Market Memo: Fed to take a “wait and see” approach

As geopolitical risk continues to underscore market uncertainty, Fed policymakers will likely take a cautious approach.

September 18, 2019

All eyes have been on the Fed this week, with investors eagerly anticipating another rate cut and holding out hope that Chairman Jerome Powell’s Wednesday policy announcement will signal that additional cuts are in store. Ahead of the 2:30PM press conference with the agency’s top official, CBXmarket’s in-house investment expert, Kevin Bliss, shared his perspective on the Fed outlook.

“The agency will get its cut done today and then refocus on being patient. Policymakers want to avoid boxing themselves into implementing additional cuts through year-end,” says Bliss, adding that a plethora of economic and geopolitical variables “warrant a ‘wait and see approach,’ although the ability for the Fed to remain flexible going forward is key.”

Global uncertainty stemming from situations like the trade war and Brexit has put increased pressure on the Fed to act now to help stave off international economic downturn. Just yesterday, the New York Fed intervened in money markets for the first time since 2008, rushing to inject $53.2bn in short-term funding to help curb borrowing costs before adding another $75bn this morning.

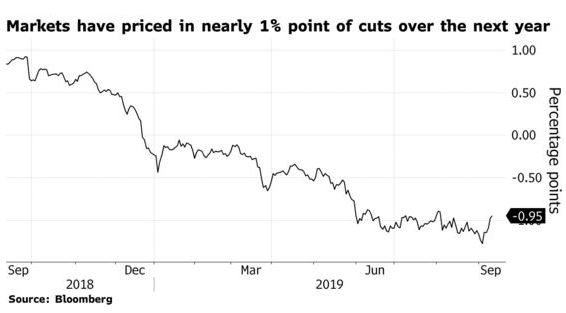

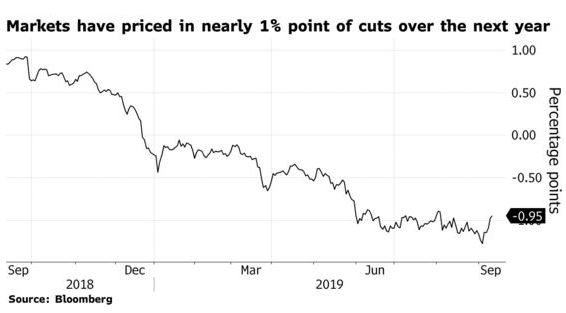

The ploy is indicative that long-term solutions are still needed by the Fed, according to Bloomberg, while the Wall Street Journal wrote that there’s a clear urgency for the agency to address funding strains. Press reports indicate that this week’s events could be giving investors hope that the Fed will move to enact additional rate cuts over the short-term, and Bloomberg data shows that the markets have priced in a 0.95 percentage point cut over the next year.

The ploy is indicative that long-term solutions are still needed by the Fed, according to Bloomberg, while the Wall Street Journal wrote that there’s a clear urgency for the agency to address funding strains. Press reports indicate that this week’s events could be giving investors hope that the Fed will move to enact additional rate cuts over the short-term, and Bloomberg data shows that the markets have priced in a 0.95 percentage point cut over the next year.

While the three risk factors that the Fed cited when it cut rates in July—namely, a slowdown in global economic growth rates, heightened trade tensions and muted inflation—have persisted or even worsened in the following months, consumer spending remains stable. Market players should still expect the Fed to be cautious amid the “mixed bag” of data as uncertainty continues to be the hallmark of the current investment climate.

“The agency will get its cut done today and then refocus on being patient. Policymakers want to avoid boxing themselves into implementing additional cuts through year-end,” says Bliss, adding that a plethora of economic and geopolitical variables “warrant a ‘wait and see approach,’ although the ability for the Fed to remain flexible going forward is key.”

Global uncertainty stemming from situations like the trade war and Brexit has put increased pressure on the Fed to act now to help stave off international economic downturn. Just yesterday, the New York Fed intervened in money markets for the first time since 2008, rushing to inject $53.2bn in short-term funding to help curb borrowing costs before adding another $75bn this morning.

The ploy is indicative that long-term solutions are still needed by the Fed, according to Bloomberg, while the Wall Street Journal wrote that there’s a clear urgency for the agency to address funding strains. Press reports indicate that this week’s events could be giving investors hope that the Fed will move to enact additional rate cuts over the short-term, and Bloomberg data shows that the markets have priced in a 0.95 percentage point cut over the next year.

The ploy is indicative that long-term solutions are still needed by the Fed, according to Bloomberg, while the Wall Street Journal wrote that there’s a clear urgency for the agency to address funding strains. Press reports indicate that this week’s events could be giving investors hope that the Fed will move to enact additional rate cuts over the short-term, and Bloomberg data shows that the markets have priced in a 0.95 percentage point cut over the next year.While the three risk factors that the Fed cited when it cut rates in July—namely, a slowdown in global economic growth rates, heightened trade tensions and muted inflation—have persisted or even worsened in the following months, consumer spending remains stable. Market players should still expect the Fed to be cautious amid the “mixed bag” of data as uncertainty continues to be the hallmark of the current investment climate.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.