The Fixed Income Brief: The Fix Is In

Fixed Income Trivia Time: True or False: Muni funds have experienced multi-billion inflows every week this year.

Help is finally on its way from Congress in the form of a $1.9 trillion package that has something for everyone as the pandemic continues to rage on. Given the shortage of available shots hindering the vaccination rollout plans across the country, this stimulus could not have come at a better time. How we will eventually pay for it remains another matter and will be the focus of investor angst for a long time.

Federal Reserve Chairman Powell’s keynote speech to the Economic Club of New York stayed on message, saying continued aggressive policy support is needed to fix the many issues workers continue to face. Dealing with pandemic-induced job losses will require a “patiently accommodative monetary policy that embraces the lessons of the past.” His point was that near-zero interest rates are working and will remain in place for the foreseeable future. Even though the economy has reclaimed more than 12 million jobs since the beginning of the pandemic, Powell said the U.S. is “a long way” from where it needs to be in terms of employment.

“Fully realizing the benefits of a strong labor market will take continued support from both near-term policy and longer-run investments so that all those seeking jobs have the skills and opportunities that will enable them to contribute to, and share in, the benefits of prosperity.”

Even though the unemployment rate has fallen from its 2020 high of 14.8% to 6.3%, the pace of job creation has slowed considerably. Last week’s nonfarm payrolls rose by just 49k in January and fell by 227k in December. More than 10 million workers are still without jobs — 4.4 million higher than before the pandemic a year ago.

Data was light this week, which is usually the case following the monthly non-farm payrolls, with the main release being January CPI. This figure was important as inflation has been top of mind for investors given the run up in oil prices, the recent focus on a minimum wage increase, and the potential impacts of monetary policy and additional fiscal stimulus. The January CPI came in as expected on the headline number (+0.3%), but below expectations on core MoM (0.0% vs 0.2% exp.), and core CPI YoY was also lower at +1.4% vs. +1.6% in December. Weekly jobless claims fell short of expectations as well, with +793k vs. +757k exp. as the recovery in the job market pauses as states continue to open slowly.

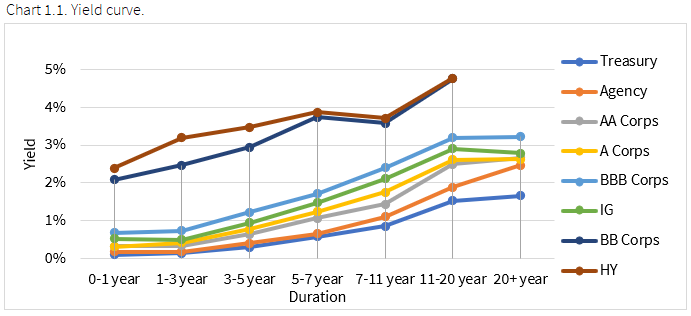

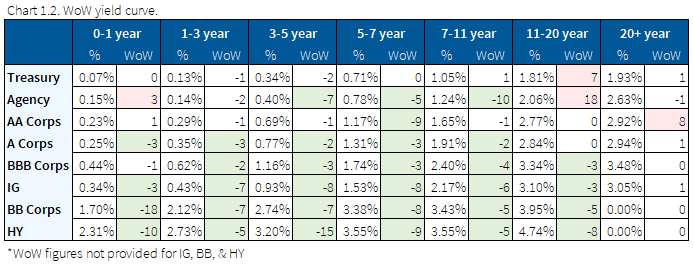

Treasury yields continue to rise in the face of stimulus

The reality of the $1.9tr stimulus is now being realized as the 10yr U.S. Treasury creeps towards 1.20%. The large price tag and the focus on how to handle the potential supply that will come on the back of this next leg of stimulus should keep the curve steep as the Fed anchors the front-end rates and the long end projects dealing with a larger deficit. The 10yr auction this week cleared at 1.155%, roughly in line with mid-January’s auction at 1.164%, a far cry from the last three auctions of 2020 that cleared at an average of 0.80%.

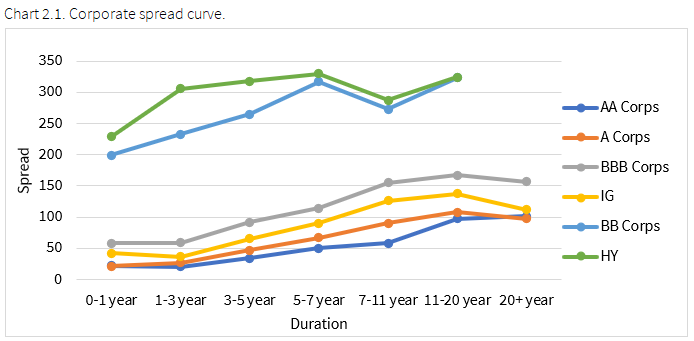

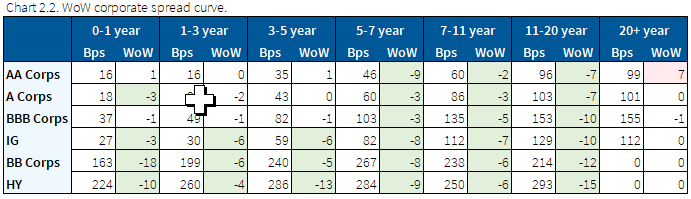

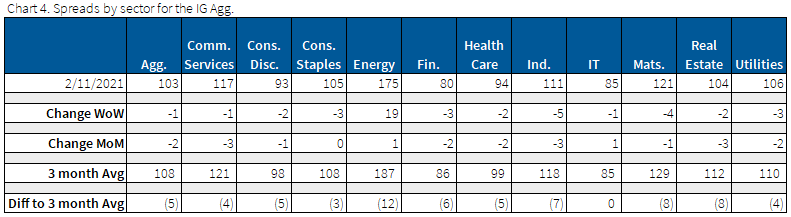

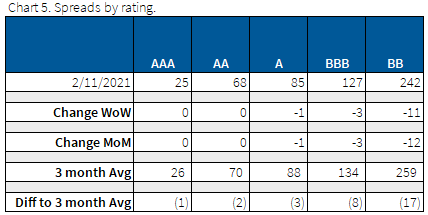

High yield spreads tighten as IG ends the week flat

Down in quality trades benefitted the most this week. On the year, NA IG and NA BB are flat, where NA HY is 10bps tighter. A lot of credit analysts have called for outperformance in lower quality trades, and thus far that has come to fruition.

Idiosyncratic winners of the week were American Express, Ford Motor, and Occidental Petroleum. Losers for the week were US Steel, Nordstrom, and International Paper Company.

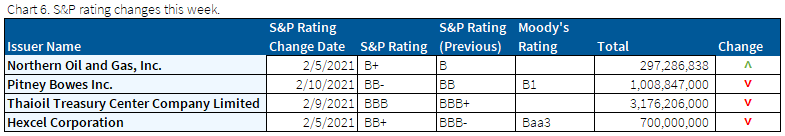

No large rating action this week

Quiet week on the ratings change front, with only certain tranches of debt seeing rating changes.

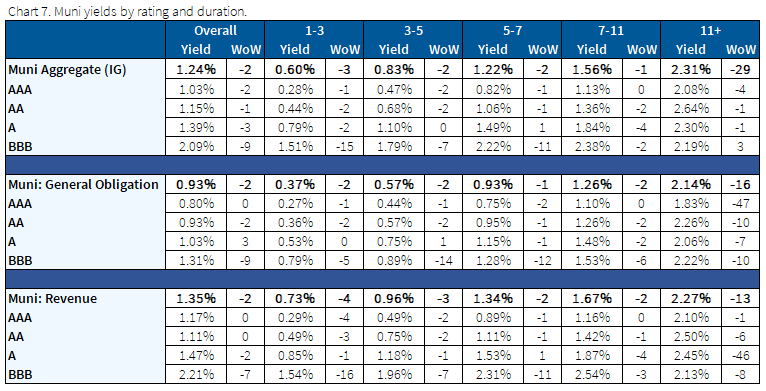

As Valentine’s Day approaches, investors choose munis

We’ve been a broken record here, but munis are trading in complete disconnect with US Treasuries at the moment. We are hearing about a continued imbalance in supply / demand dynamics and even more investors going below investment grade to find additional yield. New issuance continues to be light, putting pressure on yields to move down in quality as demand hasn’t wavered. Available bonds overall look to be very light for the foreseeable future, while mutual funds have cash and are seeking bonds along with retail investors. Given the backdrop of lack of supply and taxes inevitably going up, we believe yields will continue to grind lower from here and stay uncorrelated with underlying Treasuries for the near term.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Feb. 11, 2021.

Fixed Income Trivia Time Answer: True.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.