The Fixed Income Brief: Taxes, TIPS, and Earnings

Fixed Income Trivia Time:

The effective yield of the ICE BofA U.S. High Yield Index is ~4.3%. As of September’s end, what is the increased annual rate of cost of living?

Details around the fiscal stimulus package continue to unfold as President Biden and the democratic congress get closer to their self-proposed deadline to pass their scaled down fiscal stimulus package. The scale will be dramatically reduced from $3.5 trillion originally to roughly half that now and broad-based tax increases look off the table. This has helped boost sentiment around corporations going forward along with very positive earnings reports as ~20% of companies have reported thus far.

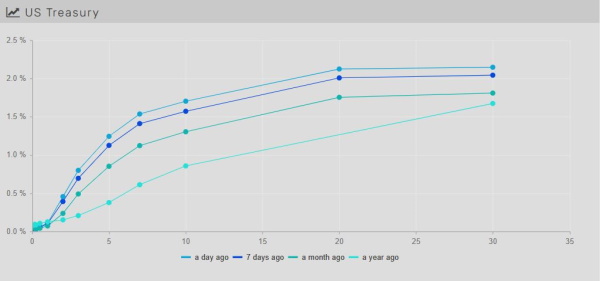

Financials are definitely the winners to date, as they have not suffered from supply concerns, and investment bank activity continues to be robust amidst financing and endless M&A advisory needs in this environment. The only issue banks face is the ever-flattening yield curve as the margin they earn from borrowing short and lending out the curve will continue to get compressed as long as investors believe that rate hikes will come sooner than expected and, ultimately, slow long-term growth in the future.

Data this week was highlighted by Friday’s Global PMI data, which in general were slightly weaker, but constructive despite ongoing supply-chain issues around computer chips that impact Europe’s large auto manufacturing sector and U.S. service company reporting issues staying fully open due to worker shortages. Next week data will be led by Friday’s U.S. PCE Price Index and E.U. CPI releases along with the ECB meeting and press conference on Thursday, rounded out with E.U. and U.S GDP data and U.S. durable good orders and new home sales data.

TIPS auction flashing warning signs for fixed income investors

Fixed income investors sent expectations for U.S. inflation to levels not seen in over a decade amid concern over supply-chain bottlenecks and resurgent consumer demand, which is expected to keep the cost of goods and services elevated for the short to medium term. ‘Transitory’ has become a derogatory word for bondholders as they watch their real yields dwindle in the face of unprecedented inflation levels.

The breakeven rate for 5-year TIPS surged Thursday to the highest since the maturity was reintroduced in 2004. The move coincided with the largest-ever auction of the 5yr tenor. The $19bn offering drew a record-low yield of -1.685%, below where it was trading before the auction, sending breakeven spreads to ~285bps, roughly +125bps higher versus the start of the year.

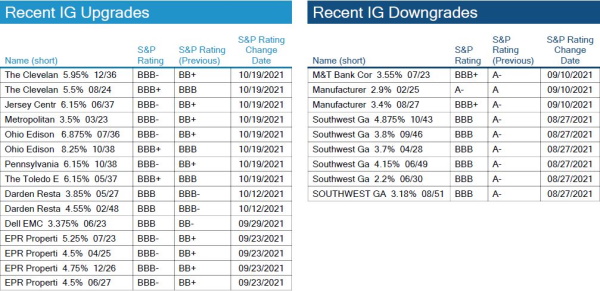

IG credit spreads tighten on strong Q3 earnings

U.S. IG saw most of the sectors tighten on the week except for energy. IT was headed for the biggest winner on the week before the SNAP and INTC earnings were released Thursday night. On the week, IT ended 2bps tighter relative to the Agg of ~4bps tighter.

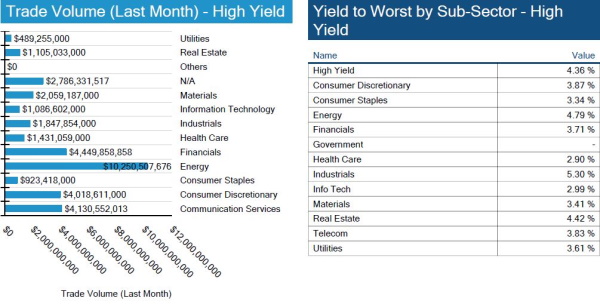

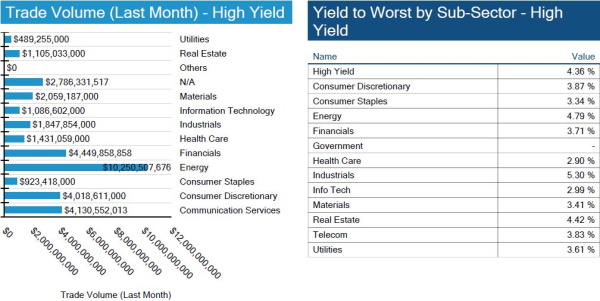

HY bonds end week relatively flat

Intra-week, there was some substantial yield movement, but we end the week relatively unchanged. New issuance calendar remains well above averages and use of proceeds for M&A are up while debt refinancing is down.

No IG S&P credit changes week over week

There were no significant IG S&P rating changes worth noting WoW.

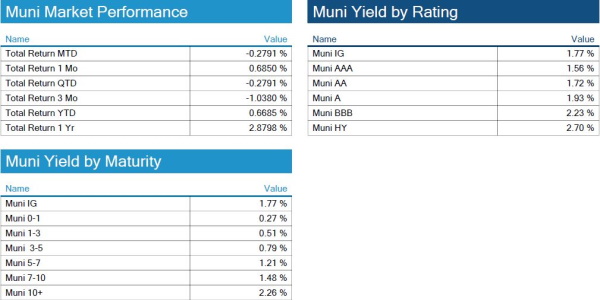

Munis could see a chink in their armor on two fronts

Given the move higher in front-end Treasury yields this week, municipals held their own. The front end of the muni curve remains well anchored and should outperform Treasuries in the near-term give the repricing of rate hikes.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, October 21, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

5.4%

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.