The Fixed Income Brief: Stair Master

Guest economic analysis and muni commentary: John Hallacy

Fixed Income Trivia Time:

Why are barns traditionally painted red?

—————–

From John Hallacy:

The Fed decision yesterday provided us a well-appreciated rally in equities in the relief mode. Today, that modicum of good sentiment was taken away in the market action. All of us may point to many competing factors and indicators as plausible causes.

I believe that this is a time that Shakespeare would have loved and would have exploited in his timeless body of work. He employed juxtaposition to its utmost irony. I searched for an apt quote that would fit this time, and I believe I have found it.

Shakespeare wrote: “He jests at scars that never felt a wound.” We certainly are feeling the wound now.

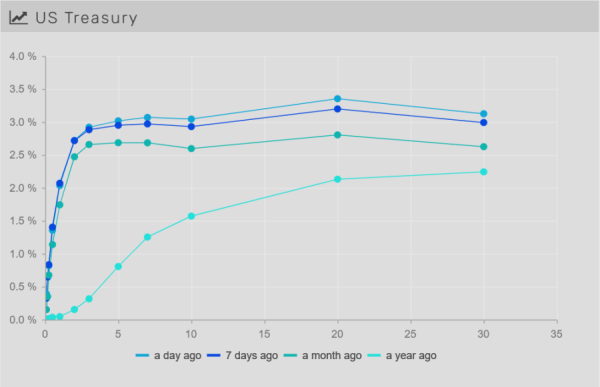

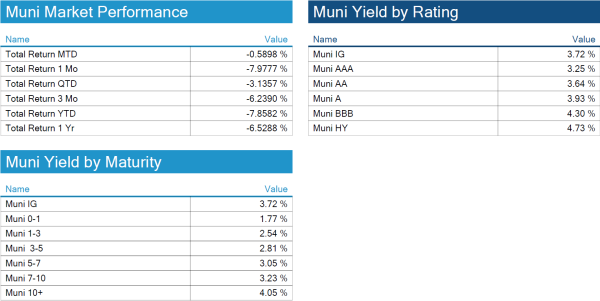

The 10yr Treasury is now holding above 3% and, as of this writing, is at 3.08%. What is more noteworthy is just how flat the curve has become. The 5yr is at 3.03%, and the 30yr is at 3.18%. The shape of the curve is the primary reason we recommended staying relatively short on maturities at this time. What has changed since my guest contribution last week is the shortest end of the curve has steepened measurably. So, we posit, does it make sense to extend from 10 years to 30 years to pick up 10bps? Methinks not.

The Chairman removed a 75bps hike from the range of possibilities in the near term and offered that 50bps will be the lead for the next several meetings. The balance sheet roll-off of assets will really kick off in earnest in the near term as well. It feels as if the next recalibration will happen in the fall.

In all of this, we continue to be concerned about the course of the “real” economy. The juxtaposition at present is that the real economy is in relatively good condition. However, some warning signs have begun to surface. Labor productivity declined by a large -7.4%, and unit labor costs surged over 11%.

Energy, financials, and consumer discretionary continue to lead the activity. The jobs report on Friday at +428,000 remains strong, and the unemployment rate is unchanged. The strength of the labor market is reinforced by reports that many recent retirees are returning to work.

Few pundits have stated that a potential recession is just around the corner, but the concerns are growing. We have just largely completed the quarterly earnings cycle, and most companies were successful in surpassing their targets. The next round of earnings may be a bit more prone to the lockdowns in China and to increasing supply chain issues. Given the war in Ukraine is not likely to proceed to a cease fire any time soon, the elevated energy prices will remain. Energy is always a key input. Some production may ramp up, but the process takes precious time.

The higher rates will certainly raise the profile of fixed income in this market. But no investor willingly selects fixed income to be whipsawed by rising rates. Except for the professional trader, most would be looking to fixed income as a safe harbor if it is on the shorter side.

The 10yr says it all this week… from calm to concern

The FOMC press conference on Wednesday put many investors at ease as the 10yr had been creeping higher going into the meeting. The following two days were a different story as many investors challenged the view that the FOMC can thread the needle here in trying to bring down inflation without slowing growth down too much. Despite this, the 10yr has risen to its highest level since November 2018 as investors are trying to digest corporate bond supply and grapple with future rate expectations. The 10yr is currently 3.11%.

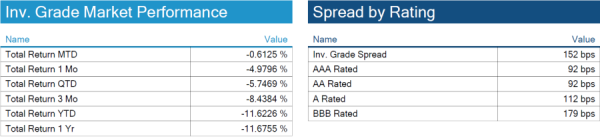

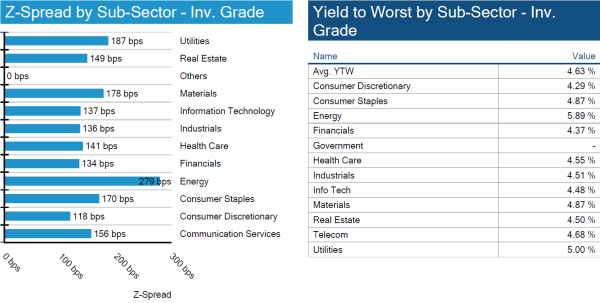

IG spreads end the week flat

Spreads tightened and then widened back to flat for the week. Equities lowered more significantly on the week and are now underperforming IG bonds on the year by ~3%. The IG market has reduced interest rate volatility as the IG duration average is a half a year shorter (7.46 years) from the end of 2021.

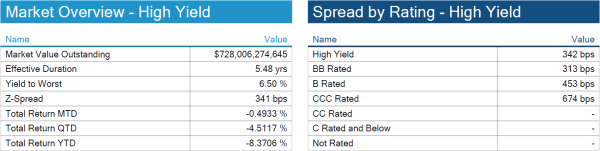

High yield spreads widen ~10bps

High yield corporate bonds continue to sell-off while volatility remains steady. The default rate has stayed steady over the past couple months even as recession risks and spreads move higher.

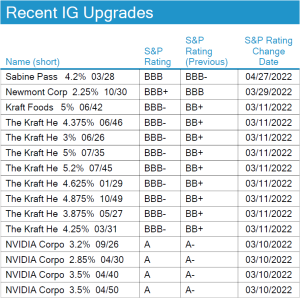

No S&P credit changes on week

No changes to investment grade credit ratings. Upgrades still outnumber downgrades on the year.

John Hallacy: Needy Reed Creek

I have worked on many special district bonds over the course of my career. One of the attractions of this sector in the municipal market has been to pick up some yield without taking on a greatly elevated level of risk. The yield differentiation has made the sector a favorite for bond insurers.

The Texas MUDs (Municipal Utility Districts) have a sound record over time. Some have had restructurings but over the longer haul have worked out. Some states have structures that are a bit more challenging from a credit perspective, but even those work in the end.

In my early days in the market, a special district I never envisioned having any difficulty would have been Reedy Creek. I worked on the district for years when I was at the prominent underwriter. What baffles me about this case is that legislators make changes without providing for the disposition of outstanding debt. We have seen such oversights in other cases, so this case is not precedent setting.

Now, there is some time before the change goes fully into effect, but can the debt wait? One billion of bonds outstanding is not an amount that can be ignored in a frugal state such as Florida. I believe that the bonds are widely held. There is time for a plan, but we anxiously await the details.

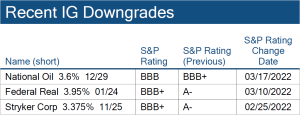

Given all the volatility in the broader markets, one would think that municipals would follow suit. However, spreads and levels in municipals have not changed all that much given what has transpired. The 10yr and the 30yr are up 3bps in yield each. Outflows have persisted with a $2.7 billion outflow this week.

The good news about the Illinois upgrade has not affected the trading range at this point. The spreads continue to be staying in a narrow range. We would expect these levels to drift lower over time and will reward those who participated in the paper earlier.

I do believe higher yields will present some opportunities. But as always with the higher yields, we should be forewarned that we do not lose sight of the fundamentals and just accede to the market sentiment. It is incumbent to consider sectors that are out of favor or ones that have not shared the spotlight but are steady performers in this environment. Water and sewer bonds come readily to mind but there are others out there.

More about John Hallacy

John is an accomplished municipal and fixed income analyst, respected and recognized by the industry with over 35 years of experience at major financial firms including S&P’s Global Ratings, FGIC, Bond Investors Guaranty, Merrill Lynch, MBIA, Bank of America, Assured Guaranty, and most recently The Bond Buyer. A leading expert in state and local fiscal affairs. John’s experience includes ratings, insurance, public finance and sell side research.

Want more from John Hallacy? Check out his recent guest post on larger muni market trends here.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, May 5, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

Many farms used rust as a sealant which turned paint red. Eventually, the red barn trend caught on, and farmers opted for red paint, nodding to tradition

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.