The Fixed Income Brief: Not So Fast

Fixed Income Trivia Time:

How many people have reached the altitude of space? (Hint: there will soon be a couple more)

The change in market sentiment this week put a lot of investors (and this author) off balance. The surprising part this week was not the fact that rates went lower and at the pace they did, but that the basis of that movement seemed so definitive – inflation fears are gone, and growth fears are here. As a fixed income investor with 20-years of experience, I’ve always seen significant moments where market themes shift to address a different paradigm or a separate way of judging future expectations. In this case, investors and strategists will not know the lasting impact these sentiment changes will have until we watch them play out. However, in the near-term, it could redeem the Federal Reserve’s stance to be unconditionally supportive in a time where high inflation and growth seemed inevitable, given the economic backdrop just a couple of weeks ago.

Despite Fed minutes this week starting to lay the groundwork for tapering markets in the medium-term, investors have pivoted from the reflation trade to one of slower growth and tame inflation in the future. The markets are concerned with the delta variant delaying or stopping the world from re-opening, less fiscal stimulus with a smaller U. S. infrastructure bill expected and higher taxes, and an overall sense of less willingness from central banks to provide support in the near/medium term. The reality is that despite recent gains on the employment front, the structural damage may take longer to recover. By then, COVID restrictions could potentially send us back into a more pandemic-like economy once again. All of these suggest investors be more cautious going forward, hence the flight to quality.

U.S. rates drop on the back of Delta variant, growth concerns

Rates ratcheted down this week, with the 10-yr dipping below 1.30% intraday on Thursday. Markets’ growth expectations were lowered on the back of the continued spread of the Delta variant and general acceptance that inflation will indeed be a transitory phenomenon. Given the move in long rates, the 2-10s curve flattened by roughly ~20 bps at one point to +110, a far cry from peak steepness at the end of Q1 2021 at +160.

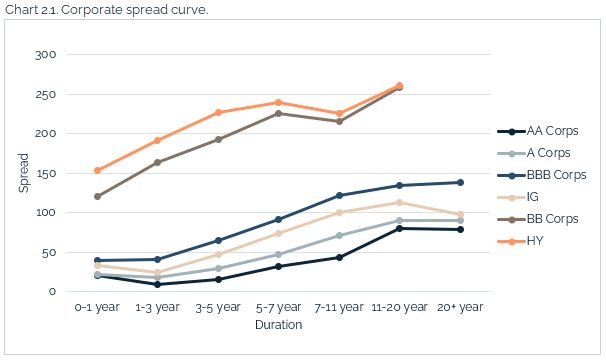

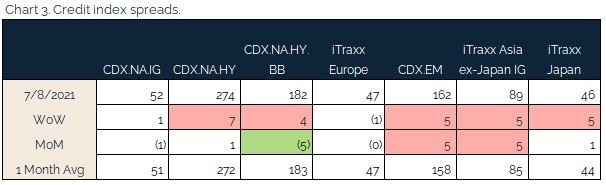

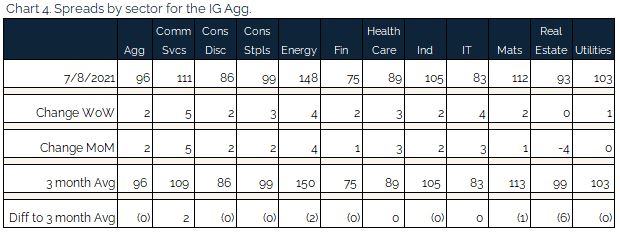

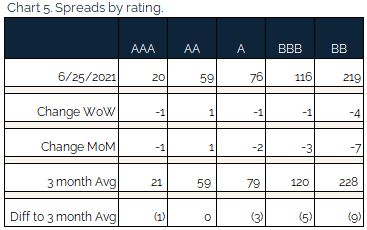

Credit spreads widen and move off tights of the year

According to Moody’s, the long term average corporate bond spread is 95 bps, consistent with last week, and remains 47 bps of the wides over the past 12 months.

Energy underperformed the broad market as oil prices took a large dip mid-week before closing the week on a high note.

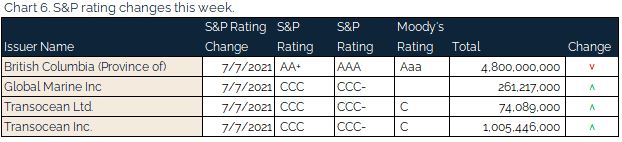

British Columbia’s AAA rating is cut by S&P

S&P downgraded The Province of British Columbia’s debt to AA+ on the back of rising debt and the economic shock from Covid.

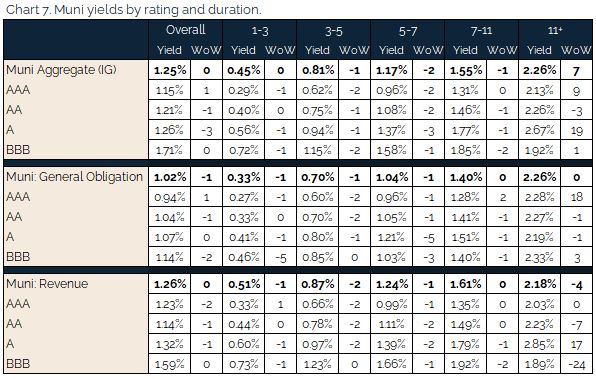

Munis move in-line with Treasuries as credit agencies upgrade debt

Municipal bond yields moved lower across the curve this week, keeping in line with Treasuries. Muni debt saw a lot of reversals from last year, implying credit deterioration from the agencies. The State of Illinois’ was upgraded by Moody’s to Baa2 on improved state financing and federal aid. In addition, S&P has raised the outlook on 400 bn and upgraded ~40 bn this year. This is almost a complete reversal from the negative outlooks and downgrades from 2020. Finally, Muni bond inflows keep smashing records in 2021.

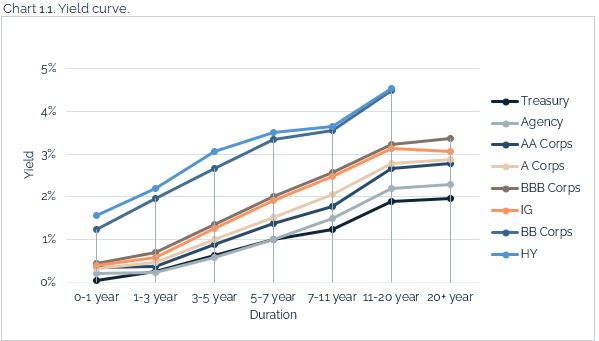

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, July 8, 2021.

Fixed Income Trivia Time:

562 people have reached the altitude of space according to the American definition. 24 people have traveled beyond low Earth orbit and either circled, orbited, or walked on the Moon.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.