The Fixed Income Brief: Yields March(ing) Higher

Fixed Income Trivia Time: What team was the lowest seed to ever win the national championship?

Fed Chairman Jerome Powell doubled down on support for the economy this week. On the back of this week’s FOMC meeting, where 10-year yields moved higher in response to the upgraded economic forecasts, Chairman Powell published an op-ed piece in the Wall Street Journal. He reaffirmed the Fed’s commitment to hold emergency support for an extended period of time. Powell said things had “much improved…but the recovery is far from complete, so at the Fed we will continue to provide the economy with the support that it needs for as long as it takes.” As he has stated since the beginning of the pandemic, he is justifying the extraordinary support for the economy based on getting people back to work; he reiterated that this pandemic has hit the lower-income class much harder and that the Fed’s continued support measures of near-zero interest rates and $120bn of monthly open market purchases will stay in place until the economy reaches full employment for all-level workers.

Markets were watching the FOMC members’ dot plot projections closely in anticipation that the Fed might react to the recent improvement in economic growth and expectations of higher inflation. Market-based measures of inflation point to a rate of +2.6% in five years, the highest level of the breakeven rate in nearly 13 years. Given these views in the market, it looks like Powell took it upon himself to try and adjust the narrative before long rates move out of reach of bringing them back down. It will be interesting to see how long the Fed can contain fixed income investors from moving rates higher if the data continues to improve and the anticipated supply becomes too much to digest over the next few months. Stay tuned.

Rates march higher with +30bps move on the long end MTD

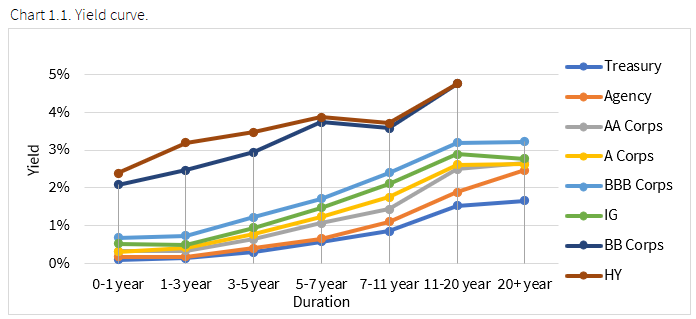

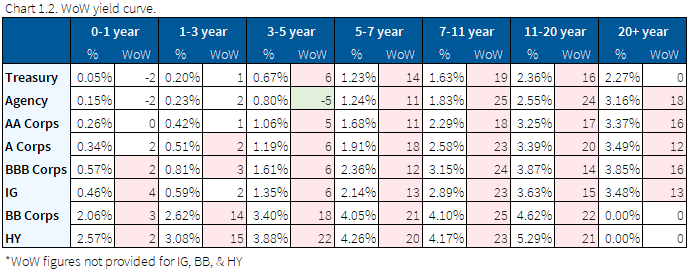

Rates on the long part of the curve were up +10bps WoW and are back to January 2020 pre-pandemic levels at this point with the Fed keeping front-end rates close to zero. The yield curve continues to steepen and 2’s-10’s are now +155bps, roughly +70bps steeper on the year. Looking back at the yield curve going back to the last three U.S. recessions (1991, 2001, and 2009) it shows that the minimum period of steepening following a recovery was eight months with an average steepening period of ~18 months. Food for thought.

HY spreads widen, IG ends the week flat

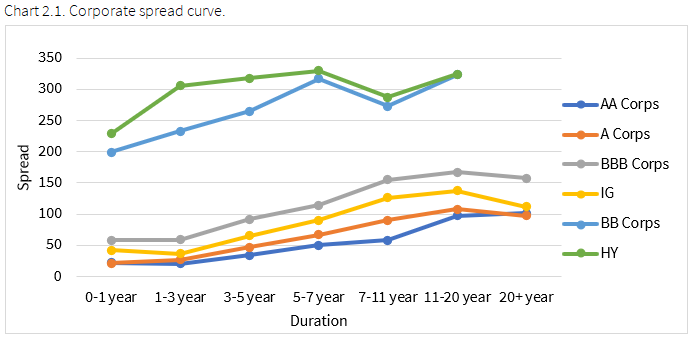

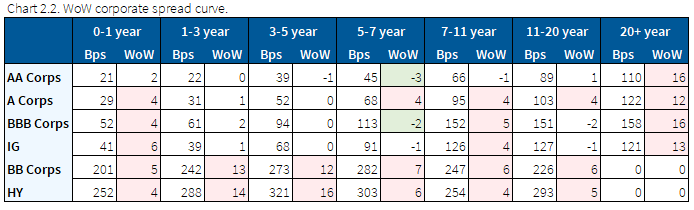

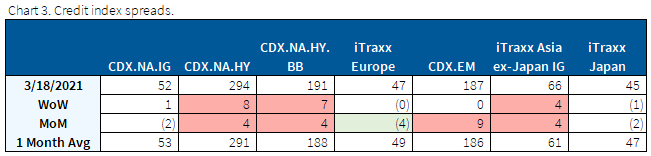

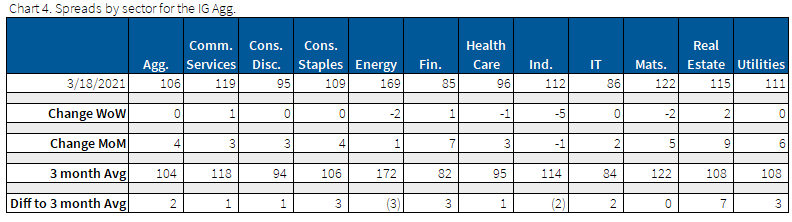

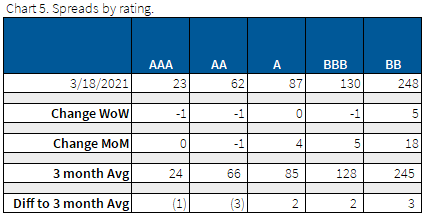

Credit indices widen this week, driving HY wider MoM. The selloff in Treasuries has spilled into corporate bonds, as investors harvest losses and expectations for rising rates get priced into the market. As the cost of borrowing moves higher, HY sees the larger selloff.

Average yields for IG bonds move to ~2.30%, up 20bps since February and up 50bps from the beginning of the year.

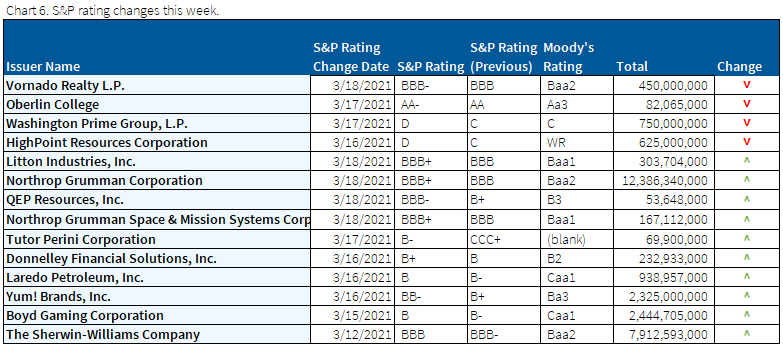

Upgrades outweigh downgrades for 2nd straight week

Northrop Grumman sees positive credit bump to BBB+ from S&P and Fitch revises outlook from stable to positive.

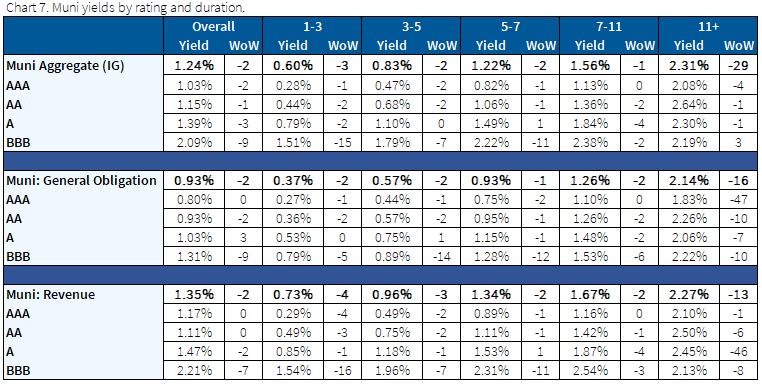

Muni yields higher but still viewed as a safe haven given technicals

The muni sector is being viewed as somewhat of a safe haven from additional rate rises or at least the area within fixed income which will likely be most shielded from higher yields. This is all predicated on the significant supply / demand imbalance; more investors are seeking tax-exempt income in the face of future tax increases and supply is not enough to satisfy the flow of funds into the sector at this point.

Moody’s raised their outlook on U.S. airport debt from negative to stable on the expectation that more travelers will fly amid the declining COVID case counts. The market is recognizing a positive fundamental shift as certain sector activity starts returning to more normal levels and we likely see more upgrades reversing some of the early-pandemic rating downgrades.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Mar. 18, 2021.

Fixed Income Trivia Time Answer: The 1985 Villanova Wildcats at the #8 seed

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.