 months, less risk of a tax hike on corporations and individuals, and overall government spending reigned in which limits the risks of outsized Treasury supply. On the negative side of the ledger looms an ongoing pandemic that governments around the world will need to contend with for the foreseeable future. Managing expectations of economic activity around intermittent closures of economies will be tough to cope with but the central banks around the globe seem to be willing to do whatever it takes.

Chairman Powell and the Fed continue to lead from the front, reiterating that their tools are not limited in aiming to further support the economy if another downturn occurs. Powell acknowledged the remarkable recovery but admitted the pace of recent activity has moderated and spending in services remains challenging. He added that the government’s quick action to provide stimulus checks and increase unemployment payments allowed the economy to find its footing faster than it would have had otherwise. The Fed needs the government to continue to provide this type of support, as Powell highlighted that the Fed can only help in terms of liquidity and lending capacity, not spending powers.

It is harder for the Fed to target specific areas of the economy than what the government can achieve. The housing sector is the main exception, as that area continues to be a bright spot of the economy given low mortgage rates. Powell stressed the need for additional spending from the government is still necessary to limit an additional tail-risk event even though the likelihood of these tail risks has diminished greatly. The Fed continues to purchase roughly $120bn in bonds each month ($80bn Treasuries and $40bn in Agency MBS); it can maneuver this program to have more impact if deemed necessary, i.e. buying more duration out of the market than what they are currently doing at the moment. All of this put the Fed at the heart of investor confidence, which saw them buy risk on the week. In the near-term all investors can hope for is an orderly conclusion to the Presidential election, really putting icing on the cake.

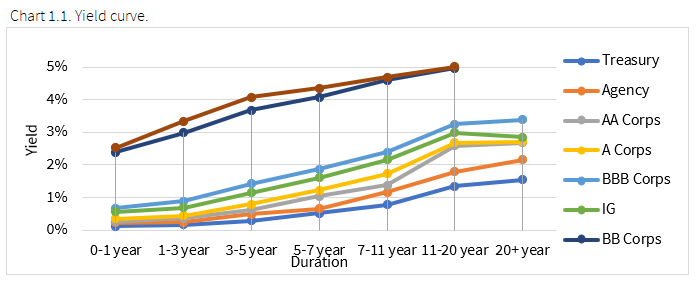

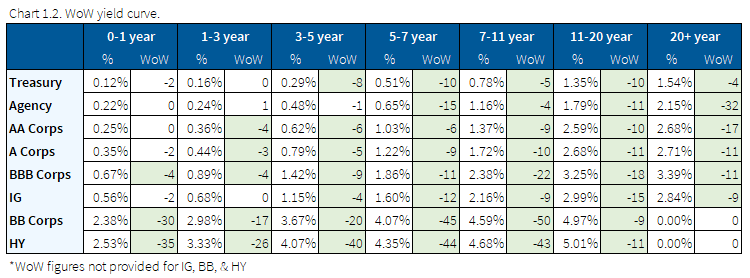

Yields tighten and curve flattens on expectations of divided government

Rates rallied throughout the week with the 2 year ~.5bp tighter, 10 year ~8bps tighter, and 30 year ~11bps tighter. The 30-year hit a 3-week low (1.48%) before closing 5bps wider on Thursday 11/05. Macroeconomic data took a back seat to election news, while investors look for additional clarity. The rally in rates is more focused on expectations of less stimulus and tempered inflation expectations rather than a flight to safety.

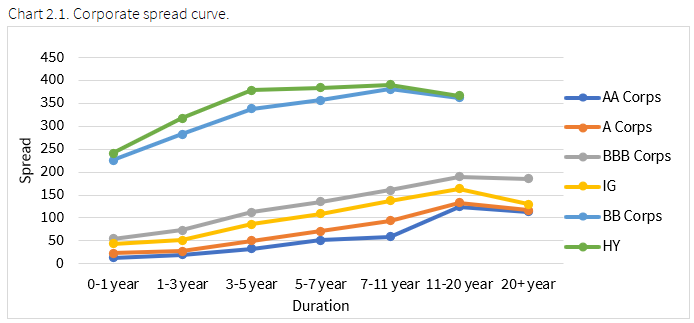

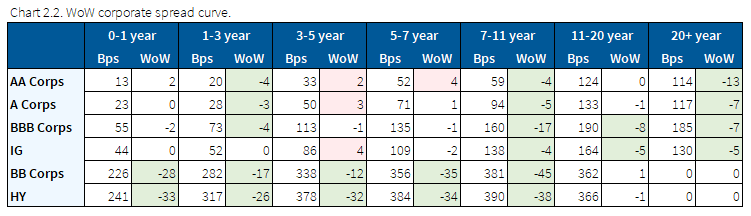

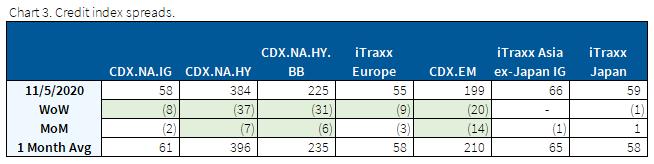

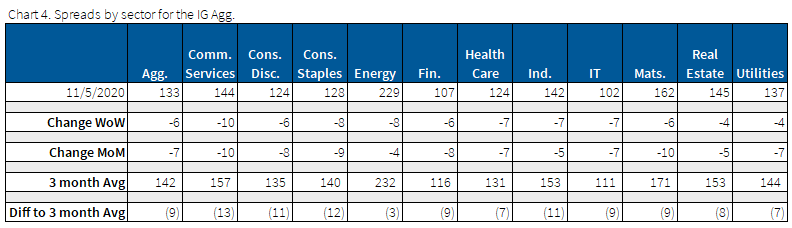

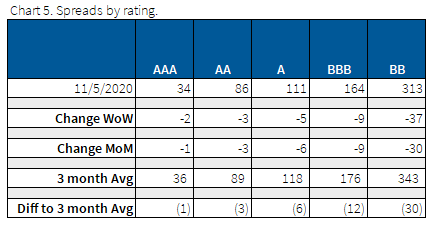

Bond spreads move tighter on week led by comms and banks

Credit spreads tightened across all sectors with communication services leading the way (~10bps tighter). Spreads modestly widened after a sharp tightening earlier in the week as the election drama continues. The potential for Republican control of the U.S. Senate and Democrat control of the House effectively precludes radical changes in the U.S. tax and regulatory framework, and the potential for a relief package becomes more likely.

In addition to communication services, large banks saw implied credit improvement, specifically in the BBB space which tightened 10bps. Names that did not participate in the rally were Nabors, Avis, and Scripps.

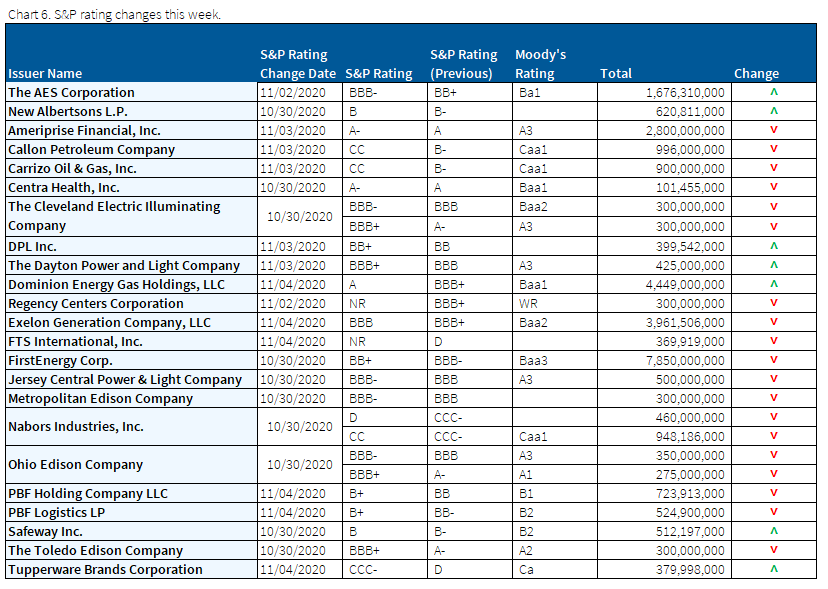

Downgrades outnumber upgrades 19-7

As quarterly earnings are digested and COVID cases begin to increase, S&P downgraded multiple names / tranches. Expectations from S&P are for this trend to continue as credit deterioration from lower revenue begins to compound.

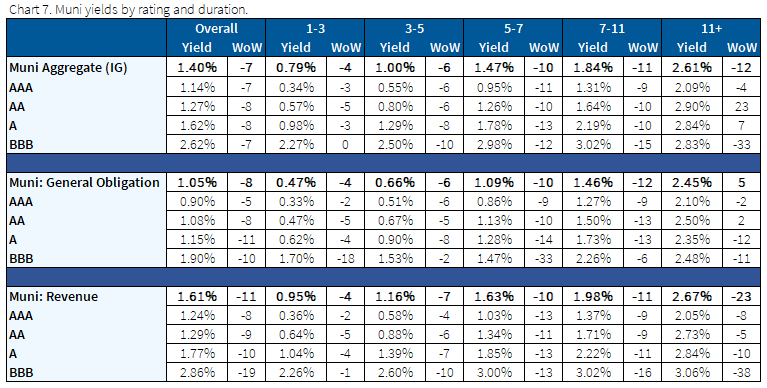

Muni supply expected to be lower following the election surge

Municipals outperformed Treasuries this past week as investors became more comfortable with the potential outcomes of the election. The safe-haven aspects of munis during the pandemic plus the potential for much less supply through the remainder of the year also should support the sector going forward. Fears around declining fundamentals have not come to fruition as tax receipts and expenses have come in generally better than originally expected when the pandemic initially hit last Spring.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Nov. 5, 2020.

Fixed Income Trivia Time Answer: 12.42% vs. 8.73%

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.