The Fixed Income Brief: “Taper is Coming” – House Powell

Fixed Income Trivia Time:

How much of the debt issued globally is negative yielding?

Stocks are continuing their march higher following a strong payroll number and a predicted move by the Fed to wind down its bond purchases from COVID-19. Non-farm payrolls increased by 531,000 for the month, compared to the Dow Jones estimate of 450,000. The 30-year Treasury is ending the week flat as the S&P is up ~2% on the week.

The FOMC announced it would begin to wind down its asset purchases program this month. The key takeaways from Powell’s address: Tapering will start mid-November 2021, a decrease of asset purchases by $10bn in T-Bills and $5bn in mortgage-backed securities per month with the wind-down completed in June 2022. Prior to the announcement, the Dow and S&P 500 were trending down but picked up after the decision was announced and closed in positive territory. Additional good news for Powell comes in the likely renomination from President Biden, which had come into question recently.

Monetary policy will still be highly accommodative after the taper begins and the FED will continue adding to its portfolio. Fed Chair Jerome Powell highlighted that tapering doesn’t mean policymakers will hike interest rates any time soon. He also held to the belief that high inflation would prove transitory and would not likely require a rapid change in policy. The announced pace of reduction in buybacks is slower than the Treasuries reduction in T issuances.

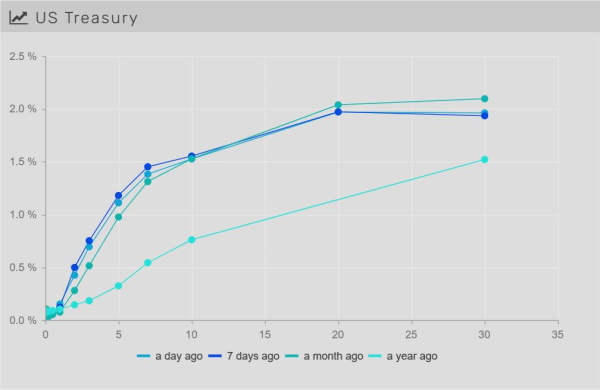

30-year Treasury ends flat as rate hikes get priced in

The 2-year Treasury ends the week ~5bps tighter even in the face of rate increases moving forward. Traders are betting the Federal Reserve hikes rates two times in 2022 and have moved forward the bet on the first hike from September to July 2022. According to Fed Funds future, contracts traders are betting for 5 hikes before the end of 2023. The long end is being capped by ultimate growth concerns on the back of future rate hikes. The U.S. 30yr was flat, hovering below 2%.

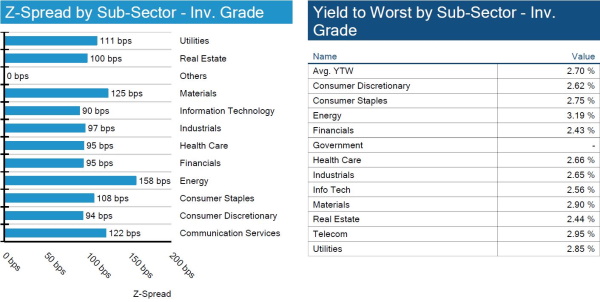

IG credit spreads end week 1bp tighter (again)

No large swings in credit spreads, but it is worth noting that we are seeing small tightening WoW. Investors have digested the mostly positive earnings season and now will be looking to the U.S. government for clarity. Potential drivers of a move wider can come from a partial government shutdown and debt-limit crisis.

High yield tightens on positive macro news

High yield bond default probabilities are at multi-year lows as yields tighten WoW. Oil is 4% lower, but with risks around inflation, it did not drive any major credit spreads. With a strong earnings season and continued demand for high yield issuance, investors will be happy with their total return.

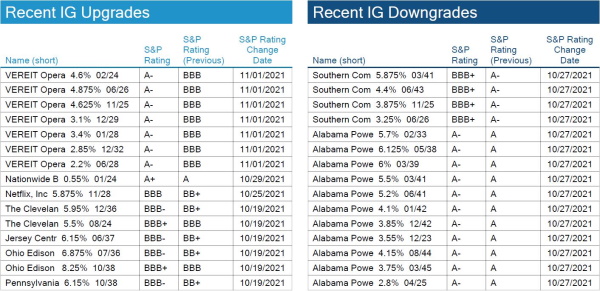

Hyatt is a fallen angel

Not pictured below in a snapshot of IG credit changes is Hyatt getting moved to junk status. The company recently issued more debt to finance the closing of the ALG deal.

Want to learn more about fallen angels from IMTC? Watch our interview last year with Kevin Roche.

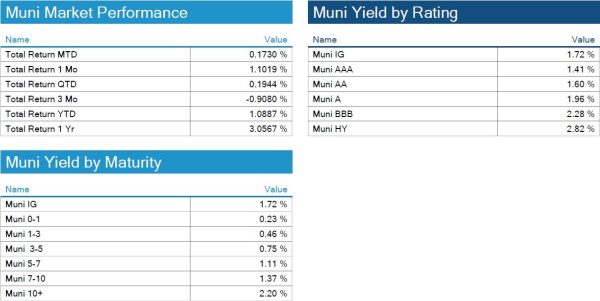

Muni curve unchanged on week

There has been some recent positive momentum in munis this week, however, there is still hope for more clarity on an infrastructure package soon. Yellen indicated that she is confident that lawmakers will get Biden’s deal done.

State tax collections have increased significantly and should help credit quality over time. NY State has been the latest to report an increase in tax revenue by ~20% in the 3rd quarter YoY, higher than pre-pandemic levels.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, November 4, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

~-21%

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.