The Fixed Income Brief: “V” for Volatility

Fixed Income Trivia Time:

What are the three largest Russian exports to the United States? Hint: Vodka isn’t one of them

—————–

Markets remain on edge this week with continued sell-offs on the back of Russia-Ukraine escalation. The global attack on the Russian economy continues to escalate as both sovereign nations and global companies increase their suspensions of Russian sales and services. The sanctions against Russia are unprecedented and will certainly have a spill-over effect on the global economy and are cited as the primary driver of the market sell-off, especially in the Eurozone.

In this light, the Fed has been tasked with handling an even murkier situation. The conflict and sanctions will certainly affect the supply chain and drive inflation higher, but how do you also combat the market sell-off? During Powell’s speech this week, he made it clear that he expected a 25bp hike (lowering expectations from 50bps), and this was before the final monthly employment report’s release. The jobless rate decreased on the back of strong hiring in February as 678K jobs were created in the month. The unemployment rate at 3.8% (down from 4.0%) was below the economists’ expectations of 3.9%. With this encouraging print, it should be a foregone conclusion of a 25bp hike as the economy continues to show signs of strengthening.

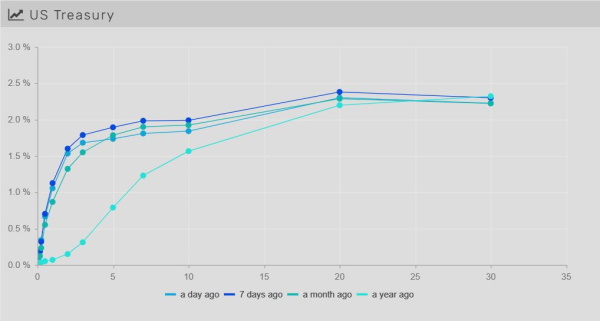

Huge rate swings, curve ends flatter and lower

The ten-year started the week at 1.91%, touched a low on Tuesday at 1.70%, before spiking back up to a Thursday high of 1.89%, ultimately selling off to end the week around ~1.71%. The Fed will be hiking 25bps in March and we should expect less volatility in the front of the curve, but there are already calls for the 2’s, 10’s to invert by the summer.

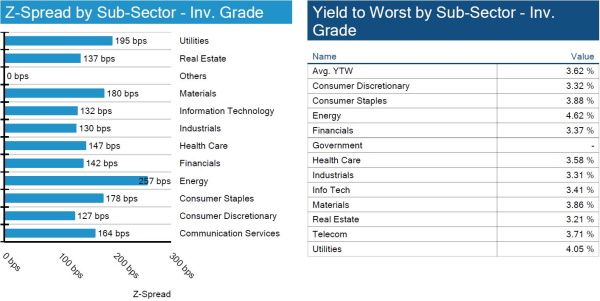

Risk off continues

Spreads widened ~7bps this week, creating a new 12-month wide. With rates whipsawing and increased volatility, it will be interesting to see where spreads settle. Corporate profit margins have been strong, and we’ll look for this to continue as lending from banks remains strong.

High yield spreads could finally slow down issuance

HY spreads widen ~7bps this week. There have been larger spread swings intra-week on changing energy prices, but the silver lining continues to be a low default rate. Idiosyncratic drivers on the weeks are Talen Energy, American Airlines, and Nabors Industries.

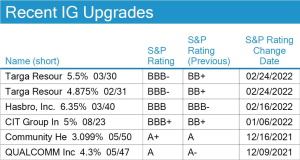

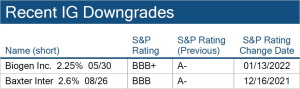

No IG rating changes on week

S&P has no downgrades in the IG space on the week.

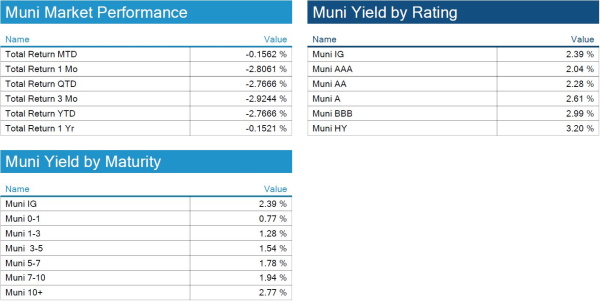

Demand continues with light muni supply

Municipal bond yields were slightly higher WoW, outperforming U.S. Treasuries on a total return basis as the new issue market continues to be light. Historically, muni bonds perform well through different interest rate environments. Given the current tax-exempt yields and diversification benefits of investing in a U.S. municipality, expectations are for spreads to move tighter.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, March 3, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

Mineral fuels, precious metals and stones, iron and steel

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.