The Fixed Income Brief: Bond Investors in a Wait and See Mode

Fixed Income Trivia Time: As of Q4 2019, what was the average debt-to-equity ratio in the airline industry?

Virus news and the presidential campaign led the headlines this week. Globally we are seeing governments take steps to reduce the recent resurgence of cases as a result of many workers and students heading back in person. These restrictions could dampen recovery efforts, but the extent of the damage will depend on whether it’s a second wave that shuts the global economy further or dealing with a number of hotspots in a more targeted manor. We will have to wait and see.

Investors continue to parse through the political noise to gauge the ongoing impact of the spread of new COVID-19 cases on the economy. Economic indicators held up relatively well on the week, but the September monthly jobs number disappointed with +661k vs 850k expected. The unemployment rate did manage to tick lower (7.9% from 8.4%), but some of this is attributed to the lower participation rate (61.4% from 61.7%). Even though the economy has recovered 11.4 million jobs of the 22 million lost in March and April, there is a growing sense the recovery is losing steam.

The Michigan Consumer Sentiment figure, which hit 80 since the first time since before the pandemic began, showed people are trying to remain optimistic, but unless Washington can come through on a stimulus agreement, this hope will fade as the recovery drags on. The transportation and services industries have been marred by additional job cuts as airlines, hotels, and amusement parks remain sources of stress — Walt Disney Company earlier this week announced 28k layoffs for theme park workers who were previously on temporary furlough. Prior stimulus provided to the airlines ran out as of October 1st and this caused these businesses to reassess their expected revenue going forward. As a result, United and American Airlines announced a total of more than 32k job cuts. These cuts will hit the October unemployment figures, not announced until after the November 3rd election. The hope from investors is that these significant industries will garner enough attention for the White House and Congress to act on an additional stimulus package.

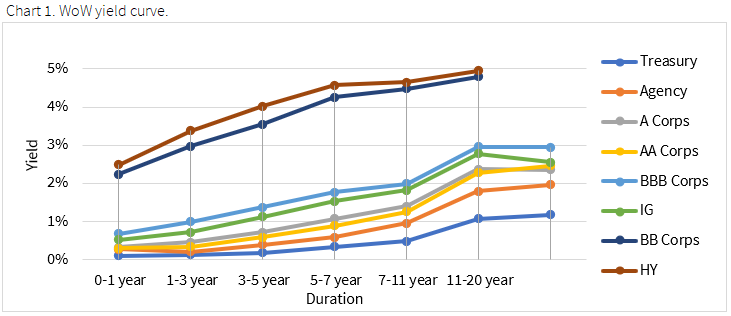

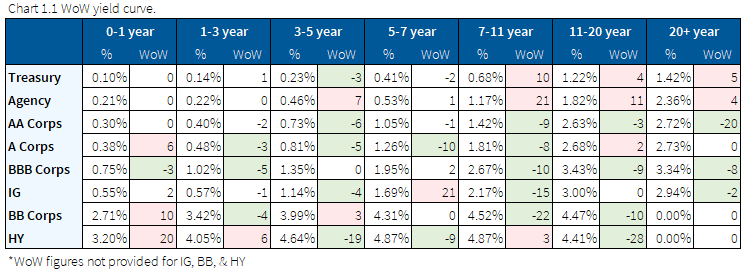

Yield curve ends the week higher on optimism of stimulus deal

Weak jobless claims and the President testing positive for COVID was outweighed by optimism of a stimulus package. The curve ends the week modestly steeper after Treasuries initially rallied on Friday morning.

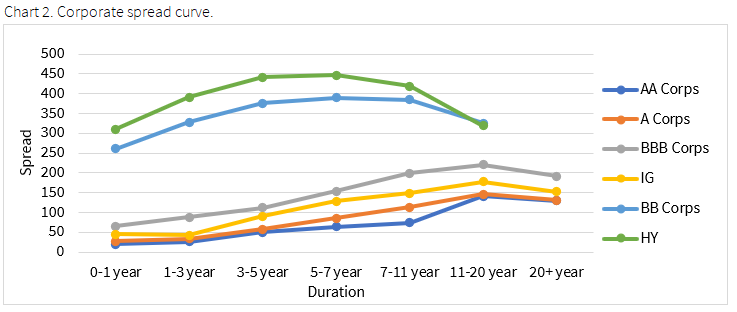

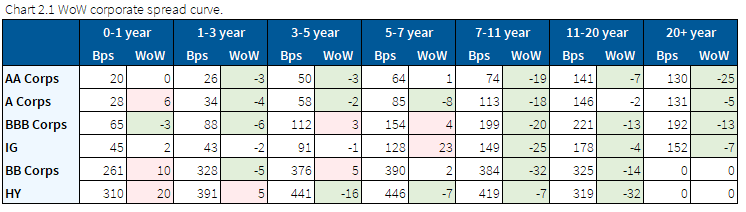

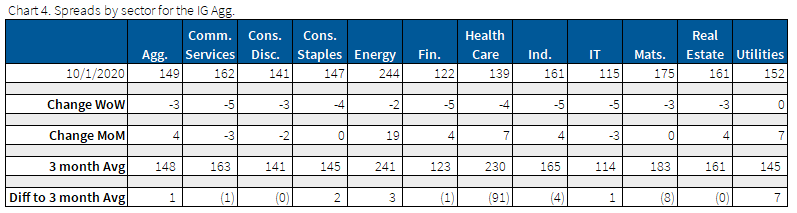

Financials, industrials, and healthcare drive spreads tighter

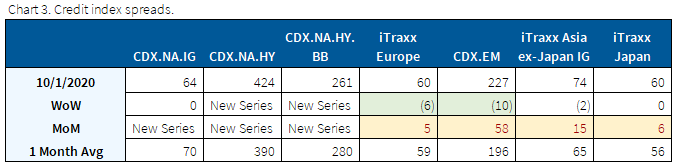

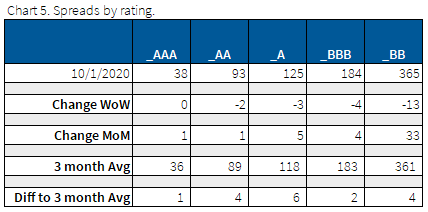

The IG Agg traded 3bps tighter on the week, which was driven by BBB bonds, specifically in the financials, industrials, and healthcare sectors. The major NA HY credit indices rolled to a new series, while the IG index was unchanged. iTraxx Europe and Emerging Markets both recovered this week after testing recent wides last week.

Merck, Walmart, and Morgan Stanley all performed well this week with implied credit improvement that helped drive the aggregate tighter, specifically in financials, industrials, and healthcare.

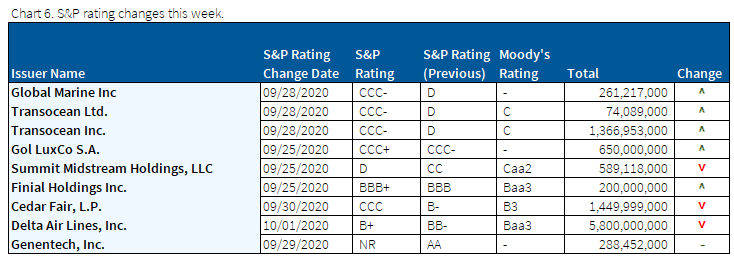

Delta unsecured debt downgraded to B+ in a week of upgrades

This week, S&P’s upgrades outweighs downgrades during a week of broader credit deterioration. S&P did move Delta Air Lines unsecured debt one notch lower to single B+ as the air carrier sold $9 billion of debt secured by its frequent-flier program last month. Currently Delta’s debt load is at 13.4x earnings and their unsecured debt makes up 35% of debt outstanding.

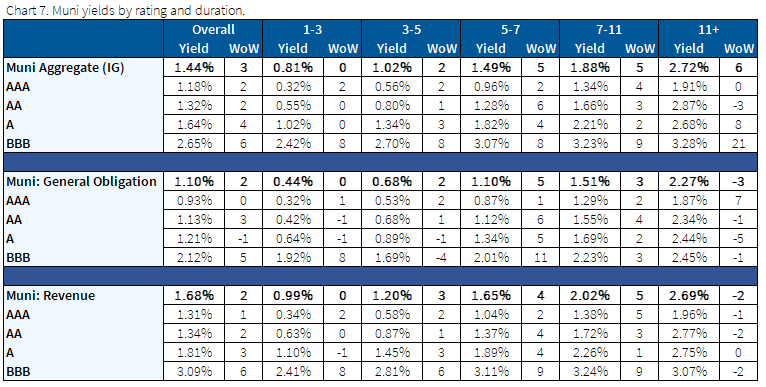

Muni yields slightly higher as supply increased to $342bn YTD

Municipal bonds underperformed Treasuries again this past week as supply continued to surge. For September, supply increased by +$47bn to $342bn YTD. The monthly figure set a historical milestone as this was the fourth month in a row that supply has been over +$40bn – this has never occurred before even in years that saw higher annual supply.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Oct. 1, 2020.

Fixed Income Trivia Time Answer: 115.62

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.