The Fixed Income Brief: Flash Dance

Fixed Income Trivia Time: Of the 1mil+ CUSIPs in the muni sector, how many ultimate obligors are there?

This week’s market moves were similar to a patient who gets flu-like symptoms from taking the COVID vaccine. It is a little uncomfortable, but worth it in the longer run to protect the person from more serious implications in the future. Not to say this move has ended yet, but the risk off tone in equities and the selloff in rates markets are healthy signs for a market to maintain its longer-term footing. As the market deals with positive vaccine news, large fiscal stimulus, higher oil prices, and higher future Treasury issuance, it is only natural to see yield moves cause a pause for risk markets. J&J’s one dose vaccination expected approval only added to that sentiment, and rather than equity markets embracing it as a positive, they began to see rising yields as a risk to the already priced in recovery starting to take hold.

Data this week was generally positive as the global economy continues to thaw out with the help of continued progress on the vaccination front. Strong data on housing, where Case-Shiller showed YoY price increases of +10.1% and new home sales beat expectations (923k vs 885k exp.), up +4.3% MoM. Existing home sales saw a decline of -2.8% vs. -0.2% exp. MoM, only because there is not enough supply at the moment. Housing will be a key area of the market to watch as rates will have a direct correlation with how well the sector sustains its torrid pace. On the jobs front, weekly initial jobless claims came in at +730k vs. 838k exp., and over 100k better than last week’s +841k. On the inflation-risk front, the PCE price index (the Federal Reserve’s preferred inflation gauge) rose +0.3% for the month, slightly ahead of the 0.2% expected. YoY it’s up just +1.5%, matching estimates, leading to less concern as the Fed had already indicated they would let inflation run hotter than 2% in order to get more people to work. This means there’s still plenty of bandwidth in terms of the central bank being comfortable not reducing its super accommodative stance anytime soon.

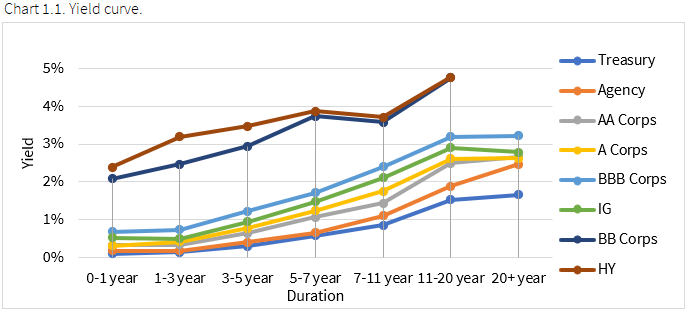

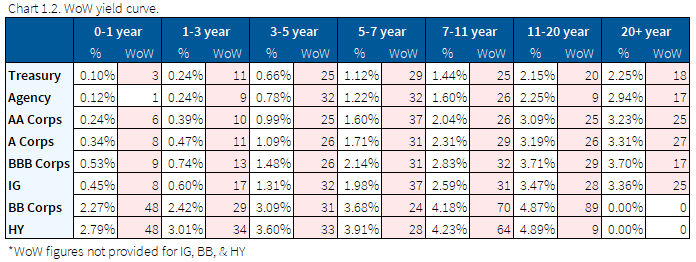

Treasury yields lurch higher as selloff trend continues

Treasury prices declined this past week, sending yields significantly higher at one point before settling in slightly higher WoW. 10yr Treasuries that started the week ~1.35% saw an intraday ‘flash move’ to 1.60% mid-week on its way to settling around 1.46%. The 30yr Treasury was up +6bps from 2.14% WoW and reached a high of 2.30% after settling back to 2.20%. The same pattern emerged across the curve, as even the stubborn 2yr note traded off +7bps at one point, finally breaking out after much resistance to recent headlines. There was a 5yr note auction on Wednesday, where the new issuance came +20bps higher than the prior auction at 0.621% and ended the week even higher at 0.77%.

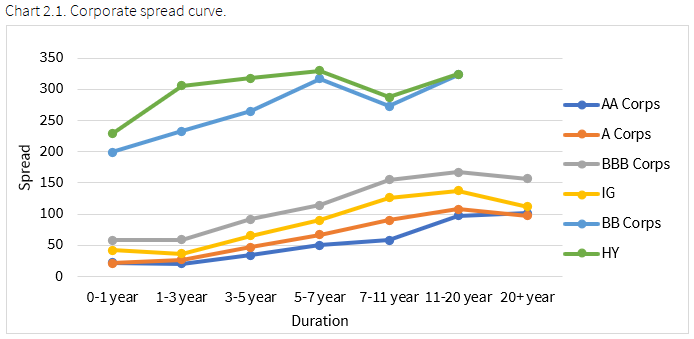

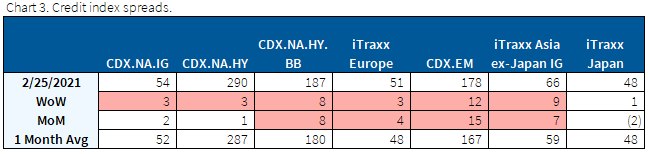

Credit selloff on back of volatile week

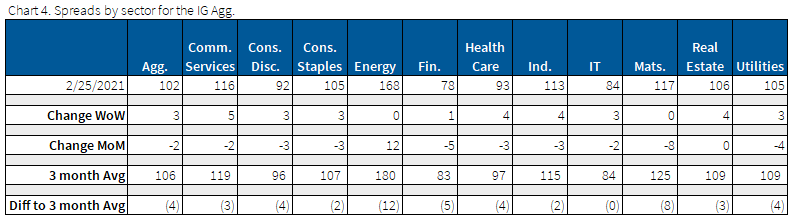

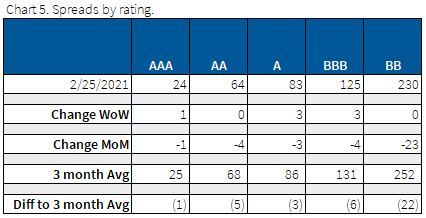

Spreads sell off on back of inflation concerns. This move is in line with equities, and the goldilocks scenario of a growing economy with increased stimulus hit a speed bump after months of tightening. These small reality checks tend to be buying opportunities for dry powder rather than a prolonged move of negative sentiment.

Energy sector was again the winner this week which ended flat. It is notable to mention that on the month, energy is the only sector that is wider (12bps). Materials was the winner on the month, closing 8bps tighter.

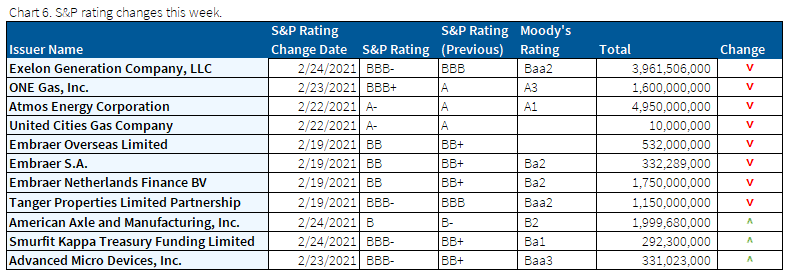

S&P sees deterioration in energy and gas, even as prices rise

S&P downgraded a handful on energy and gas names this week, most notably is a tranche of Exelon that moves to BBB-.

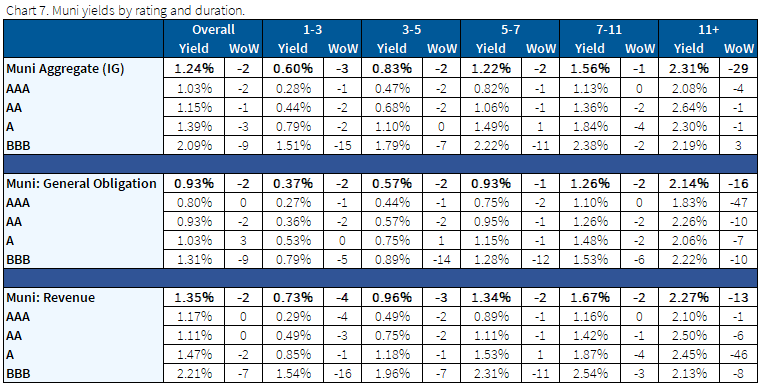

Muni yields continue to rise with the rate selloff

Municipal bonds sold off again for the second week on the back of the continued Treasury selloff. There is a sense that investors are happy to engage here at higher yield levels but that yields could still go potentially higher so not a huge rush to lock all their cash at this point. There is still no sense that selling is taking place given the continued supply / demand imbalance, though now it seems investors can be a little more patient than they were a few weeks ago.

On the fundamental front, Puerto Rico reached a deal with bondholders to reduce its debt, a critical step to moving forward. The aim is for Puerto Rico to exit bankruptcy in 2021, seeking court approval by this fall. The terms indicate that the GO bondholders would receive $14.4bn – $7bn in cash and the rest through new securities issuance.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Feb. 25, 2021.

Fixed Income Trivia Time Answer: ~54,000

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.