The Fixed Income Brief: The Next 100 Days

Fixed Income Trivia Time: Which Greek measures the sensitivity of underlying to passage of time, or “pull-to-par”?

In the U.S., no matter your political beliefs, the peaceful transfer of power is something we hold dear as Americans. As we saw the 46th President of the United States being sworn in on Wednesday, the focus now turns to priorities of the new administration and the next 100 days. In a legislative process designed to be difficult to navigate, most initiatives will get watered down, but at this juncture, both parties are eager to deliver pandemic stimulus first and foremost.

One thing is for sure, fixed income investors are about to gain some comfort from the expected appointment of Janet Yellen as Treasury Secretary. First, Dr. Yellen is a known entity, with vast government experience given her roles as Fed Chair and head of the Council of Economic Advisers under President Clinton. There will be no learning curve for Yellen, which will allow her to get straight to work on figuring out how the fiscal side can support this economic environment. As head of the monetary side for so long, she’ll know where the fiscal side can be most effective. Also, given her familiarity with Chairman Powell, this will only help to improve the communication between the two pillars holding up our economy at the moment. Second, Yellen is setting a different tone. She has vowed to work closely with both parties to get legislation passed, which means the scary $1.9tr price tag of the initial Biden package is surely going to be scaled back in order to get it through. This ultimately should curb investors’ fears, and that the borrowing and debt issuance will not get out of hand – thus tampering expectations for significantly higher rates.

Due to the shortened holiday week and the inauguration, U.S. economic data was back loaded to Thursday and Friday. The U.S. January PMI data came in very strong with services and manufacturing PMIs significantly exceeding the prior month and expectations, 57.5 vs 53.6 exp. and 59.1 vs 56.5 exp. respectively. The release of European PMIs shows manufacturing, think cars, remains the driver of activity (54.7) as services (45.0) remain in contraction plagued by harsher pandemic induced lockdowns. Other highlights include many housing data points showing that low rates continue to bolster the sector. Total existing home sales were 5.64mn units in 2020 hitting the highest point since 2006 with December sales being +22% greater than December 2019 and no sign of demand slowing down at this point. Finally, initial jobless claims remained elevated at +900k, with a 4-week average of +860k. Rest in peace Henry Louis “Hank” Aaron, a major loss to the baseball world but also society as a whole.

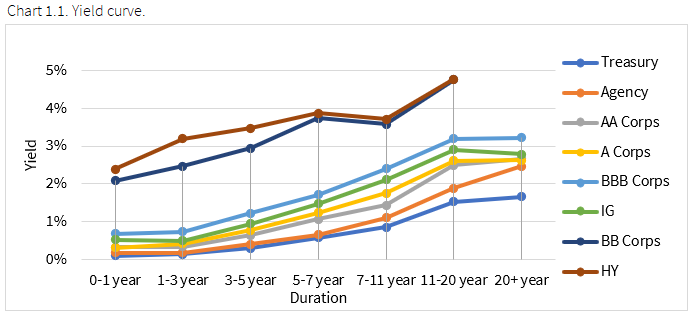

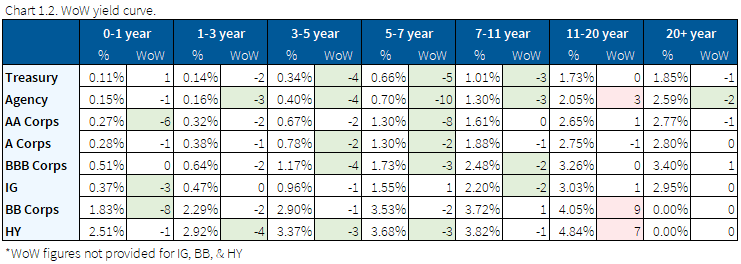

Treasury yields slightly down as investors weigh the future

It was a calm week in rates markets this week with the U.S. 10-yr note trading in a very narrow range as investors weigh government spending and the pandemic recovery. The week ended relatively unchanged after the prior week run-up in yields in anticipation to more advanced stimulus talks and discussions around how soon the economy could reopen.

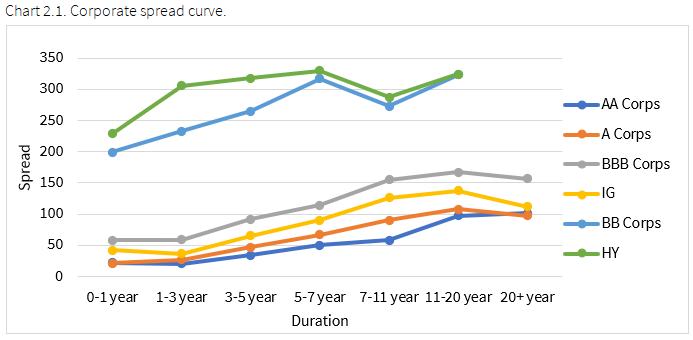

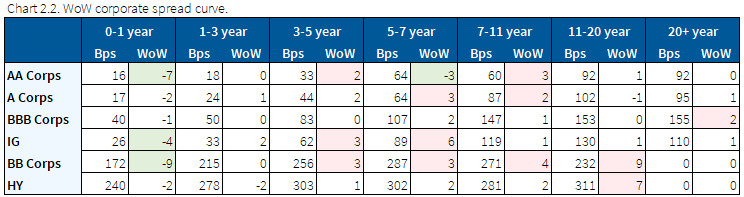

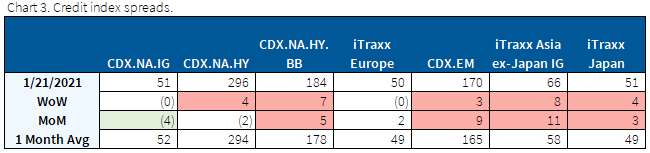

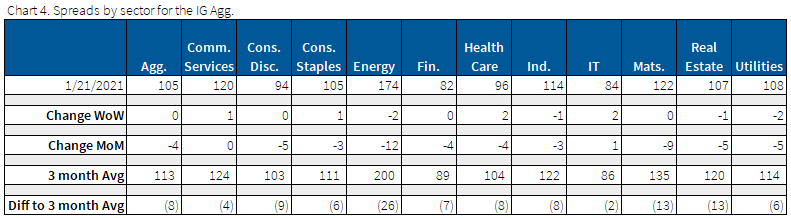

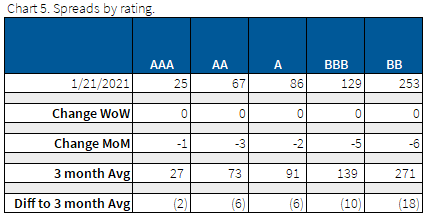

IG spreads back at pre-pandemic levels

Investment grade bond spreads and CDX tightened during the week and end the week flat. Energy continues to modestly outperform the broader market, while AA outperformed A bonds.

Idiosyncratic winners of the week were Amgen, Kimberly-Clark, Clorox, and JPM. Losers for the week were Comcast, Univision, and Pitney Bowes.

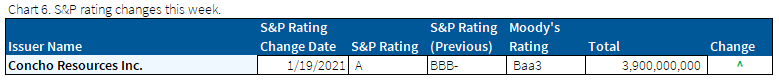

A quiet week for rating changes

This week saw no notable ratings actions, with only an upgrade for Concho Resources.

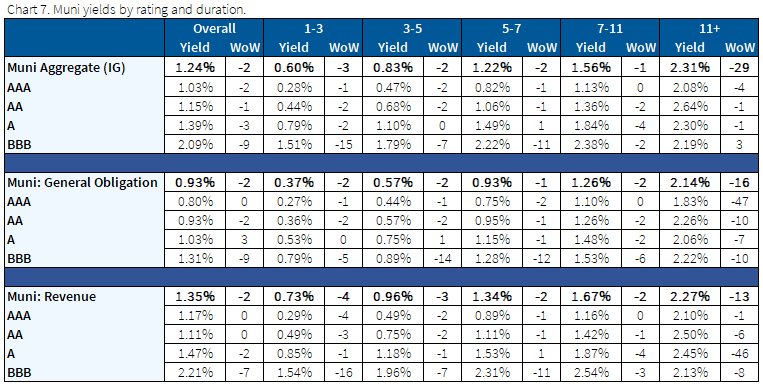

Muni sector key beneficiary of expected Biden stimulus package

Yields were slightly down in line with Treasuries this week as investors look to the next injection of pandemic stimulus to bolster muni fundamentals. Biden’s new plan calls for +$350bn for municipalities. Funds will be directly injected into state and local governments to cover the immediate shortfalls caused by the shutdowns. It would also consider extending funds to major transit systems that have been hammered by this pandemic with the exodus of people from major cities. Stay tuned.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Jan. 21, 2021.

Fixed Income Trivia Time Answer: Theta

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.