The Fixed Income Brief: Fixed Income Investors in the Sweet Spot

Fixed Income Trivia Time: The Massachusetts Investors Trust was the first official mutual fund, created on March 21st, 1924. What year was The Wellington Fund established as the first mutual fund to include both stocks and bonds?

The bond market has come to terms with the fact that stimulus is coming in some form or another. The latest move in yields seems more linked to the prospect of a blue wave in Washington rather than getting a smaller stimulus deal done before the election. Recent polls in swing states have increased the perceived probability of a blue wave, where Democrats would regain control of both the Whitehouse and the Senate, whereby the expected fiscal stimulus is anticipated to be larger and more broad based under a unified government than what is currently on the table. Ultimately, to pay for that stimulus the Treasury will need to increase the amount of debt it is issuing and the larger the package, the higher that amount of supply will be — that is a key factor helping to drive yields higher.

Data and earnings have helped risk markets in the face of a significant uptick in coronavirus cases around the globe. Housing and PMI data released Friday morning were positive and continue to be a supportive bellwether of economic activity picking up. Although the weekly jobless claims were the second lowest since March, there is recognition that a lot of noise around the figures is on the back of California handling back-logged claims and others seeing their benefits expiry after the allotted 26-week allowance. As one of the more real-time pieces of information the markets get each week, the latest numbers should be taken with a grain of salt as we will need to look at the trend over the next few weeks to see if things are improving as much as the data indicates.

Overall, current market conditions and the slight uptick in yields leaves fixed income investors in a sweet spot at the moment. There are enough risks on both sides of the ledger at the moment that are keeping things somewhat balanced. With the Fed holding rates at zero and actively buying Treasury assets, most strategist believe the 10-year yield is not going to rise that much further. If the reason yields are rising is fiscal stimulus, that would not necessarily scare investors from continuing to buy spread product in the meantime as it would bolster the near to medium-term economic outlook. The flip side is that the polls are again being relied on too heavily and if the election result is delayed and controversial, it would take the near-term prospect of stimulus off the table and send risk assets in to hiding – keep your head on a swivel out there.

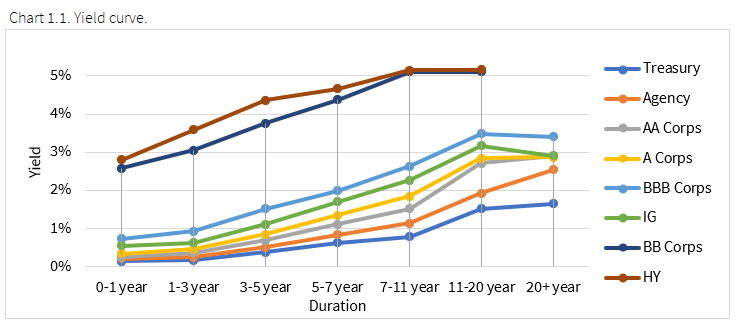

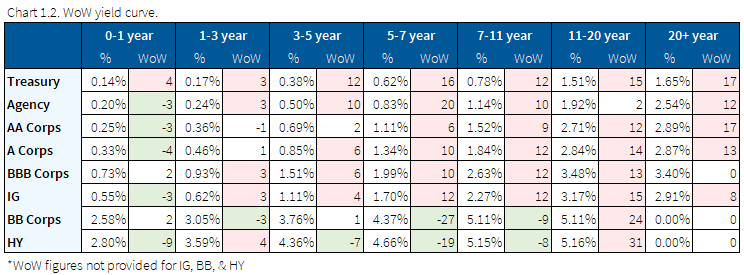

Yields rise across the board as curve steepens

The yield on the benchmark 10-year Treasury note climbed for a seventh straight day to 0.859%, the highest level since June. The yield on the 30-year Treasury bond also rose slightly to 1.680%.

After trading in a close range since June, Treasury yields are starting to break out of their 4-month range. The 10-year yield reached the high of 0.86% on Thursday; it had been virtually stuck under 0.70% for most of September and into early October, but it has been trading above that level for a couple of weeks.

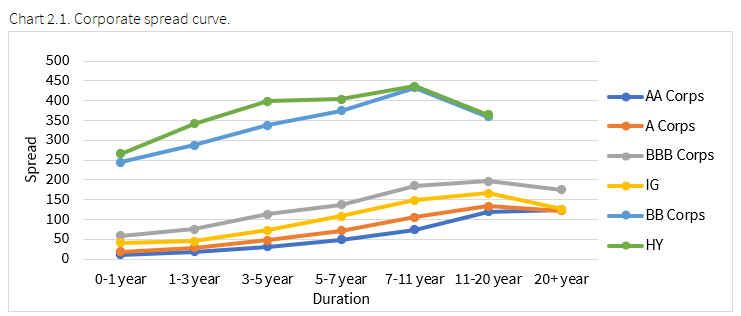

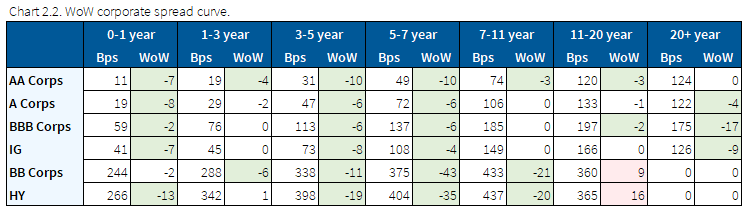

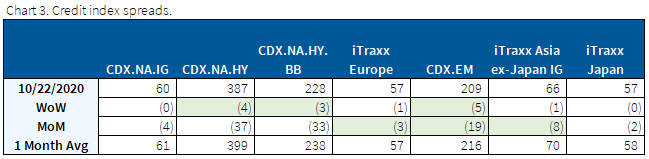

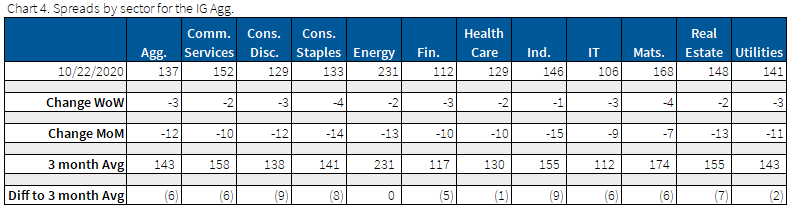

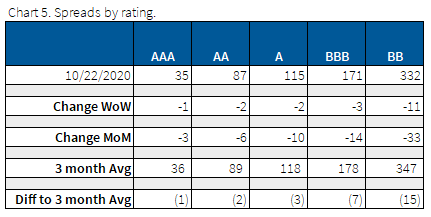

Bond spreads tighten modestly as credit indices are flat to tighter

Credit spreads continue modest tightening and investors are providing a steady demand for new issuance. According to Moody’s, “US$-denominated corporate bond issuance is expected to soar higher by 50.6% for IG to a record $1.972 trillion, while high-yield supply may rise 25.2% to a record high $542bn.”

Materials and consumer staples lead the index in tightening WoW. In response to an outsized YoY increase in new orders for heavy duty trucks, one industry analyst remarked that because of the restraints placed on air travel and dining by COVID-19, Americans are turning away from the consumption of experiences and, instead, are buying more tangible goods.

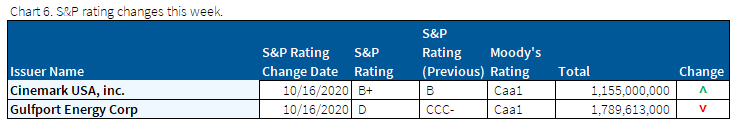

An uneventful week for ratings activity

There was no major S&P rating activity for the week ending 10.23.2020 with only 2 ratings changes total – one upgrade and one downgrade.

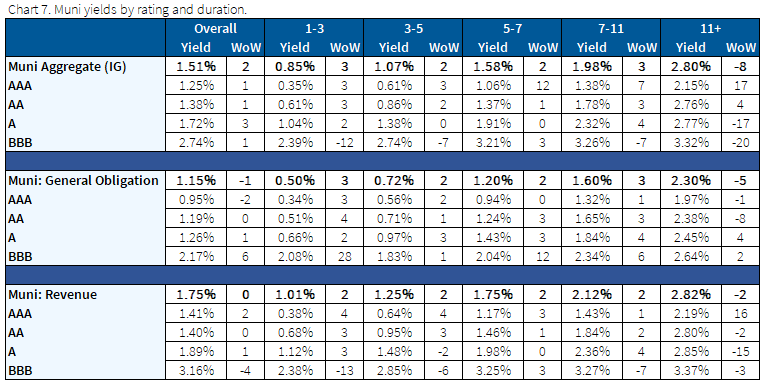

Muni yields higher on continued issuance, but still outperform Treasuries

Demand for municipals remains strong despite the recent heavy supply as we lead up to the election. Expectations of higher taxes across states and local authorities has bolstered individuals’ demand for tax-exempt investments. Overall, visible supply continues to be elevated, outpacing the last three months, resulting in higher yields needed to clear auctions which continue to offer better opportunities for buyers.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Oct. 22, 2020.

Fixed Income Trivia Time Answer: 1928

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.