Fixed Income and the Ballot Box: Investor Expectations for the 2020 U.S. Election

It’s no secret that investors hate uncertainty and an unexpected election result can bring greater volatility to fixed income markets that may improve or weaken credit fundamentals. What’s unique about 2020 is that the election has become more than simply Donald Trump versus Joe Biden as president with investors focusing on if a single party will control both chambers of Congress as well as the White House.

A June 2020 Citigroup poll of 140 fund managers found that 62% of respondents now expect Biden to win as opposed to 70% who predicted a Trump victory in December 2019.[1] Furthermore, many investors are now discussing the realistic possibility of a Democratic sweep in November that could significantly impact financial markets as many of Trump’s policies are reversed.

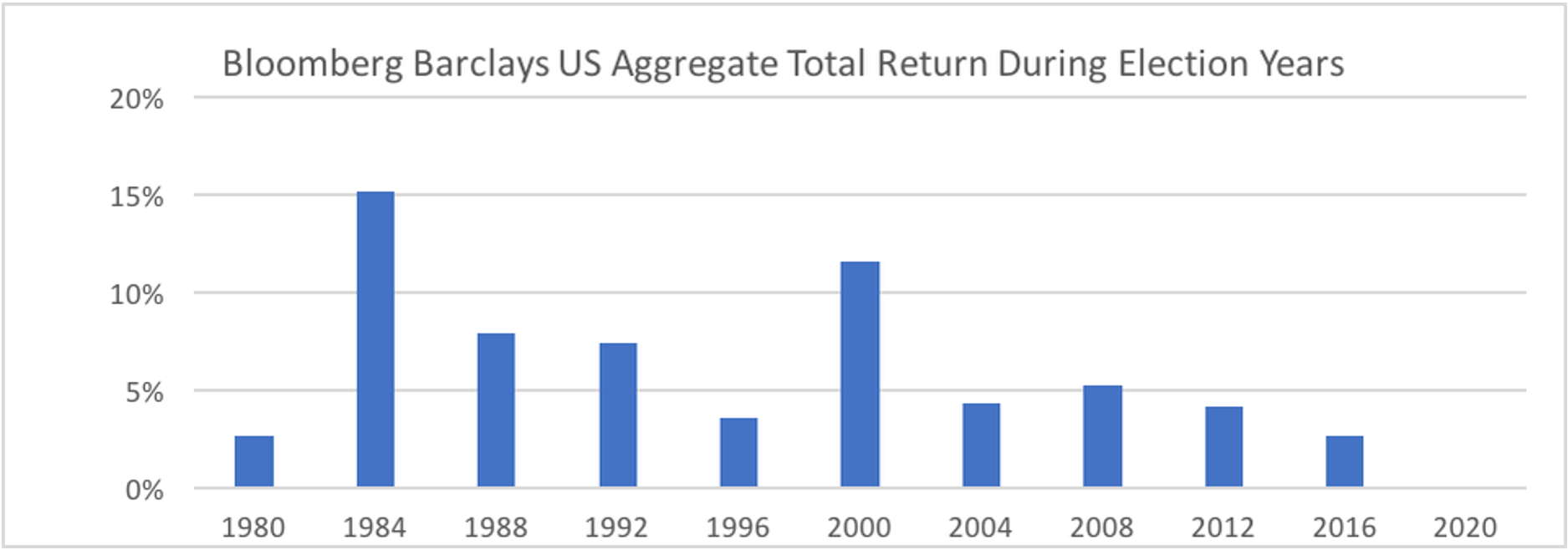

Historically, a degree of volatility is inherent in the lead up to an election as investors attempt to price in the outcome despite the S&P 500 averaging 10% returns when the incumbent party wins and 2.8% in years when they lose. Looking at the fixed income market, the Bloomberg Barclays U.S. Aggregate Bond Index has witnessed positive returns over the last 10 presidential election cycles.[2]

A “Wildcard” Election or Clean Sweep?

Since taking office in 2016, Trump has focused on economic issues such as tax reform, trade policy, and deregulation. His re-election is likely to result in a continuation of the Republican agenda and orthodoxy. However, if Biden wins the election, it’s likely to see an increase in the corporate tax rate to 28% from 21% and a roll back of the 2017 Tax Cuts and Jobs Act that dramatically cut personal income taxes. A Biden administration is also expected to come with tougher regulations for financial, healthcare, and energy markets as most can be enacted through executive orders rather than Congressional approval.

JPMorgan analysts conducted in-depth research and scenario analysis on the election result that will benefit the markets the most and found a divided government would be best for investors.[3] A Biden presidency while Congress continues with the status quo of Republicans controlling the Senate and Democrats the House would create the strongest returns. This scenario is viewed as the most positive since the Trump tax cuts and market-friendly economic policies would likely continue while doing away with unexpected foreign policy and trade disruptions. Additionally, a full Democratic sweep could usher in increased regulation that would hamper the markets.

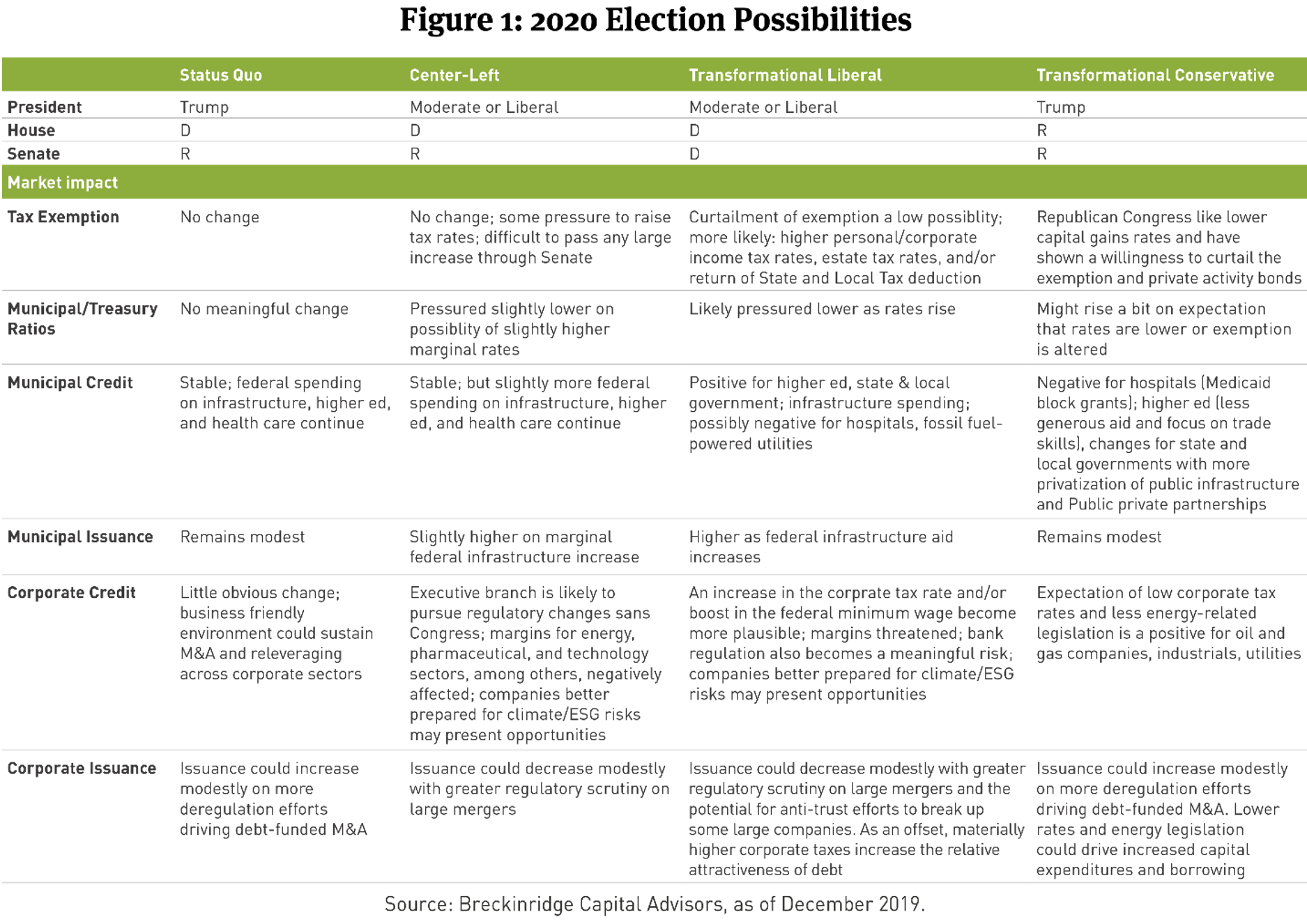

Looking further into scenarios for the fixed income markets, Breckinridge Capital Advisors discusses the four potential scenarios for the election – Trump or Biden with a divided government or a full sweep.[4]

Focus on the Long-Term

Regardless of who wins the election, the result is likely to only exert a limited influence on municipal and corporate bond markets since it’s often unlikely that a candidate’s policy platform actually becomes successful legislation. In the run-up to an election, investors tend to remain conservative with their portfolios to minimize risk. However, this “wait and see” approach poses significant stress on portfolio returns since timing the market around an election is rarely a winning long-term investment strategy. In fact, it’s better to deploy capital today because election year volatility also brings select opportunities that investors can take advantage of as long as they remain mindful of their portfolio’s maturity profile.

Investors “should not let how they feel about politics overrule how they think about investing,” reminds JPMorgan.[5] Diligent portfolio managers will be well prepared for any market disruptions following the election if they don’t lose sight of their long-term objectives and remain well equipped to not only anticipate but act on any post-election market disruptions.

Want to find out more about how cloud-based investment management systems can help you improve fixed income returns?

1 Rabouin, Dion. “Wall Street Is No Longer Betting on Trump.” Axios, 7 July 2020.

2 Halliburton, Benjamin C. “Presidential Election Years Impact on Stocks, Bonds, and Federal Reserve Policy.” Forbes, 31 Jan. 2020.

3 Winck, Ben. “JPMORGAN: The Best Case Scenario for Stocks Is a Biden Presidency with a Republican Senate | Markets Insider.” Business Insider, 13 Mar. 2020.

4 Nicholas Elfner and Adam Stern. “2020 Election Quick Take.” Breckinridge Capital Advisors, 16 Jan. 2020.

5 Dr. David Kelly, Hannah Anderson and Meera Pandit. “The Investment Implications of the 2020 Election” J.P. Morgan Asset Management, 31 Jan. 2020.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.