The Fixed Income Brief: The Everchanging Dot-Plot

Fixed Income Trivia Time:

“The hawk will never die” – which Philadelphia university’s slogan is this? Hint: Its head coach did not retire this week

Make sure to tune in next week as John Hallacy joins us for a series of commentary on muni markets right here in The Fixed Income Brief!

Want more from John? Check out a guest blog post he shared with IMTC on key muni market developments affecting fixed income investors now.

—————–

The main story for the week (and year) is the hawkish Fed. Jerome Powell suggested on Thursday that the “central bank would be move more aggressively to curb inflation.” This confirms that, at the very least, there will be a 50bps hike in interest rates. Volatility in both the fixed income and equity markets have increased because of the war in Ukraine and the Fed’s signaling of being more aggressive with hikes in the short-term due to inflation and labor markets. The more “aggressive” dialogue from the Fed isn’t too surprising, as the bigger surprise came from the ECB, which now has two hikes priced in by September. Next week, the market will have more earnings and inflation numbers to digest, but the double hike should now be priced into the equity market.

The recent yield curve movements are increasing the probability of recession. A Goldman Sachs analyst has a chance of recession at 35% over the next two year, and Moody’s model has it at 20% over the next 12 months. Additional factors to take into the models are consumer confidence, supply chain, and Q1 earnings. Consumer confidence has weakened recently, which normally comes with commentary around an inverted yield curve. The increase of mortgage rates is expected to drive confidence lower, which according to Freddie Mac, are at 5.11% for a 30 year fixed mortgage.

Supply chain issues continue to drive higher inflation, but they also reduce supply in all sectors. A good indication of supply chains woes is in the homebuilders’ sector, where retail completion projects fell by over 2% in Q1. This is the third decline over the past year.

Earnings have been stronger than expected and should be a stabilizer for equities. The idiosyncratic names worth mentioning are Netflix, SNAP, and GAP, which have all sold off significantly post-earnings. The big tech names will release next week.

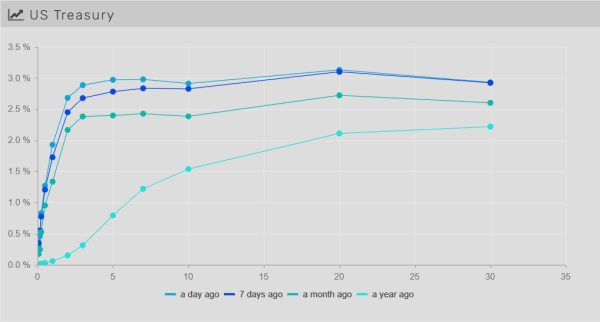

Rates sell off and curve flattens on the week

Even though the curve is no longer inverted, it did flatten this week. The 2’s10’s spreads are extremely thin and volatile, currently at ~20 bps, with the large increase in two year yields this week that shadowed the move higher in the 10-year. The 10-year is now close to its three-year high at ~2.95%.

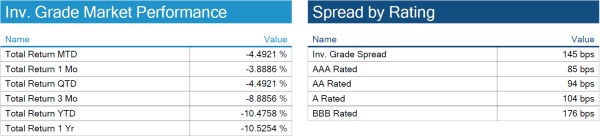

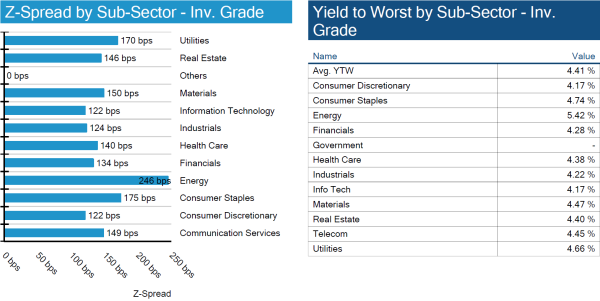

Spreads widen as rate movements increase volatility

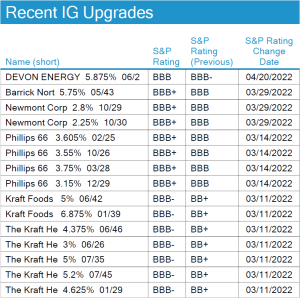

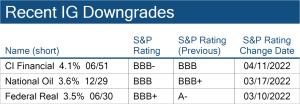

Spreads widened WoW by ~5bps. Issuance has not slowed down even in the face of spreads and rates as credit ratings are positive. Upgrades are outweighing downgrades and default probabilities remain at 2 year lows.

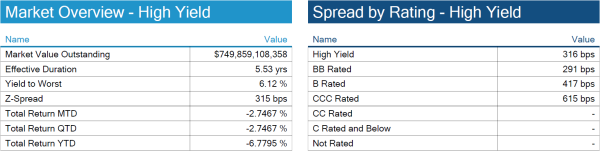

High yield spreads widen ~25 bps

High yield corporate bonds continue to sell off on 2022, which is both an indicator and a result of heightened recession risk. As Moody’s notes this week, spreads have widened 74bps on the year, but spreads are still historically low, and the analytics firm does not see an impact on issuance or any significant moves wider in the short term.

No S&P credit changes on week

No changes to investment grade credit ratings.

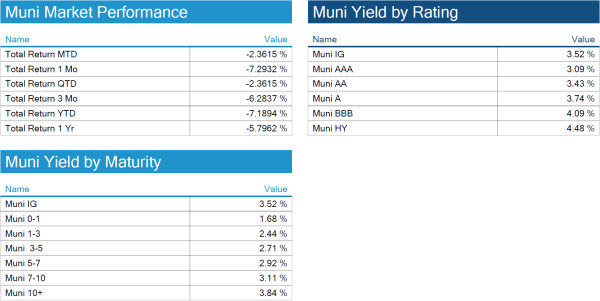

Municipal outflows continue on week

Muni mutual funds are still experiencing outflows, according to a recent survey by Hilltop Securities, 76% of analysts expect this trend to continue. The one positive to expected returns are that new issuance is down, specifically the issuance of shorter-dated maturities. Also, in higher tax states, a win for munis came from a ruling by the Supreme Court which rejected a constitutional challenge by New York state referring to the SALT tax.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, April 21, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

St. Joe’s University

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.