The Fixed Income Brief: Senate Goes 50/50 and Rates Rise

Fixed Income Trivia Time: Tough year to be long duration – what is the YTD return of the 10-year TSY?

Welcome to the first week of 2021 where the markets have already dealt with a couple of very significant events. As the calendar turned over, many investors were hoping for some calmer waters to tread but given the start it seems as though 2020 vibes are still lingering out there as investors are already looking towards the back half of 2021 for some sense of normalcy and recovery. The hope is by then, the pandemic will be well contained and consumer pent up demand will boost growth. The issue is we have plenty of known risks that can cause us to deviate from that path along the way.

For fixed Income investors, the focus was on bigger budgets and more stimulus coming out of Washington as both Senate races in Georgia went Democratic. The initial market fear around a majority Democratic government has not borne fruit yet as risk assets continue to break recent all-time highs. Despite the horrific images coming out of Washington as protestors stormed the Capital, the Senate shift to 50/50 saw rates jump higher on the expectations of more government stimulus across the board. Rate volatility is back as well, as we saw longer maturity bond yields break recent highs as investors prepare for more spending and cash payouts out of Washington.

Data this week was highlighted by the December Non-Farm Payroll Report, which showed its first contraction in 8 months (-140k vs. -50k exp.). The job losses stemmed mostly from the leisure and hospitality sector with almost -500k jobs lost due to bars and restaurants being re-closed as the winter weather takes hold across a good portion of the U.S. and indoor dining is shuttered. Construction jobs were additive, mainly due to the continued growth in the housing sector as mortgage rates remain near all-time lows. The unemployment rate held constant at 6.7% due to people falling out of the workforce. Poor Markit PMI data reflected the new lockdowns and retreating service industry, while the strong ISM manufacturing figure (60.7 vs. 56.6 exp.) shows that sector continues to remain strong as consumers continue to sit at home and buy things online. This uneven recovery is meant to continue for some time, and it will be interesting to see the approach the Biden administration takes now that it has more flexibility in passing legislation to get help to where it is needed.

For more insight on our aggregated insights on the fixed income market for the new year, read our 2021 Outlook on Fixed Income.

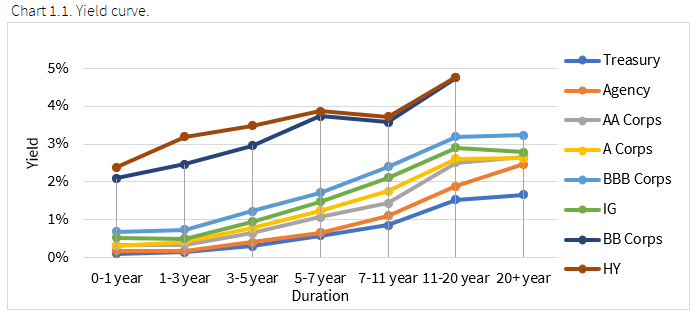

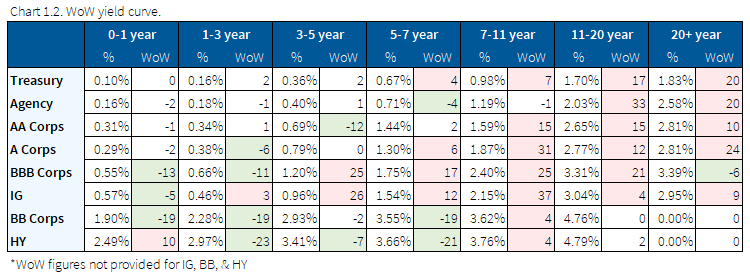

New year welcomes in rate volatility, higher yields, and a steeper curve

The U.S. Treasury curve steepened dramatically on the back of the Georgia Senate runoffs after the Democrats won both seats and earned a 50/50 split in the Senate. The steepening was led by the 10yr and 30yr selling off roughly +20bps, while the 5yr and 2yr only sold off +10bps and +2bps respectively. The 2/10s spread now stands at +94bps, a mark that had not been reached since July 2017.

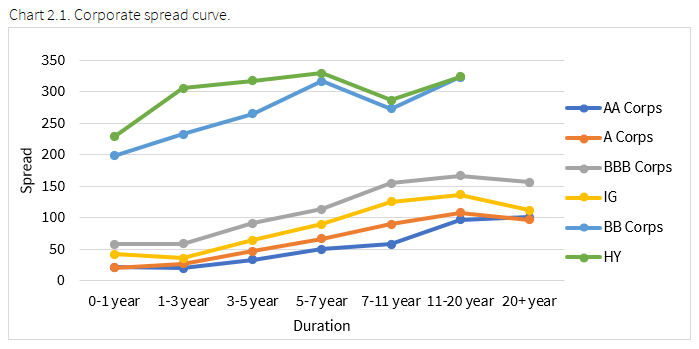

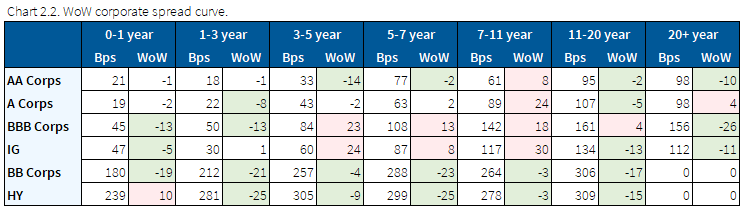

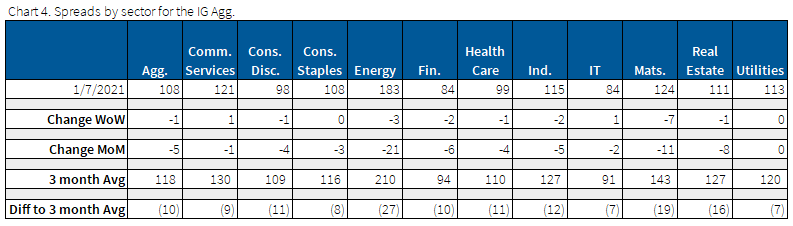

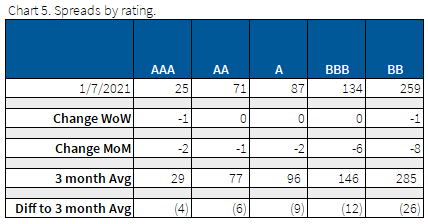

Credit spreads flat with credit index spreads tighter on the week

Credit spread indices tightened, with HY segment tightening the most due to energy names that performed well on the back of a +6% increase in oil prices this week on the announced voluntary production cuts out of Saudi Arabia. U.S. credit index spreads are now trading through their 1-month averages.

Minimal movement in spreads this week as investors get back in their seats following the holidays, but we continue to see a positive trend in risk assets as a whole. Once Treasury yields find their footing you can see a strong case for continued tightening as we hopefully start to emerge from being under the pandemic.

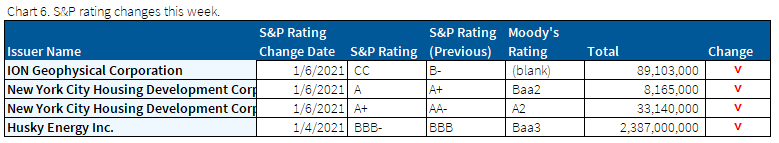

Quiet on the ratings front with only a few small downgrades

This week saw no notable ratings actions.

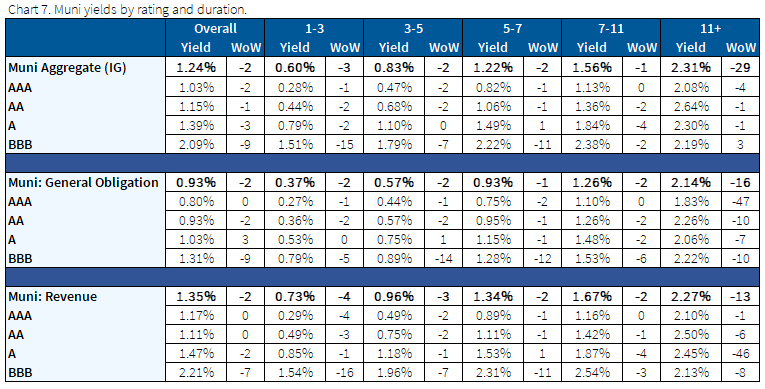

Muni yields were slightly up to flat with strong demand in BBBs

Munis outperformed Treasuries, which sold off this week. The dual key impacts of the Democrats now in full majority are the likelihood of increased support for state and local government budgets and the likely increases in taxes at the corporate and individual level that will eventually be pushed through. In the meantime, munis continue to be underpinned by strong technicals as there is a lot less expected issuance projected in Q1 as deals were pulled forward ahead of the election in 2020. In looking at the calendar in Q1 2021, there is roughly +$80bn in maturing and called bonds rolling off that will likely be put back into the sector at a time where paper is not that plentiful.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Jan. 7, 2021.

Fixed Income Trivia Time Answer: -1.5%

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.