The Fixed Income Brief: Whites of Their Eyes

Fixed Income Trivia Time:

What year was the highest ever 10-year Treasury note auction offering amount?

a. 2009

b. 2018

c. 2020

d. 2021

Investors sent interest rates lower this week on the back of believing the Fed’s message that their $120bn of bond buying and zero-interest-rate-policy (ZIRP) will stay in place despite finally seeing inflation figures break well-through their stated inflation target of 2.0%. The message is clear in that the FOMC members are in complete lockstep on doing nothing as a policy for the foreseeable future. The Fed PR machine has been hard at work preparing the market for inflation figures that were bound to be alarming given year-over-year comparisons and the temporary items we have discussed here in recent weeks. Risk markets are also cheering the do-nothing policy by keeping spreads low and equity markets setting new highs several weeks in a row. The risk is that inflation stays elevated and seeps into inflation expectations going forward and no amount of Fed jawboning can stop the rise, and therefore, they have to act prematurely. The true test will come this summer as inflation lingers and consumers continue to feel the impact in their wallets.

The main economic release did not disappoint news outlets as May’s headline CPI report showed an uptick of +5.0% (+4.2% in April) and core prices that strip out energy and food were up +3.8% vs. 3.4% expected. Positive data around the employment picture continued with a jump in the JOLTS figure increasing to 9.286 million, up +1 million from March; additionally, continuing claims (3,499k vs. 3,602k exp.) and weekly initial jobless claims (376k vs. 405k last week) are trending lower towards pre-pandemic levels. Lastly, Michigan Consumer Sentiment for June improved to 86.4 (vs. 84.0 exp.) and +3 points higher than May’s survey. Next week, the main focus will be the much-anticipated Fed meeting on Wednesday with a Q&A news conference and the release of the prior Fed minutes. Also, we will get retail sales, industrial production, building permits, and U.S. Producer Price Index which is expected to surpass May’s release of +6.2%.

Inflation is only temporary

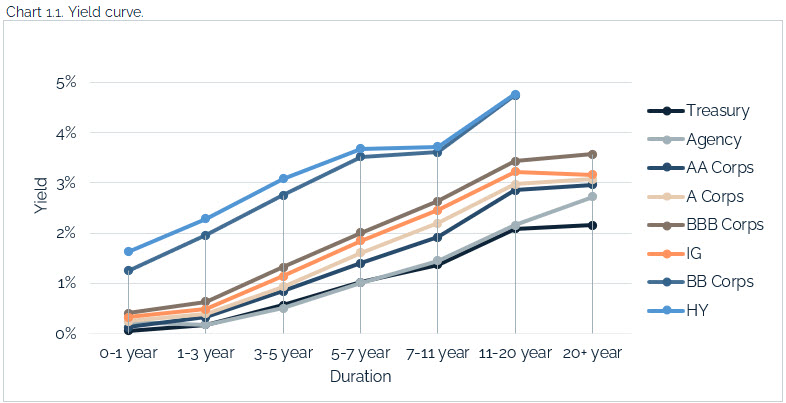

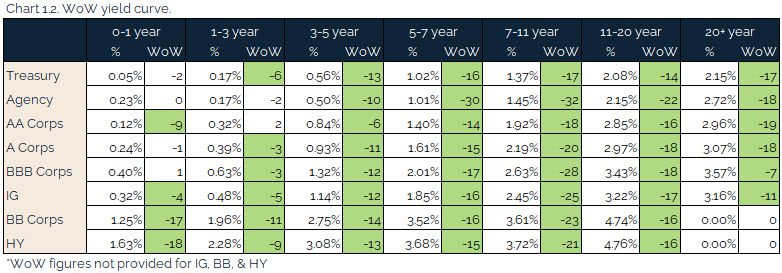

Rates tighten WoW as the market seems to collectively agree with the Fed that inflation will only be temporary, and not a long-term concern that can derail a market rally.

Credit spreads benefit from market optimism

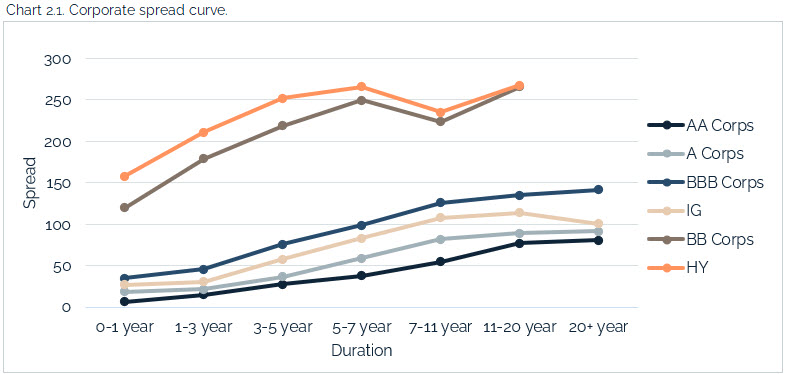

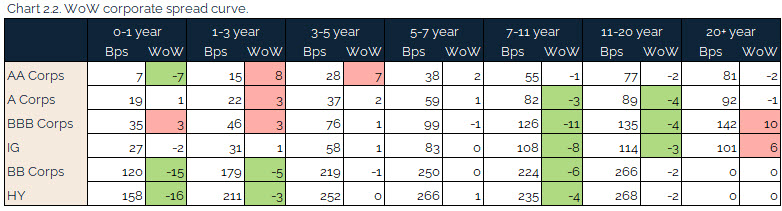

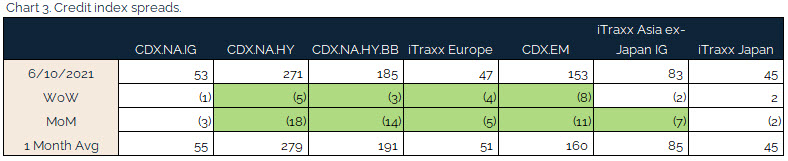

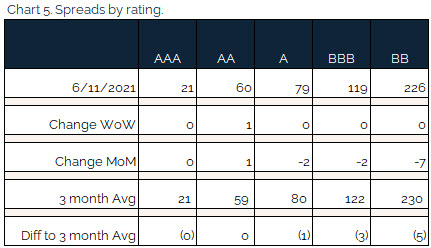

Investors are optimistic that markets are ready to move higher and spreads move tighter on the week. CDX NA IG ends 1bp tighter, while HY is 5bps tighter. As compared to early May when inflation concerns were on everyone’s mind, the consensus view is that inflation will not be a factor and a large contributor to the tightening MoM.

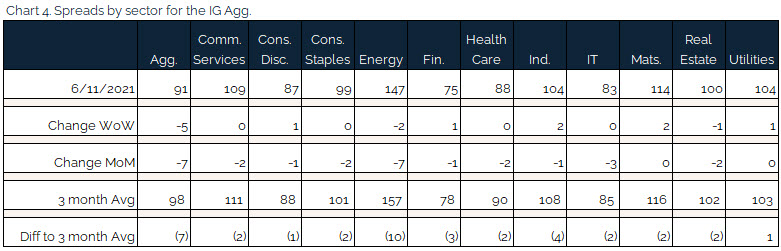

Energy continues to outperform the market on the back of demand expectations. Crude is up 2.5% WoW and IG energy sector is 2bps tighter; MoM crude is up 8.5% while IG energy credit spreads are 7bps tighter.

“Alexa – what is Amazon’s credit spread?”

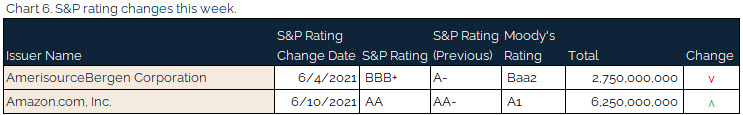

S&P upgraded Amazons unsecured senior lien bonds this week as Amazon is taking over the world.

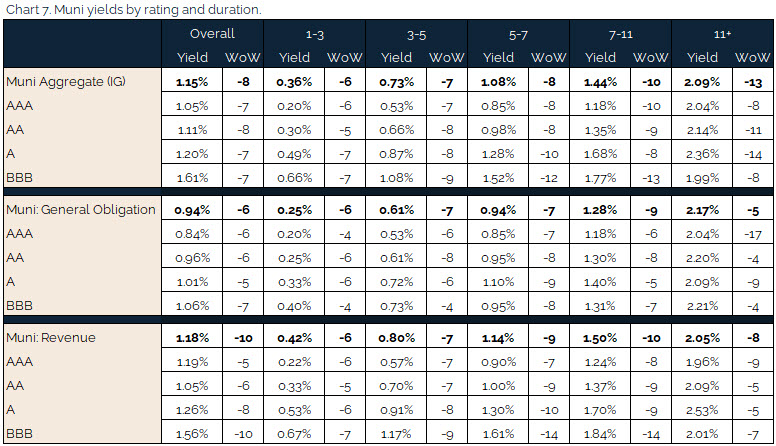

Muni yields lower, outperform in the front-end but underperform out the curve

Municipal investors saw lower bond yields across the curve, with a bull steepening of the curve as longer-dated bonds outperformed. The move was triggered less on pure muni sentiment, although the positive momentum remains well intact, but more on the back of U.S. Treasury yields. Outlines of the Federal infrastructure plan bodes well for muni performance going forward due to much less expected supply; however, it will also wreak havoc on investors that are expected to be increasing their needs to find tax-exempt paper.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, June 10, 2021.

Fixed Income Trivia Time:

c. 2020 – $41 billion on Nov. 10, 2020

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.