The Fixed Income Brief: Inching Closer to Clarity Ahead of Fed and Central Bank Meetings

We’re excited to announce an updated version of The Fixed Income Brief! New charts are included that previously were only available to clients with full reports at the bottom. Please feel free to reach out if you have feedback on the new charts.

Fixed Income Trivia Time:

What does “quadruple witching” refer to for futures and options contracts?

The delta variant’s continued spread and the potential for increased taxes drove the market lower this week. This extends the September selloff while investors will have to look to next week for clarity from central banks.

On a more positive note, 87% of S&P 500 firms reporting earnings have beat analyst projections. Tech and financials have led the way, but even pandemic-affected sectors, like goods producers, have beat expectations in the face of supply chain disruptions. As Moody’s pointed out this week, historically, this means that we should not expect for earnings weakness — “large increases in earnings have not been followed with significant earnings weakness.”

Despite these strong earnings reports, massive macro stories remain in question. Most notably are questions on the federal government plans around budget approvals, fiscal deadlines, tax hikes, stimulus packages, and the debt ceiling. Externally, factors for disruptions include China’s regulatory changes (i.e., around pollution this week), COVID-19, and the central banks. We should have more clarity after next week on central bank actions, as the Fed will speak on 09/22 (although we do not expect any additional details on the taper) before flash PMIs being released on 09/23, in addition to central bank meetings in Brazil, China, Hungary, Indonesia, Norway, Switzerland, Sweden, and the United Kingdom.

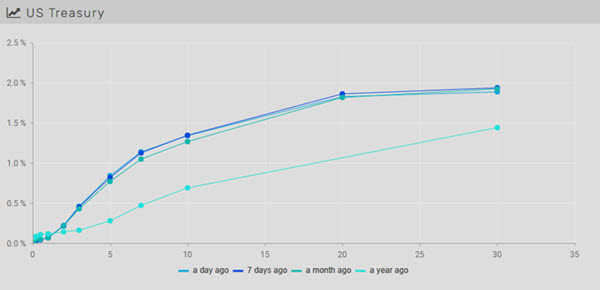

Treasury curve flattens led by demand on the long end

The 30-year bond is ~3bps tighter on the week, while the 2s-10s are both higher to end the week. Rates across the curve are moving higher on the back of August retail sales, but the long bond still ends the week tighter, which could be a result of worse-than-expected weekly jobless claims.

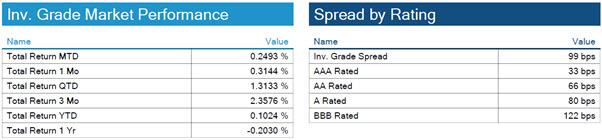

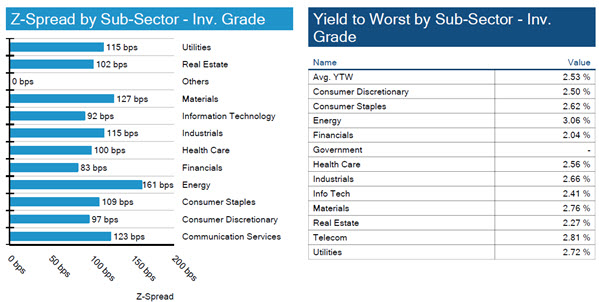

IG credit spreads end week 1bp tighter

U.S. IG remains stable as expectations for the corporate tax hike is mostly priced into the market. Corporate issuance is up ~15% year-on-year and defaults remain low.

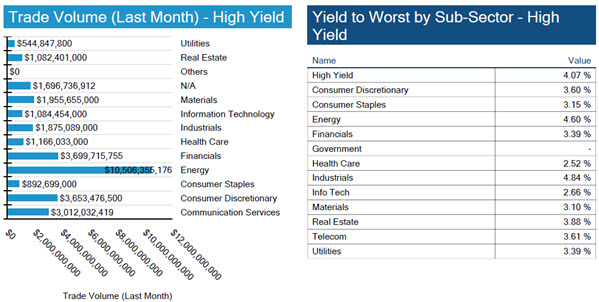

High yield issuance is up YoY

High yield issuance is up 20% year-on-year and the default rate is now below pre-pandemic levels at 3%, compared to 3.3% in Q1 2020.

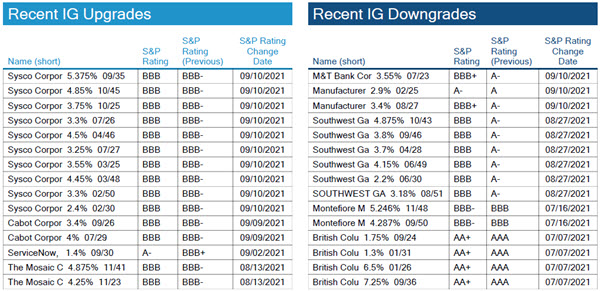

No major S&P rating changes

Not captured in data, but worth mentioning, are reports that Chinese developer Evergrande’s main unit applied Thursday for a trading suspension of its onshore bonds, a move that could take it closer to restructuring or default.

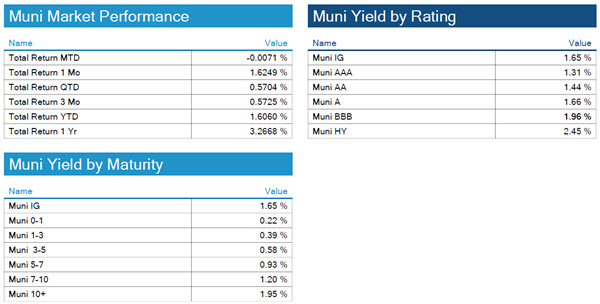

Higher taxes can drive demand, can advanced refunding increase supply?

One of the most consequential items in the Biden package moving through Congress is the reinstatement of the Advanced Refunding Option, eliminated initially as part of the Republicans’ 2017 tax overhaul. This option allowed cities to cut their debt costs and, at one point, accounted for nearly a third of all issuances in the state and local bond market. If passed, it could unlock over $100B in new issues as we move into 2022.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, September 16, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

It is when the market has simultaneous expirations of contracts for stock index futures, stock index options, stock options, and single stock futures. This occurs on the 3rd Friday of March, June, September, and December.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.