The Fixed Income Brief: How Do You Spell Relief?

Fixed Income Trivia Time: How many RIAs are there in the U.S.?

Equity markets have closed at new all-time highs, on the back of both stimulus and better than expected weekly jobless claims. It is not news to anyone that the ~$1.9 trillion stimulus bill will have large implications on both the economy and the bond market. The $1.9 trillion package is close to 8.5% of GDP and expectations are that $1.1 trillion of it (4.9% of GDP) will be disbursed in some capacity this year. When looking at the economy, the stimulus checks will drive growth primarily in Q2 2021, but additional stimulus will come in 2022 and potentially cushion any large YoY swings. Investors expect to see job growth to pick-up, specifically in the second half of the year as states re-open the economy. This should drive to a lower unemployment rate and investor expectations are for pre-pandemic unemployment levels by as early as next year.

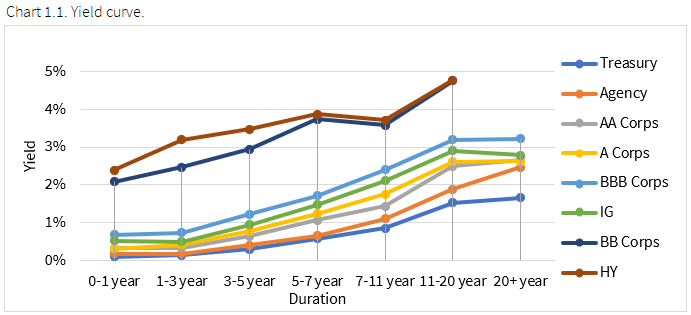

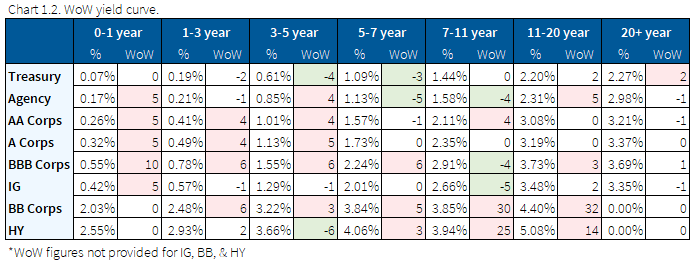

2’s-30’s steepen ~50bps from early February

The yield curve continues to steepen and 2’s-10’s are 60bps steeper on the year. Obviously, the steepening of the yield curve brings the conversation of when the Fed will hike rates again. As of this week, the market has started to price in the first FOMC hike to Q1 2023. The highly anticipated Fed meeting on March 16-17 will highlight their outlook and reemphasize what will be needed from the economy and inflation to warrant an interest rate hike in 2023.

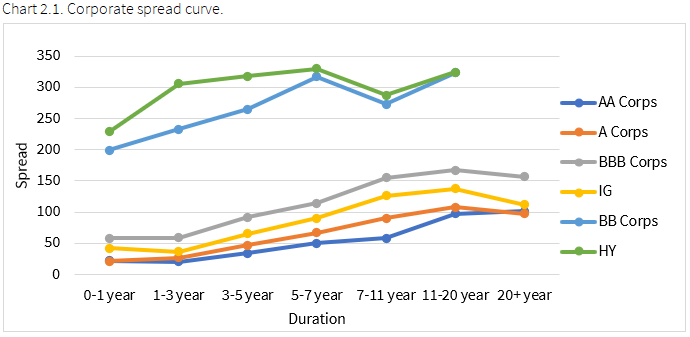

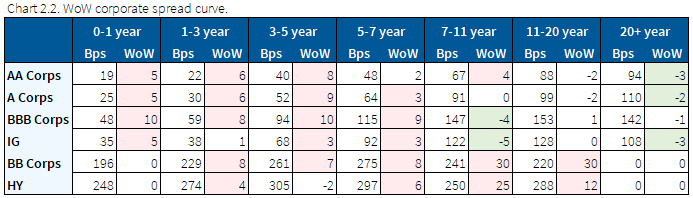

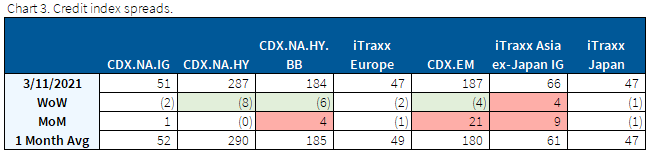

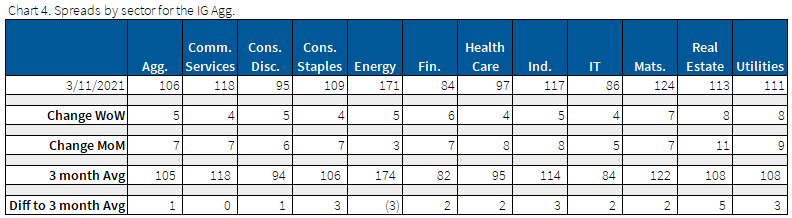

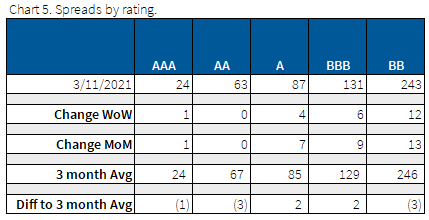

Credit spreads tighten as bond spreads end flat

Credit indices tighten in line with equities and GDP growth expectations. Bond spreads sell off earlier in the week and then tighten to end the week about flat. Bond spreads are not fully insulated from inflation expectations and total returns can remain negative. High yield has outperformed investment grade throughout 2021; it will be interesting to see how this latest rally in HY and energy names plays out in the primary market.

As per Moody’s, positive outlook for corporate earnings favors narrower credit spreads.

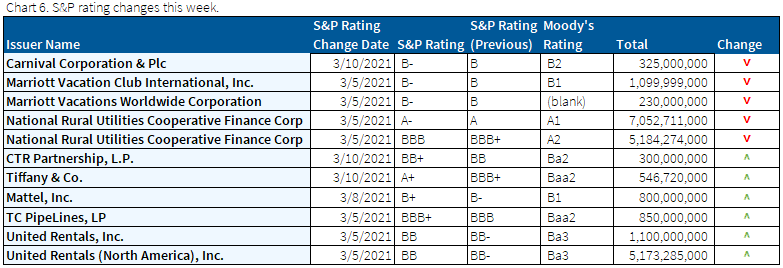

Nat Rural sees $12bn of debt downgraded

S&P had a busy week of both upgrades and downgrades. S&P issued a downgrade to National Rural’s secured and unsecured debt, revising its outlook to negative. This is based on the potential for elevated credit stress for electric utilities operating in Texas following last month’s winter storm that resulted in blackouts and unprecedented power costs.

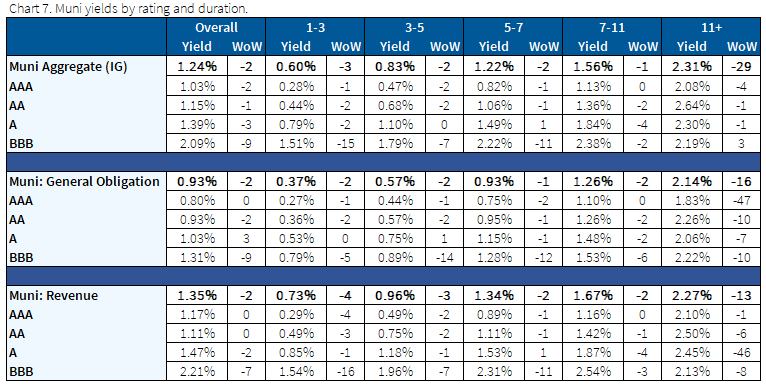

Muni yields tighten after two week selloff

$350-500bn of the stimulus package is earmarked for state and local governments. State budgets have already been finalized for the year so expectations for additional spending from the stimulus are more likely relevant in 2022. Muni investors believe this will greatly diminish new supply for 2021 and 2022 and as a result, spreads in munis tightened on the back of the news.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Mar. 11, 2021.

Fixed Income Trivia Time Answer: ~13,000

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.