The Fixed Income Brief: GameStop Surges, Yields Pullback

Fixed Income Trivia Time: What’s the name of the subreddit that has been behind GameStop’s (GME) meteoric stock price rise?

At times equity investors get distracted by chasing big moves and getting hung up on the drama of a particular event or story. The majority of fixed income investors shy away from drama and rely on time-tested views until they fundamentally change, sometimes too late but rarely in a panic. They tend to look for shifts in market dynamics, ultimately assessing fundamentals first and always keeping an eye on protecting to the downside. The risk reward balance between the two investor groups is as wide as our current political divisions, with little yield to be had in most areas of investment grade sectors; because of this, there is little room in expected returns to absorb realized downside risk – hence why you see a natural pullback in spread assets this week.

On the positive side, Jerome Powell will not waiver. In the FOMC press conference on Wednesday, he talked down the existence of bubbles and any cracks in their assessment of economic stability. As expected, the Fed maintained their near-zero rate policy and level of open market purchases at $80bn of Treasuries and $20bn of mortgage-backed-securities. Despite an uptick in inflation recently, the key focus remains on the economic recovery and bringing back the nine million jobs lost due to this pandemic. It will be interesting to see the Powell-Yellen double punch play out as Yellen gets settled in to handling the fiscal side of the ledger. Still lots to play for out there.

Data this past week was highlighted by the preliminary Q4 2020 GDP figure, confirming QoQ growth of +4.0%, which was slightly below Wall Street expectations of +4.3% with a full-year decline of -3.5%, the worst year since the end of WWII. The backward-looking measure saw gains from consumer spending and private investment, while cuts in government spending held us back. Also notable about the figure was the GDP Price Index which was +1.9%, lower than the +2.4% expected. On the positive side December’s Core Durable Goods Orders continued their impressive run with +0.7% vs. 0.5% expected, showing continued strength in the manufacturing sector. Finally, initial jobless claims ticked down to +847k vs. +875k expected and broke up the two-week spell above 900k.

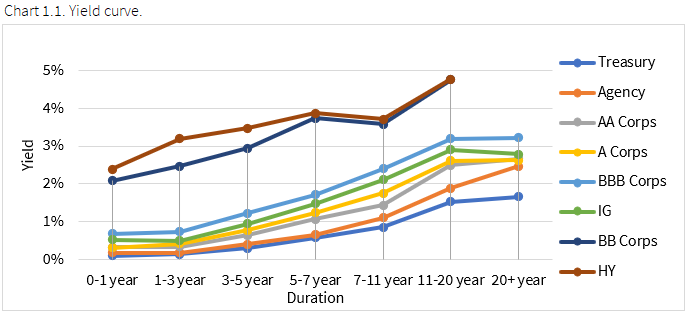

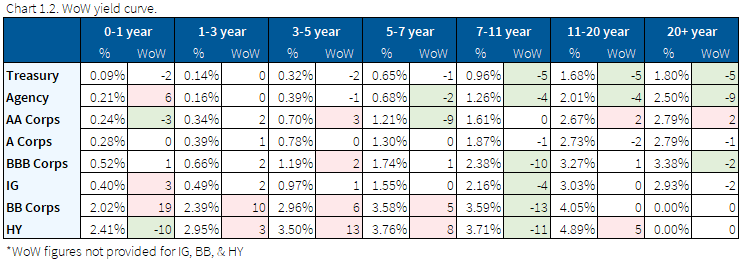

Treasury yields remain low as market volatility has investors shying away from risk

At one point this week, the 10-year Treasury yield had rallied from around 1.10% to 1.00%, but the YTD range held firm and we ended the week slightly lower than where we started. Overall, the lack of progress on stimulus and talks of a much lower-sized package, coupled with risk-off sentiment, kept yields at bay. The 2/10s curve flattened 5bps to +95bps as the front-end yield remained pegged here.

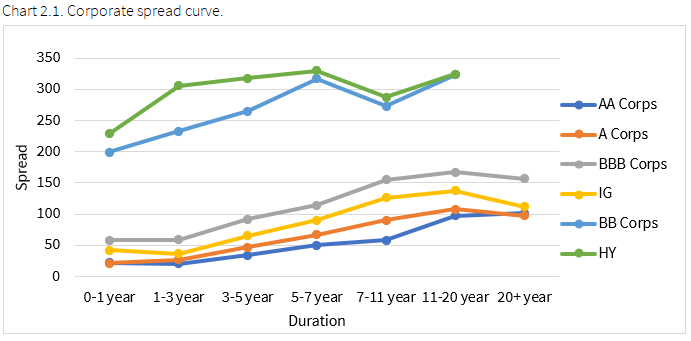

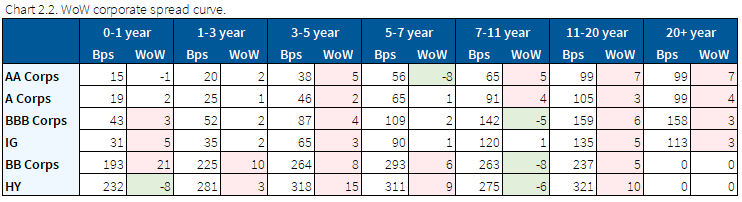

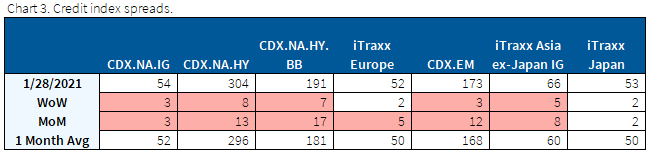

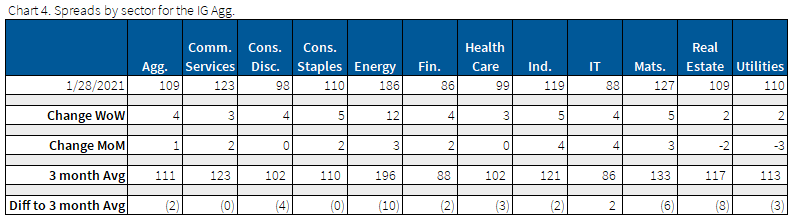

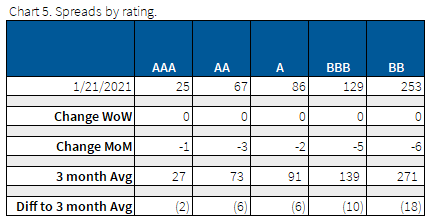

Spreads sell off after lackluster equity performance and earnings numbers

Spreads sell off as the likelihood of defaults rise. Volatility picked up in the market driven by equity markets and with most of the upside priced into the market, any weeks without overwhelming positive news could lead to modest sell-offs.

Idiosyncratic winners of the week were Colgate, American Express, and Rite Aid. Losers for the week were Murphy Oil, Occidental, and US Steel Corp.

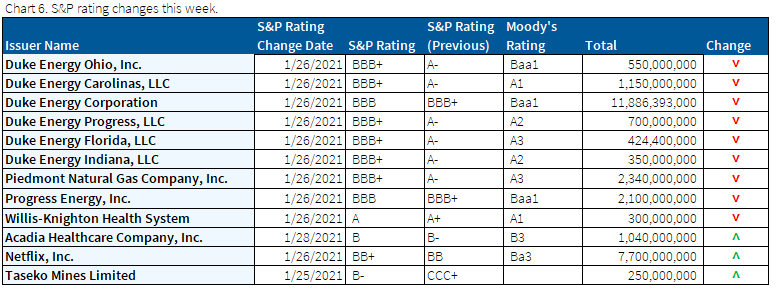

Netflix sees upgrade while energy suffers downgrades

We saw both upgrades and downgrades this week as earning season progresses. Duke Energy Corp and its subsidiaries all saw a one notch downgrade, while Netflix did more than chill this week while it slowly moved up the ranks of high yield.

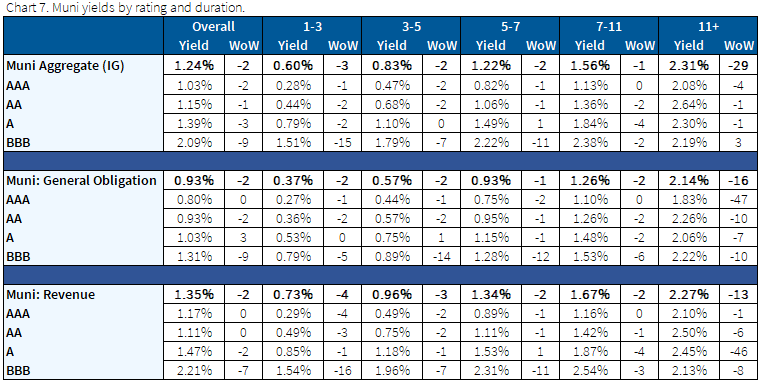

Muni yields generally lower as anticipated stimulus to bolster the sector

Yields were generally lower in-line with Treasuries over the week. The muni market technical dynamics remain intact with visible supply at $8.26bn, well off the ~$14bn average we saw throughout 2020. As stimulus is expected to flow through, investors don’t anticipate higher issuance providing increased confidence in the sector.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Jan. 28, 2021.

Fixed Income Trivia Time Answer: Wall Street Bets

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.