The Fixed Income Brief: CPI – Peak or Pop?

Guest economic analysis and muni commentary: David Loesch

Fixed Income Trivia Time:

U.S. inflation hit 8.6% in May: Energy, groceries, and shelter costs drive fastest rise in consumer-price index since December 1981. What was the #1 hit song on the Top 40 Singles on Dec. 12, 1981?

Hint: The second season of a drama series related to fitness classes in LA with the same title was just released on Apple+ last week.

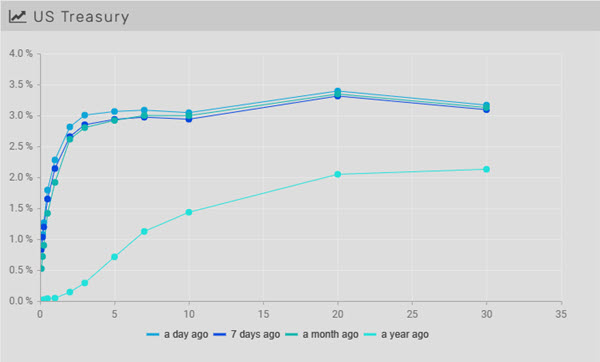

This week, waning confidence and flight to quality was offset by Friday’s elevated CPI print, sending yields higher with significant curve flattening. So, lots of moving parts as we head into FOMC meeting week where a +50bps hike is fully anticipated on Wednesday.

Fortunately for our readers, we have partnered with DRL Group’s David Loesch to provide his recent insights into the municipal market:

- The University of Michigan’s widely-followed Consumer Confidence Index continues to decline and is currently at its lowest since 2011. The last time the consumer confidence level was this low was when the unemployment rate was 9%. I believe this number is due to the weight of inflation, not jobs, and will not rebound until we see CPI numbers come down.

- Columbia Threadneedle is the latest firm to share with the street that they are buyers of longer-dated munis as they believe inflation has peaked along with yields. They indicated yesterday that pricing would likely stabilize and possibly rise as the year progresses. They also think the higher yields on the longer-term bonds will probably be a boon in the coming months and expect a flatter curve as the FED tightens monetary policy.

- Reports indicate that the FED could have monthly losses in early 2023 if the current interest rate hike pricing is realized. Bloomberg calculates that the FED’s net interest income and total net income may dip into negative territory if the central bank raises the FED Funds target rate above 2.75%. This indicates that moving the FED Funds rate too high will negatively impact the U.S. Treasury Department’s balance sheet. This point goes back to the opinion we have discussed that rates cannot go “too high” from a Treasury’s affordability standpoint.

- Reports this week show that mortgage demand has fallen to the lowest level in 22 years. Applications fell 7%, 21% lower than a year ago. These numbers have a direct correlation to the rate moves we have seen.

- Bank of America strategists and asset managers said they are buying high-grade munis to offset the risks of a recession in upcoming years. BOA indicated they continue to advocate munis, focusing on higher-grade securities, while the FED delivers more hikes and the economy slows. They also said that investors should be more selective regarding high-yield paper.

- Goldman Sachs said the U.S. economy is still on a narrow path to a soft landing. Improved inflation figures and other factors suggest the FED can pull off its aggressive interest rate hike plan without tipping the U.S. into a recession. This thought is a slight deviation from what their chairman indicated earlier. Supply chain flow weighs heavy on the soft-landing issue. It will be a difficult balance to not tip into a recession; however, it can be avoided.

- New-issue sales of municipal debt due within 18 months are at $5.1B to date, down 41% from the same period last year and the lowest total since 2013. Even with a summer bump, total new-issue sales for this year are not expected to surpass 2019 or 2020 levels; there is simply no need. At the end of last year, the short-term data was less about cash flow borrowing and more about Bond Anticipation Notes (BANs). Concerns about higher rates pushed municipalities to issue paper out long instead of short. These factors should continue to help our markets as we move through the year.

Rates end the week at their highs on headline CPI print

After a relatively calm trading week, rates shifted higher on the back of the latest CPI print. The most significant move came from the 2yr (3.05%), which shot up +25bps on Friday alone and ultimately settled +38bps higher WoW. Despite moving +20bps higher WoW, the 10yr (3.15%) could not keep up, ultimately causing the 2s-10s spread to flatten by -18bps to end ~+10bps. The 5s-30s curve inverted this week as the 30yr (3.19%) was only up +8bps and the 5yr (3.25%) rose +31bps WoW.

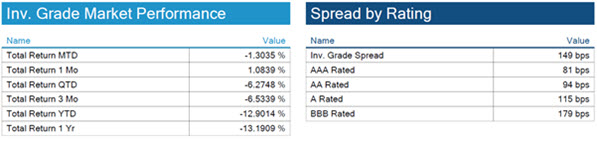

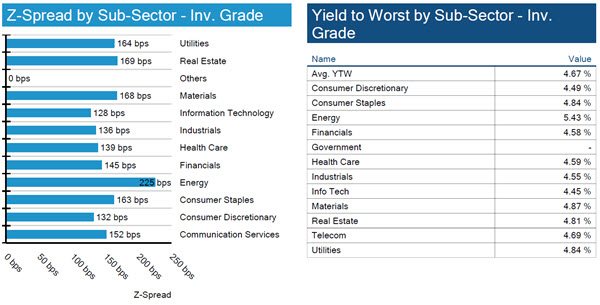

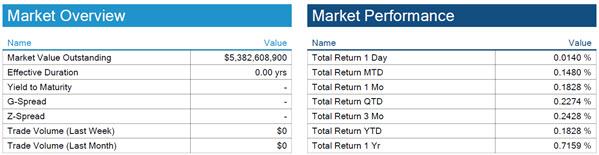

IG spreads relatively unchanged

Spreads widened slightly WoW (+2bps) through Thursday as calmer sentiment prevailed headed into the CPI print on Friday. Spread moves in consumer discretionary (+14bps) and healthcare (+8bps) underperformed the rest of the IG credit space and energy (-9bps) and consumer staples (-8bps) were the notable outperformers as commodities and food prices push higher. In general, MoM spreads are roughly -10% tighter (-17bps) since mid-May, moving to +149bps from +166bps over the period.

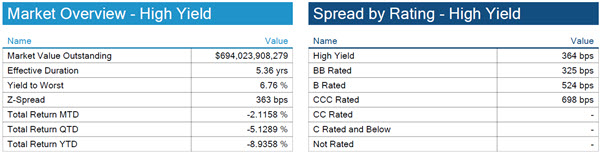

Spread widening in HY WoW, but slightly better MoM

High yield corporate bond spreads widened ~+25bps, but remain tighter MoM (-15bps) as investors remain comfortable with credit fundamentals despite the increased probability of a near-term recession.

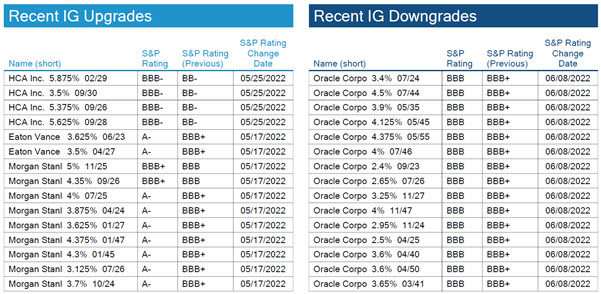

Morgan Stanley, Easton Vance, and HCA upgraded while Oracle notched down

S&P upgraded Morgan and Eaton to A- from BBB+ and moved healthcare provider HCA into IG space to BBB-. Additionally, it downgraded Oracle one notch to BBB on the back of Cerner acquisition.

Demand in high quality bonds bolsters munis

More about David Loesch, Owner of DRL Group

David has specialized in fixed income trading since 1994, covering all areas of the bond markets. David deals with everything from defaulted issues to AAA bonds to tax-exempt and taxable bonds. David is constantly collaborating with other dealers in the marketplace bidding on issues and making markets in certain securities. David not only deals with the large institutional accounts on fixed income transactions, but also has a large retail client base that gives a good insight on what the markets are looking for and how the retail world looks at current events in addition to how it affects them on a personal level.

Explore the DRL Group, specialists in bonds, primarily tax-free bonds.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, June 9, 2022.

Fixed Income Trivia Time:

“Physical” by Olivia Newton John (MCA) was at #1 for 4-weeks at this point and remained #1 for 10 weeks.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.