The Fixed Income Brief: Bond Market Riding the Waves

Fixed Income Trivia Time: After which war was there a large issuance of railroad bonds that largely defaulted and halted the growth of municipal debt?

We are only 10% through earnings season, but 85% of companies reporting have been better than Wall Street expectations. September retail sales released before the opening bell on Friday showed a little more life than many had expected. The headline number rose 1.9% vs. the 0.7% average Wall Street estimate. However, most of the week has been a retreat from the previous week given the sentiment around fiscal stimulus.

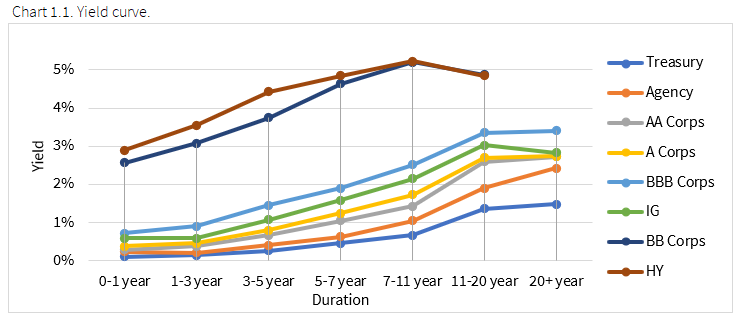

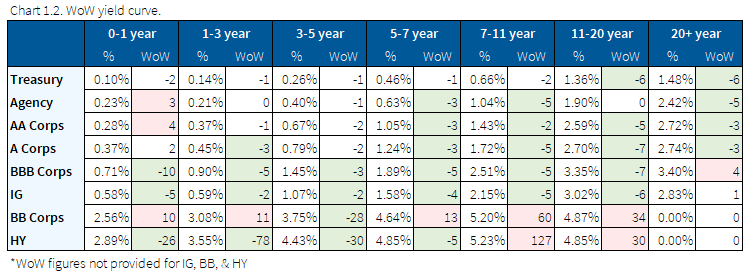

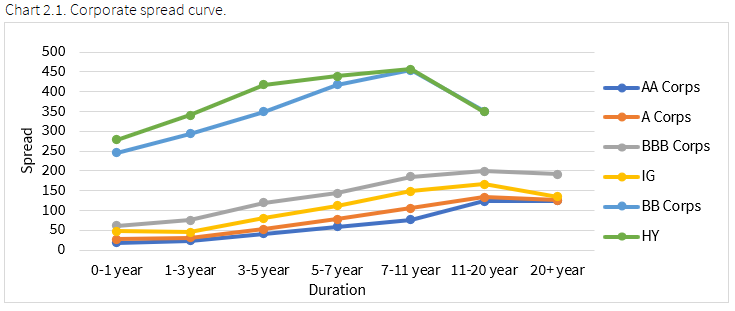

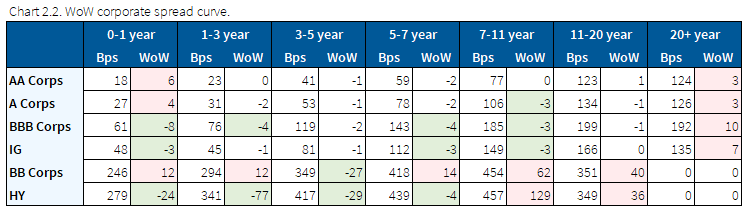

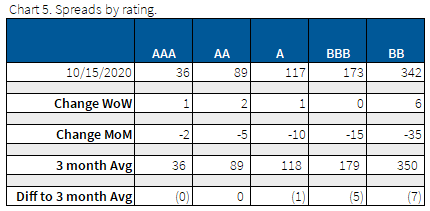

Treasuries tightened on the week due to a flight to quality, but Friday optimism left the curve mostly unchanged. The curve is expected to steepen with a democratic victory due to additional stimulus driving inflation. The moving five-day averages of investment- and speculative-grade corporate bond yield spreads recently fell to their narrowest bands since March 2020.

U.S. states saw their tax revenue drop by 6% from March through August compared to the same period a year earlier. This is seen as better than expected as states have reported their revenue did not decline as much as anticipated.

10yr Treasury ends week 2bps tighter

The Treasury curve modestly flattened this week as long end yields move on interpreting stimulus talks. The 10yr auction cleared at 76.5bps last week (+6bps higher than last auction) before tightening to 70bps on Thursday. Lawmakers in Washington continued to send mix signals about progress toward a stimulus deal, but optimism and strong retail sales brought the 10yr back to 75bps to end the week.

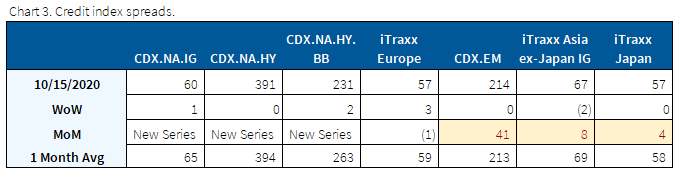

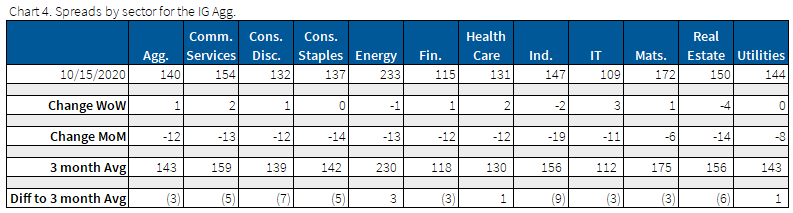

Financials implied credit improves on earnings as airlines widen

All major credit indices were flat on the week as implied credit improvement in the financials space, specifically major U.S. banks, offset other sectors. Bond spreads were flat on the week and remain 12bps tighter MoM. Airlines saw the largest spread widening, specifically JetBlue and United Airlines. United Airlines reported worse-than-expected results and Delta had a significant decline in revenue announced earlier in the week.

High Yield Credit Index tightening was driven by Nabors Industries as its US supplies decline and retail names like Macy’s and Rite Aid.

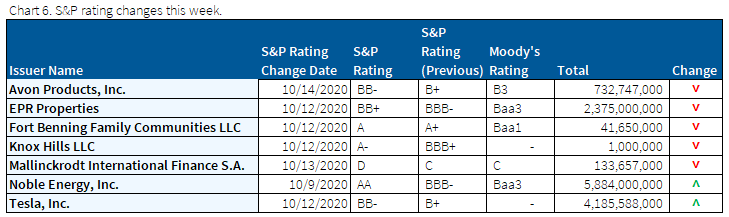

S&P downgrades outpace upgrades 5:2

The high yield default rate in September was up 8.5% from September 2019’s 3.4%. Moody’s predicts an 10.9% default rate in Q1 2021. The most notable rating change this week was Tesla, which had $44.2bn of its debt upgraded by S&P.

Issuer groups request expanded federal effort including secondary muni purchases

As noted in the BondBuyer, issuer groups request expanded support from the Fed’s Municipal Liquidity Facility to expand to the secondary market. The issuer group stated that support would “compensate for delayed revenues.” If passed, this would help relieve economic contraction and most likely drive yields lower as we saw in the corporate space in April.

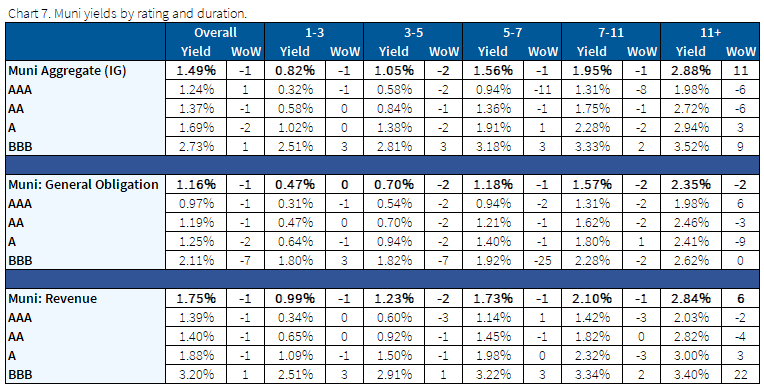

Increased supply continued this week as issuers look to raise funds prior to the election and in the face of decreased tax revenue. For more insight into positioning munis ahead of the 2020 election, read our latest blog.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Oct. 15, 2020.

Fixed Income Trivia Time Answer: The Civil War

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.