The Fixed Income Brief: Separating Taper from Hikes

Fixed Income Trivia Time:

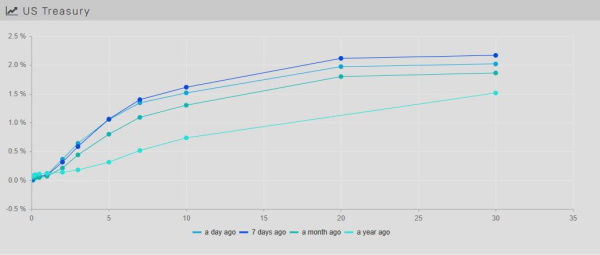

Rate markets this week started to flatten the yield curve, with front-end yields moving higher and long-end yields moving lower, as bets are being made that the Fed will have to act sooner than expected on rate hikes. A good portion of fixed income investors are not sold on the ‘transitory’ nature of the persistent inflation that we have been experiencing globally and feel that it will ultimately force Chairman Powell and the FOMC to move quicker than they have indicated from their dot plots. Expectations for the first rate-hike has moved from late 2022/early 2023 to July of 2022.

Given the recent move, the front end is offering a lot more yield, but at the same time, investors think longer term that inflation and rates could settle south of 2%; this is keeping longer-term yields capped to the more recent range based around 1.5%. The message we hear from Chairman Powell on November 3rd will clearly state that there is no association with ending of open market purchases and hikes, but investors will show through the yield curve whether they believe this or not.

Treasury curve flattens mid-week, a sign of what’s to come

Treasury yields rose this week on the back of expectations that the FOMC will need to bring rate hikes forward to combat the inflation risk in the economy. Despite the risk market rally throughout the week on the back of strong earnings, long rates fell as there is a sense Powell will bring inflation under control faster than originally anticipated. At the peak of the flattening, the U.S. 2yr increased +3bps, the 5yr was unchanged and the 10yr and 30yr maturities were down -8bps and -14bps respectively. That is a significant move and despite the fact that the curve normalized by the end of the week, it shows investor tendencies to want to shun the front end for the time being as they wait and see the market reaction going forward.

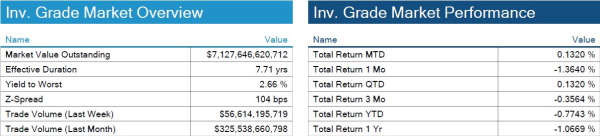

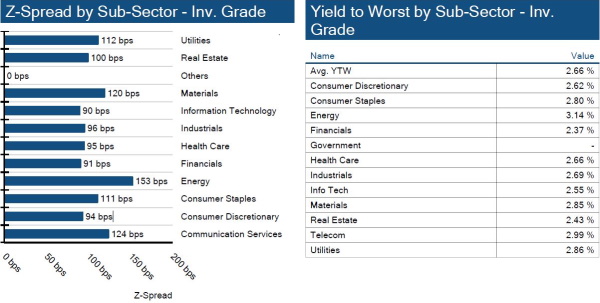

IG credit spreads reverse course, tighten on the back of strong risk tone and earnings

U.S. IG saw most of the sectors tighten on the week. The stronger moves were across the riskier sectors as the growth picture got a boost from quarterly earnings commentary out of key global companies.

Despite positive risk tone, HY bonds stay relatively unchanged

Trade volume in the energy and financials far surpasses other sectors as bets on commodities and strong financial results continue to bolster the space.

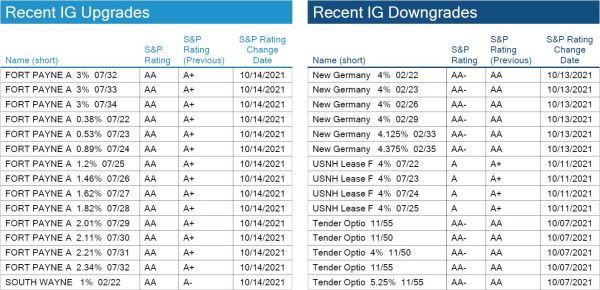

No IG S&P credit changes week over week

There were no significant IG S&P rating changes worth noting WoW.

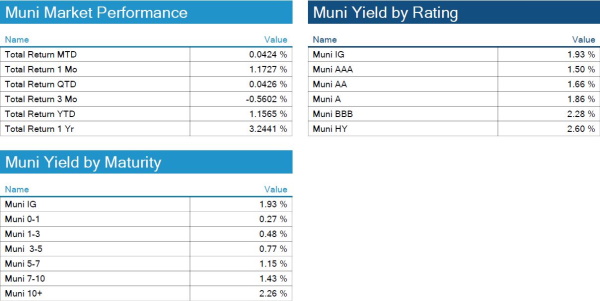

Munis relatively unchanged WoW as investors digest Treasury moves

Given the move higher in front-end Treasury yields this week, municipals held their own. The front end of the muni curve remains well anchored and should outperform Treasuries in the near-term give the repricing of rate hikes.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, October 14, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

B. Brown

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.