The Fixed Income Brief: Strong Earnings, Strong Bid for Treasuries

Fixed Income Trivia Time:

When was the last Olympics held in Japan and where was it?

The main highlights for fixed income investors this week were the Fed meeting on Wednesday and Q2 earnings. On other news fronts, COVID remains negative as companies defer reopening offices and reinstating mask mandates are picking up steam. Infrastructure took a surprisingly positive turn on bipartisan support and the U.S. GDP grew 1.6% in the second quarter.

Jerome Powell took a small victory lap to say the Fed has made progress and that the economy is strengthening. He admitted to near-term inflation risks being skewed to the upside but still transitory. The front end of the curve heard his reiteration that he has no plans in the near future to raise interest rates from the 0-25bps range. Powell did provide clarity on tapering as he expects to start a gradual reduction of the $120bn monthly asset purchase program in early 2022. This can be seen as slightly dovish given other Fed officials were pushing for a start date in 2021. More to come on tapering in the September FOMC meeting.

Tech companies dominated the earnings tape this week as Google had a blowout quarter, Apple crushed street consensus in both revenue and EPS, and Facebook had strong earnings on the back of ad revenue; however, Amazon disappointed as more shoppers head back to the store. Overall, 88% of companies are beating EPS and Q2 was extremely successful.

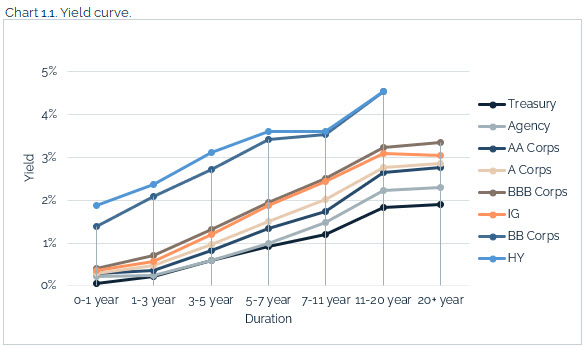

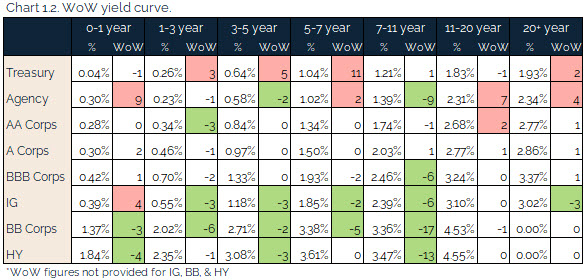

U.S. rates rally as Treasuries see another week of strong bids

The Treasury curve is lower across the board with a slight flattening. The Fed promised to keep rates lower on the short-end and the 30-year ended the week ~3bps tighter, even after tapering comments made by Powell. MarketWatch published an article saying the main reason rates are low is because “Traders don’t see the Fed repeating the 2015-2018 hiking cycle, which brought the policy rate band to 2.25%-2.5% in December 2018.”[1]

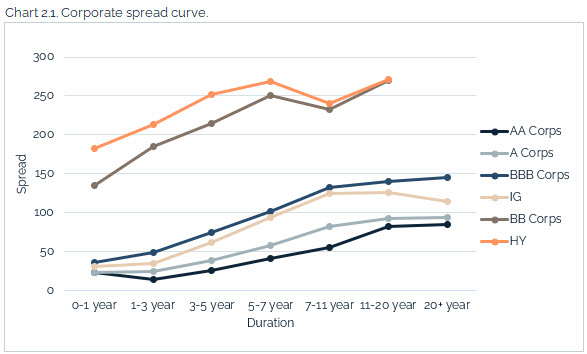

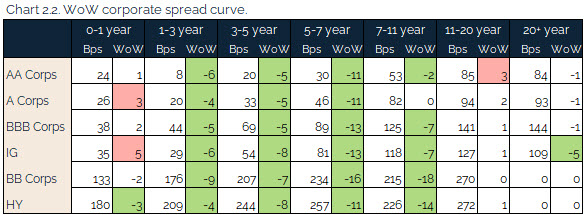

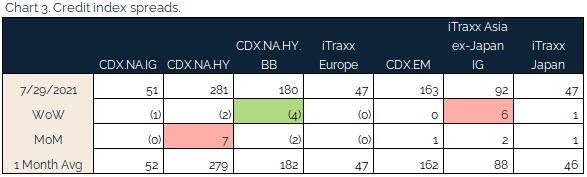

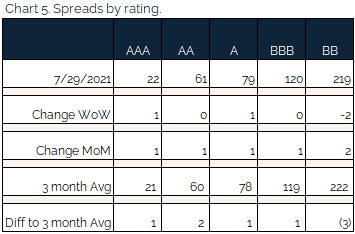

Credit spreads slightly tightened

Reaction to the Fed was fairly muted in the bond market as spreads were largely unchanged. Issuance remains hot in the high yield space and BBs outperformed this week. Expectations are for rising stars to increase as the economy continues to improve.

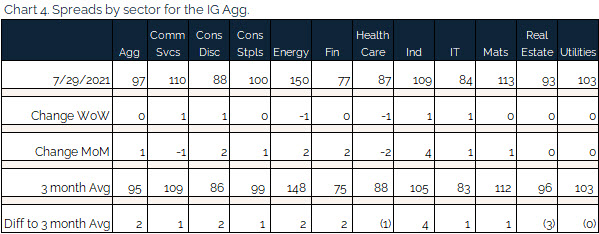

No sub-sector saw any material change this week. Idiosyncratic drivers in credit spread decreases include United Airlines, FirstEnergy, and Avis.

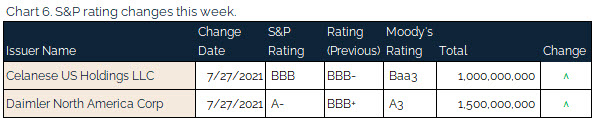

Two upgrades this week to small tranches of debt

No major upgrades or downgrades this week from S&P.

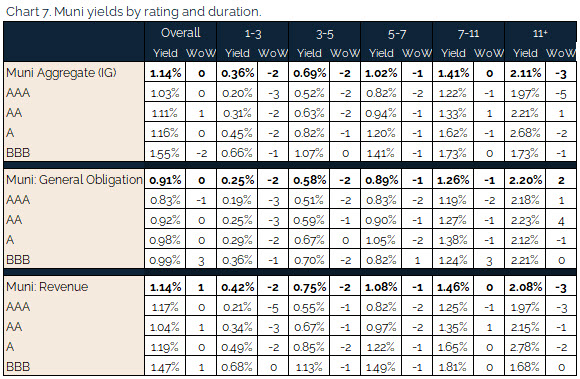

Where have all the cowboys munis gone?

On the taxable side of fixed income, corporates and Treasuries continue to issue record levels of new debt. Municipalities have not needed to issue debt as a lot of their budgets have been covered by federal stimulus. The City of Chicago is cancelling $500mm of debt refinancing for 2021 as the Federal aid package has made it unnecessary. Investors hoped for new issuance this year through expectations of Build America Bonds via the infrastructure bill, but the latest bill had no reference to this type of security. Therefore, it is no surprise that yields moved lower again this week. How quickly will investors shift to taxable investments if demand remains low and yields stay suppressed?

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, July 29, 2021.

Fixed Income Trivia Time:

1998 in Nagano

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

[1] MarketWatch: Here’s why the 10-year yield is so low, and the summer event that could change it, from Bank of America, July 29, 2021.

.